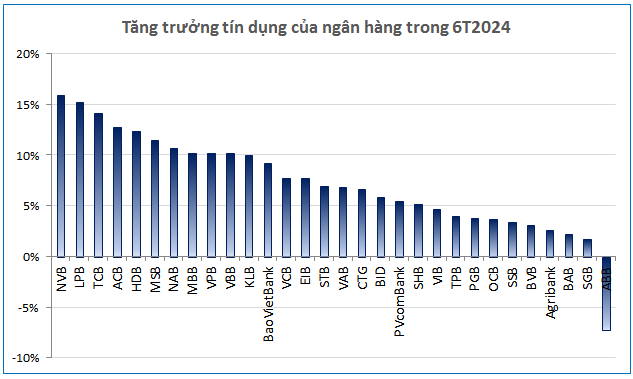

After a sluggish first quarter in 2024, where credit growth was lackluster due to weak credit demand amid a struggling global economy, escalating geopolitical tensions, increased risks, and seasonal factors, the second quarter saw a rebound in credit growth. This improvement was driven by an economic recovery, leading to increased loan demands for production expansion and consumption. Additionally, a revival in the real estate sector also played a role in boosting credit demand.

By the end of the second quarter of 2024, credit growth had reached approximately 6% compared to the end of 2023, meeting the government’s target of a 5-6% increase.

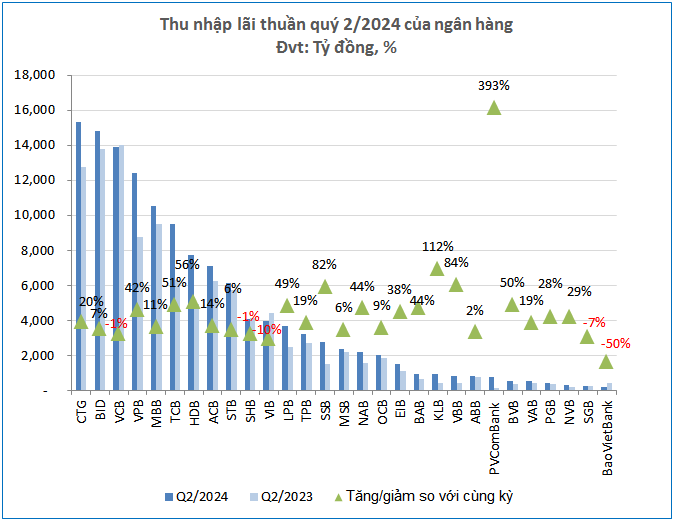

Bank profits in the second quarter flourished on the fertile ground of credit growth. As credit accelerated, banks’ interest income improved. At the same time, non-interest income remained stable, contributing to a boost in bank profits during the quarter, despite the pressure of operating costs and provisions for credit risk.

Source: VietstockFinance

|

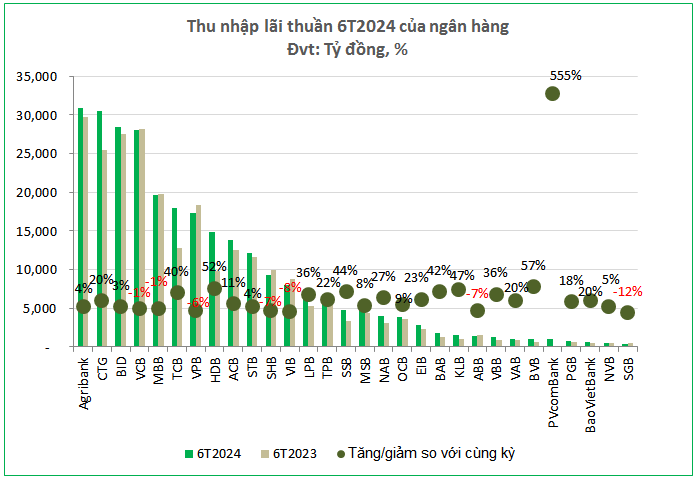

According to VietstockFinance’s statistics, the main interest income of 29 banks reached VND 129,584 billion, a 20% increase compared to the same period last year. The contribution of interest income to the total income of banks improved from 76% to over 78%.

Source: VietstockFinance

|

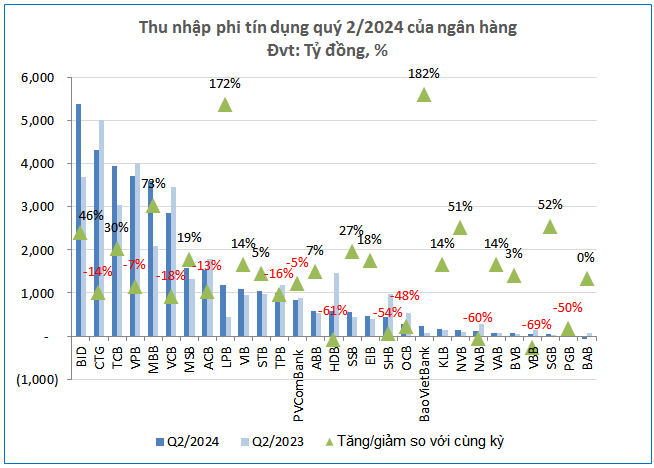

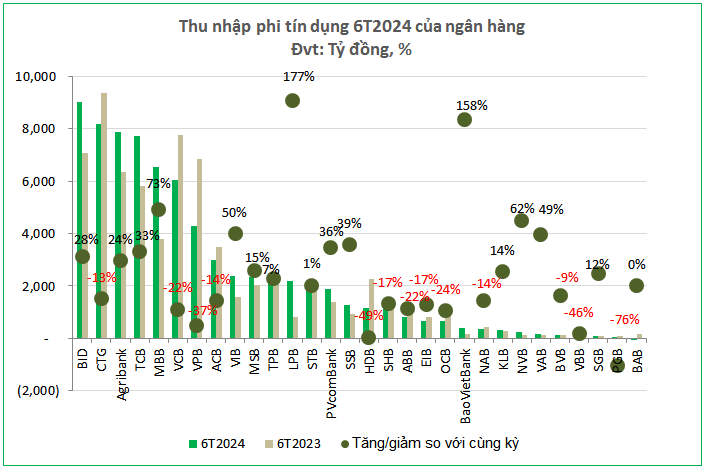

Meanwhile, non-interest income decreased in terms of contribution to total income, from 24% to 22%. However, in absolute value, total non-interest income of banks slightly improved compared to the same period, reaching more than VND 35,750 billion in the second quarter of 2024, a 5% increase. This improvement was mainly due to a 9% increase in pure service income, reaching VND 17,228 billion, and a 36% increase in foreign exchange and gold trading income, reaching VND 7,384 billion.

MB Bank recorded a high growth rate in non-interest income, with a 73% increase. This result was due to a sudden increase in securities trading profits during the period, reaching over VND 1,500 billion, nine times higher than the previous year.

Source: VietstockFinance

|

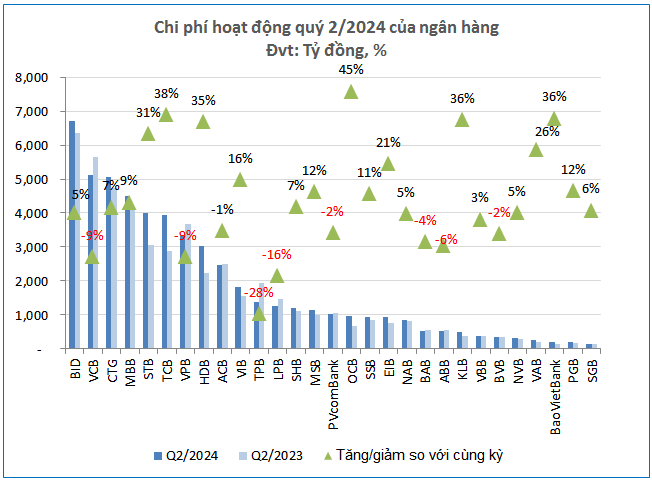

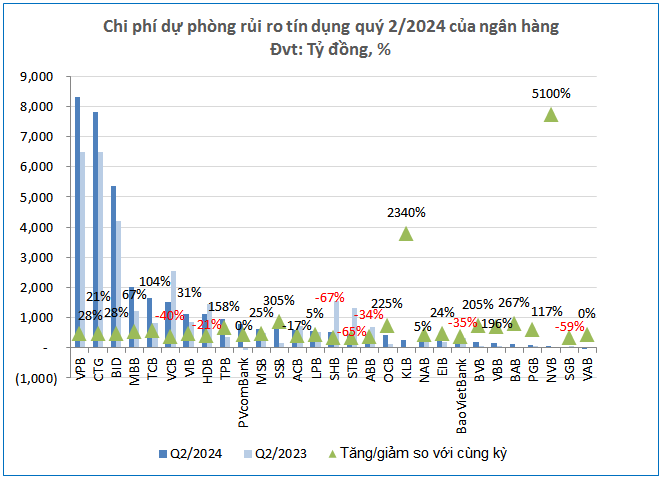

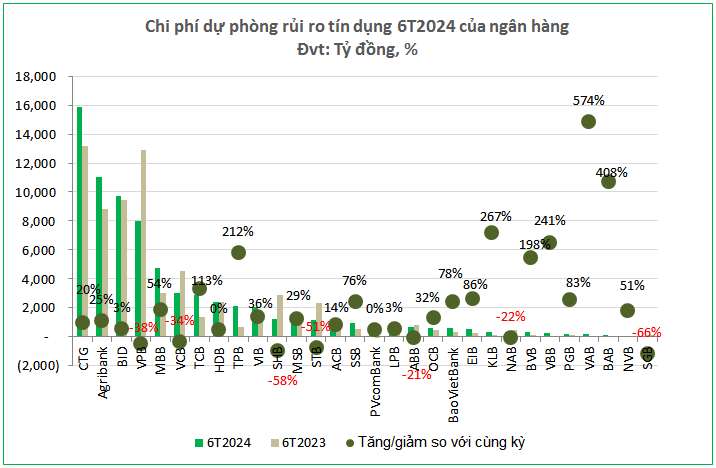

With improvements in both interest and non-interest income, the pre-tax profit of the entire banking sector increased by 22% in the second quarter of 2024, reaching VND 75,583 billion. This growth was achieved despite a 7% and 18% increase in operating costs (VND 53,054 billion) and provisions for credit risk (VND 36,421 billion), respectively, compared to the same period last year. Notably, NVB and KLB were the two banks with a significant increase in credit risk provisions, with a 52-fold and 24.4-fold increase, respectively.

Source: VietstockFinance

|

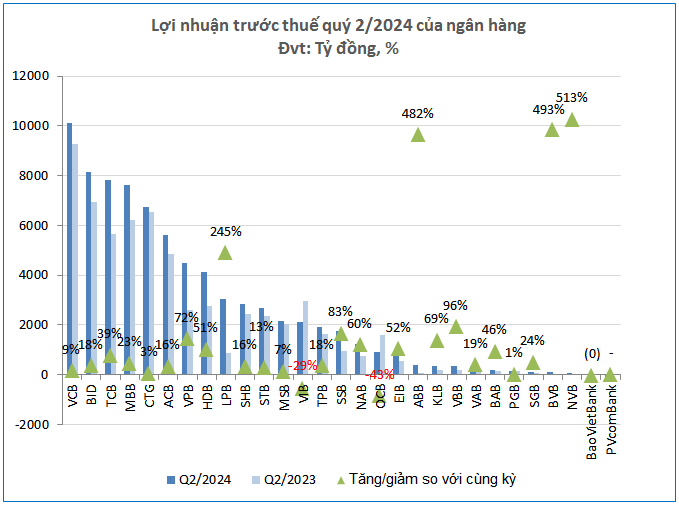

Except for OCB and VIB, which experienced a decrease in pre-tax profit, all other banks reported higher profits compared to the previous year. The decline in OCB’s profit was due to a nearly halved non-interest income, along with a 45% increase in operating costs and a 3.3-fold increase in credit risk provisions compared to the previous year.

Source: VietstockFinance

|

In a contrasting scenario, despite being the bank with the highest increase in pure interest income in the system (nearly five times higher than the previous year), PVcomBank suffered a loss due to the burden of operating costs and provisions for credit risk, which outweighed its income.

On a brighter note, NCB and BVB, which had pre-tax profits in the “bottom tier,” recorded the fastest profit growth in the system, with a 6.1-fold and 5.9-fold increase, respectively, compared to the previous year.

Can the profit target for the year be achieved in the third quarter?

Source: VietstockFinance

|

Source: VietstockFinance

|

In the first six months, the pure interest income of 30 banks reached VND 276,879 billion, a 10% increase compared to the same period last year. At the same time, the total non-interest income of the banking sector also improved by 5%, reaching VND 73,085 billion.

Source: VietstockFinance

|

Source: VietstockFinance

|

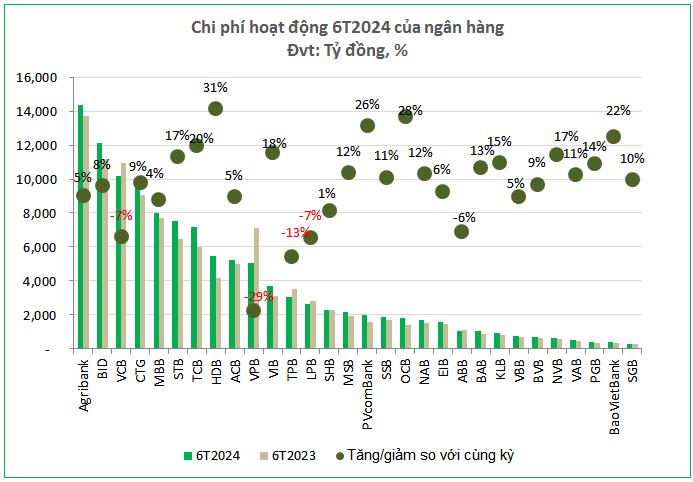

In terms of expenses, the 30 banks recorded a total operating expense of VND 114,572 billion and a credit risk provision of VND 73,115 billion, representing a 5% and 6% increase, respectively, compared to the previous year.

Source: VietstockFinance

|

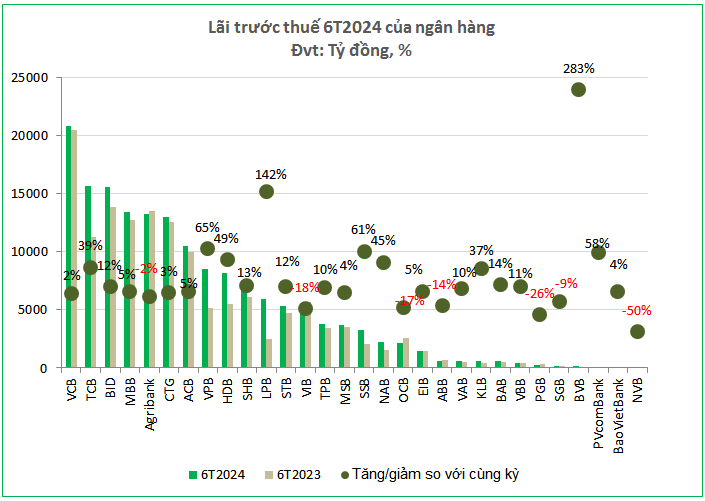

It can be seen that the increase in interest and non-interest income has collectively pushed the pre-tax profit of the group of banks to a new high, reaching VND 161,309 billion, a 14% increase compared to the same period.

Source: VietstockFinance

|

Banks with high profit growth in the first half of the year include BVBank (3.8 times), LPBank (2.4 times), VPBank (65%), HDBank (49%), and Techcombank (39%). This performance is attributed to various factors, such as accelerated credit growth, slower cost growth compared to pure interest income growth, more optimistic provisions for credit risk, and high sudden non-interest income.

Source: VietstockFinance

|

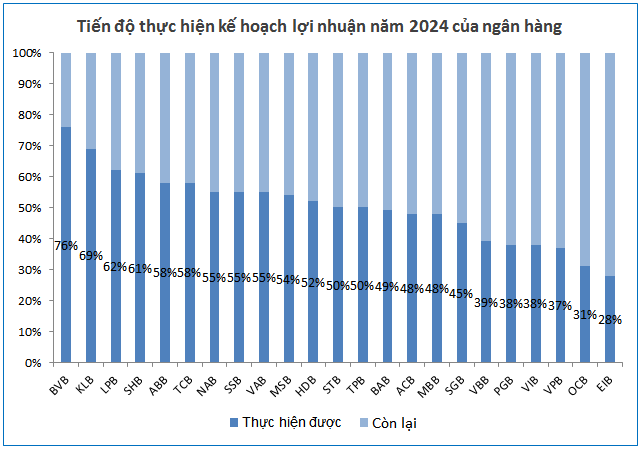

It is not surprising that BVB is the bank with the highest ratio of profit plan achievement compared to the general level thanks to its leading profit growth rate in the first quarter and the second-highest growth rate in the second quarter.

With an ambitious target of a 178% increase in pre-tax profit compared to the low base of 2023, BVB has achieved 76% of its plan, even though only half of the year has passed. It is possible for BVB to achieve its annual profit target as early as the third quarter if the bank can maintain its profit growth rate, which has been increasing exponentially in the first two quarters.

The race for bank profits has yet to heat up

Source: VietstockFinance

|

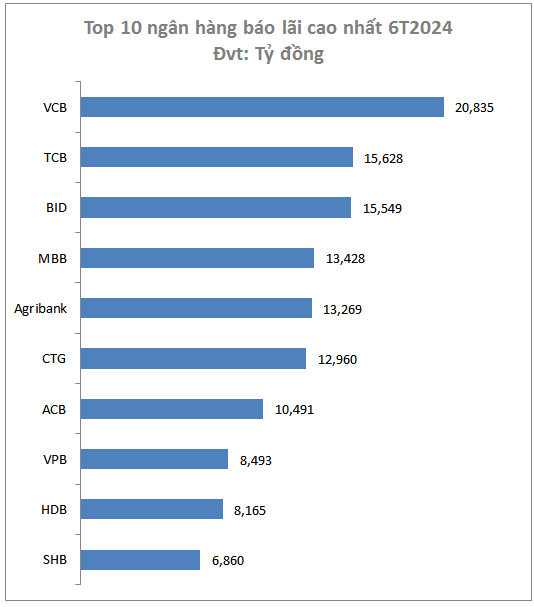

Similar to the ranking of the top 10 profitable banks in the first quarter of 2024, the ranking of bank profits after the second quarter remains unchanged.

Vietcombank, a giant state-owned bank, saw its profit increase by only 2% in the first half of the year but still far outpaced other banks with a profit of VND 20,835 billion, maintaining its top position. Techcombank, following its profit increase in the first quarter, continued its upward trajectory in the second quarter, solidifying its second-place position with a profit of VND 15,628 billion.

BIDV, with a slightly slower profit growth rate than Techcombank, came in third with a profit of VND 15,549 billion.

Bank profits in 2024 rise with increasing capital demands

According to Agriseco Research, the interest income of the banking sector for the whole of 2024 will grow positively as credit is promoted, with a remaining growth potential of about 9% in the second half of 2024. Factors contributing to credit growth include low-interest rates, which will support the disbursement of loans to manufacturing enterprises, improved macroeconomic indicators reflected in PMI, import and export turnover, and a recovering real estate market. Additionally, the government and the State Bank’s policies and measures to support credit growth will play a crucial role.

KBSV Research also points to positive signs in the latter part of the second quarter, with improved credit growth and macroeconomic indicators. KBSV predicts that credit growth for the economy will achieve the 15% plan as the government continues to implement the policy of maintaining low lending rates to support economic recovery.

“The momentum of credit growth in the second half of the year will be further contributed by the individual customer segment and the real estate market, which is expected to continue its recovery following the government’s efforts to resolve legal issues,” KBSV stated.

Similarly, BETA Research expects credit growth to continue improving in the second half of 2024, driven by recovering personal credit demand for consumption and home purchases. Moreover, there is a sustained demand for production expansion from manufacturing enterprises, supported by improved exports and increased import demand from major countries. The real estate market is also anticipated to recover and become more vibrant in the latter half of the year.

Khang Di

Every day, Trần Đình Long, the owner of Hòa Phát, has to shoulder nearly 10 billion dong in loan interest.

In 2023, Hoa Phat’s borrowing costs amounted to nearly 3.6 trillion dong, increasing by over 16% compared to 2022 and reaching a record high since its inception.