The VN-Index surged to 1,284 points, an impressive 11.5-point increase from the previous day’s trading, led by a strong rally in banking stocks. This positive momentum resulted in a broad market advance, with 241 stocks rising compared to only 174 declining.

Almost no sector faced corrective pressure, indicating a high level of consensus and uniformity in the market. Leading the charge were the banking heavyweights, which climbed a robust 1.75%. Individual stocks within this sector witnessed notable gains, including VCB, up 2.2%; BID, up 2.95%; CTG, up 3.01%; and MBB, up 2.06%. This group single-handedly propelled the overall market upward, largely driven by news about peak non-performing loans, which have mostly been priced in following the recent correction.

In addition to banking, other sectors that contributed to the rally included securities, up 0.79%; building materials, up 0.68%; telecommunications, up 2.54%; energy, up 1.12%; and real estate, which trimmed its losses from the previous day to just 0.2%.

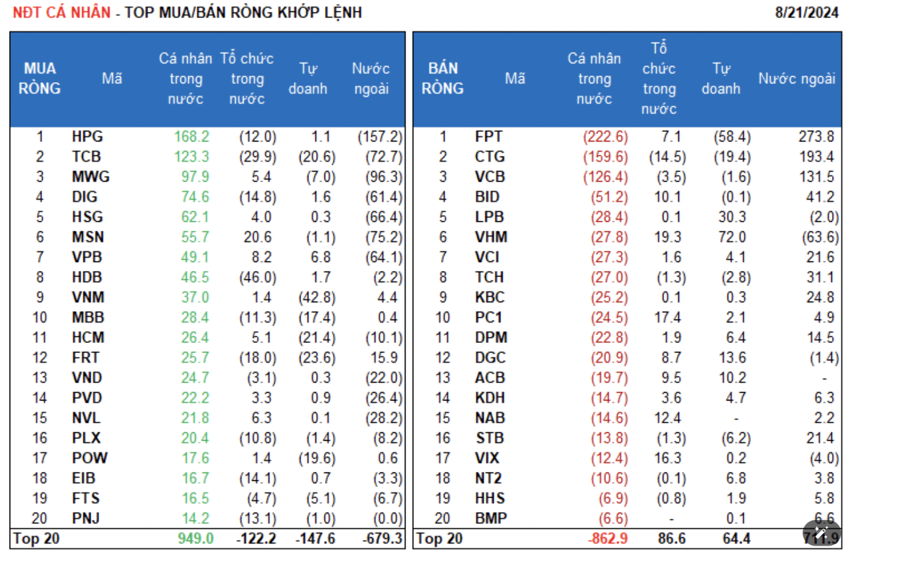

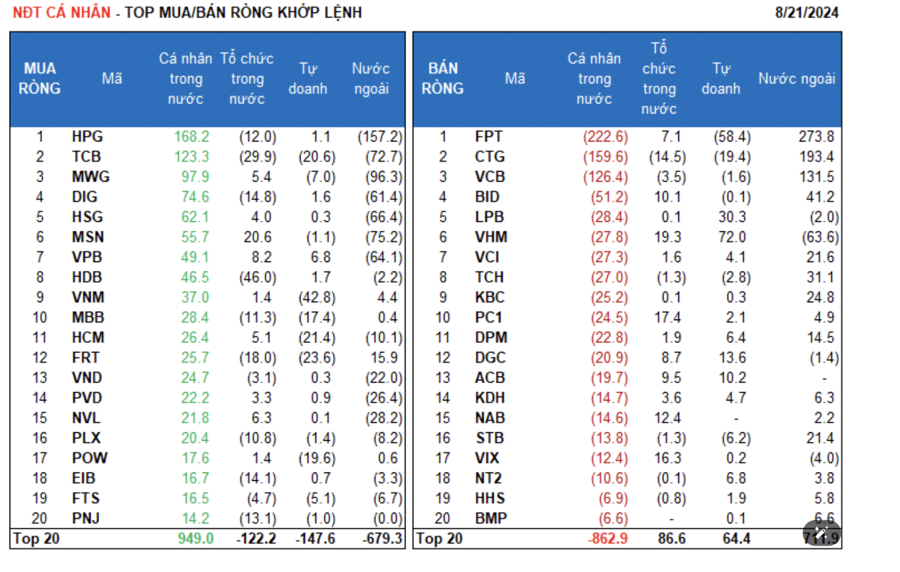

The market witnessed a strong influx of capital, with a combined trading volume of 23 trillion VND across the three exchanges. However, foreign investors offloaded holdings, resulting in a net sell-off of 218 billion VND, mainly attributed to their selling of HPG and buying of FPT, CTG, and VCB.

Foreign investors sold a net amount of 321.8 billion VND, with a net sell-off of 214.9 billion VND in the matched bargain segment. Their net buying in this segment focused on the information technology and banking sectors, with top purchases including FPT, CTG, VCB, BID, TCH, KBC, VCI, STB, FRT, and DPM.

On the other hand, their net selling was concentrated in the basic resources sector, with HPG, MWG, MSN, TCB, HSG, VHM, DIG, NVL, and PVD being the top stocks offloaded.

Retail investors sold a net amount of 582.0 billion VND, while their net buying in the matched bargain segment stood at 286.3 billion VND.

In the matched bargain segment, retail investors bought a net amount in 11 out of 18 sectors, primarily focusing on basic resources. Their top purchases included HPG, TCB, MWG, DIG, HSG, MSN, VPB, HDB, VNM, and MBB.

On the selling side, they offloaded holdings in 7 out of 18 sectors, mainly information technology and banking. The top stocks sold by retail investors included FPT, CTG, VCB, BID, LPB, VHM, TCH, KBC, and PC1.

Proprietary trading accounted for a net sell-off of 54.7 billion VND, with a net sell-off of 71.1 billion VND in the matched bargain segment. In this segment, proprietary traders bought a net amount in 6 out of 18 sectors, with real estate and chemicals being the top sectors. Their top purchases included VHM, LPB, DGC, DXG, ACB, NT2, VPB, DPM, E1VFVN30, and SSI.

On the selling side, they offloaded holdings primarily in the information technology sector, with FPT, VNM, FRT, HCM, TCB, POW, CTG, MBB, VIB, and APH being the top stocks sold.

Domestic institutional investors bought a net amount of 853.6 billion VND, while their net selling in the matched bargain segment was a meager 0.2 billion VND. In this segment, institutions sold a net amount in 7 out of 18 sectors, with the largest net selling observed in the banking sector. Their top sells included HDB, TCB, FRT, DIG, CTG, EIB, PNJ, HPG, MBB, and PLX.

On the buying side, they focused on the financial services sector, with MSN, VHM, PC1, FUEVFVND, VIX, NAB, FUESSVFL, BID, ACB, and DGC being their top purchases.

Block trading surged to 3,008.4 billion VND, a significant increase of 151% from the previous day, contributing 13% to the total trading value.

Notable block trades occurred between domestic institutions (buyers) and domestic individuals (sellers) in SSI and VIB.

Additionally, block trades were observed among domestic individuals in the banking sector (MSB, TCB, HDB), MSN, MWG, VHM, KOS, HVN, and FPT, among others.

The allocation of funds witnessed an increase in banking, information technology, oil and gas, retail, and steel sectors, while it decreased in real estate, securities, food, agricultural and marine products, and warehousing and maintenance sectors.

Specifically, in the matched bargain segment, the allocation of funds increased in the large-cap VN30 sector but decreased in the mid-cap VNMID and small-cap VNSML sectors.

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.