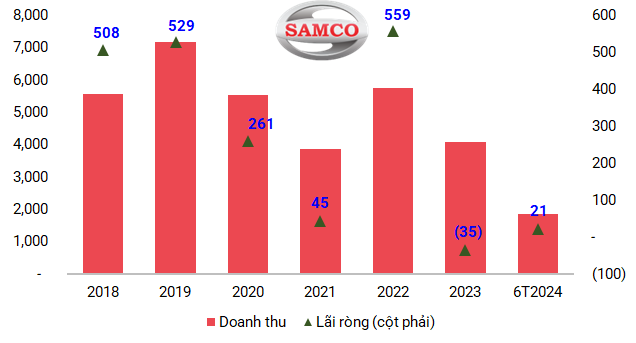

For the first half of 2024, the Saigon Transportation Mechanical Engineering Corporation – SAMCO recorded more than VND 1.8 thousand billion in revenue, unchanged from the same period last year. However, lower cost of goods sold led to a 13% increase in gross profit, reaching VND 244 billion. Revenue from the sale of goods during this period decreased by 22% to VND 834 billion, while revenue from finished products doubled to VND 323 billion.

Joint ventures and associates continued to make significant contributions to SAMCO’s profit structure, with a profit of nearly VND 30 billion this period, equivalent to the first half of last year. Other income decreased by 22%, to VND 54 billion, due to reduced income from sales support.

As a result, SAMCO’s net profit improved by 19%, reaching VND 21 billion, partly due to a 14% reduction in selling expenses, amounting to about VND 88 billion. Compared to the plan of VND 3.8 thousand billion in revenue and VND 194 billion in after-tax profit, the company has achieved about 50% and 29% of its targets, respectively. Regarding the target of VND 936 billion in taxes and other contributions to the state budget, SAMCO has achieved 96% of this goal.

|

Business results of SAMCO from 2018 up to now (Unit: billion VND)

Source: Author’s compilation

|

As of the end of June 2024, the state-owned enterprise’s total assets amounted to nearly VND 5.9 thousand billion, a decrease of VND 671 billion compared to the beginning of the year, with two-thirds being long-term assets. Cash and cash equivalents stood at VND 307 billion, half of the previous amount. Short-term receivables decreased by more than 50% to VND 243 billion, mainly due to reduced receivables of profit and dividends from the associated company, Isuzu Vietnam Co., Ltd.

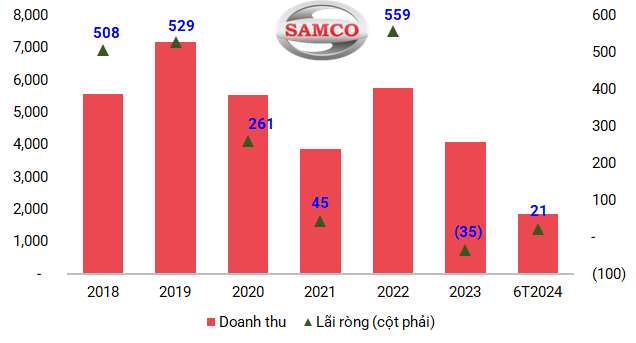

During this period, SAMCO paid VND 900 billion in dividends, double the peak of VND 458 billion in 2019. Consequently, owners’ equity also decreased by 20%, to nearly VND 3 thousand billion, due to the accounting treatment of transferring VND 716 billion from the development investment fund and VND 17 billion of undistributed post-tax profits to the “transfer to state budget, dividend distribution, and other changes” account.

SAMCO, a state-owned enterprise established in 2004, is headquartered in District 1, Ho Chi Minh City, and is owned by the Ho Chi Minh City People’s Committee. Currently, SAMCO has 11 subsidiaries and 14 joint ventures and associates.

|

SAMCO’s dividend payment history from 2014 up to now (Unit: billion VND)

Source: Author’s compilation

|

Relying on Mercedes-Benz for Success?

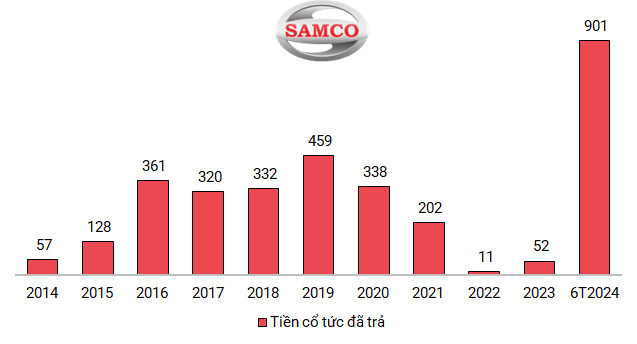

The challenging automotive market has caused significant “shortfalls” for SAMCO in terms of revenue from its joint ventures and associates, leading to a decline in net profit in recent years. Two investments, accounting for over 50% of long-term financial investments, namely Mercedes Benz Vietnam Co., Ltd., and Isuzu Vietnam Co., Ltd., where the enterprise owns 30% and 20% of the capital, respectively, have had a significant impact.

As of the end of June 2024, the investment in Mercedes Benz Vietnam was VND 928 billion, a decrease of VND 30 billion compared to the beginning of the year, while the investment in Isuzu Vietnam was VND 247 billion, a reduction of VND 10 billion. Moreover, the dividends and profit sharing of VND 54 billion during this period were also very low compared to hundreds of billions in previous years.

SAMCO’s peak performance was in 2022, when it earned VND 513 billion in profit from joint ventures and associates, resulting in a net profit of VND 559 billion. This was also the time when the investment values in Mercedes Benz Vietnam and Isuzu Vietnam reached their highest levels in more than a decade, at VND 1,000 billion and VND 522 billion, respectively. In 2023, the company reported a loss of nearly VND 29 billion from joint ventures and associates, resulting in a net loss of VND 35 billion.

|

SAMCO’s main investment trends from 2014 up to now (Unit: billion VND)

Source: Author’s compilation

|

Established in 1995, Mercedes-Benz Vietnam is a joint venture between SAMCO and Daimler AG, Germany. The collaboration is expected to end in April 2025. An application for extension has been submitted since 2021 to prolong the partnership until 2030, but the procedures have not been completed yet.

During a working session on August 17 with the leaders of Ho Chi Minh City, General Secretary and State President To Lam affirmed that he would continue to work with relevant agencies to find solutions to these difficulties.

SAMCO is in the process of implementing the restructuring plan for the 2022-2025 period, as decided by the Ho Chi Minh City People’s Committee in August 2022, related to the project “Restructuring state-owned enterprises under the Ho Chi Minh City People’s Committee.”

In its development strategy for the period of 2020-2025, with a vision towards 2030, SAMCO aims to achieve a total revenue of VND 9,000 billion and a pre-tax profit of VND 700 billion by 2025. These targets encompass revenue from the production and business activities of transportation mechanical products and automobile services, as well as financial investments in member companies (parking lots, passenger transport, and joint ventures).

Tu Kinh

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.