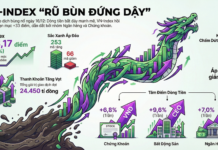

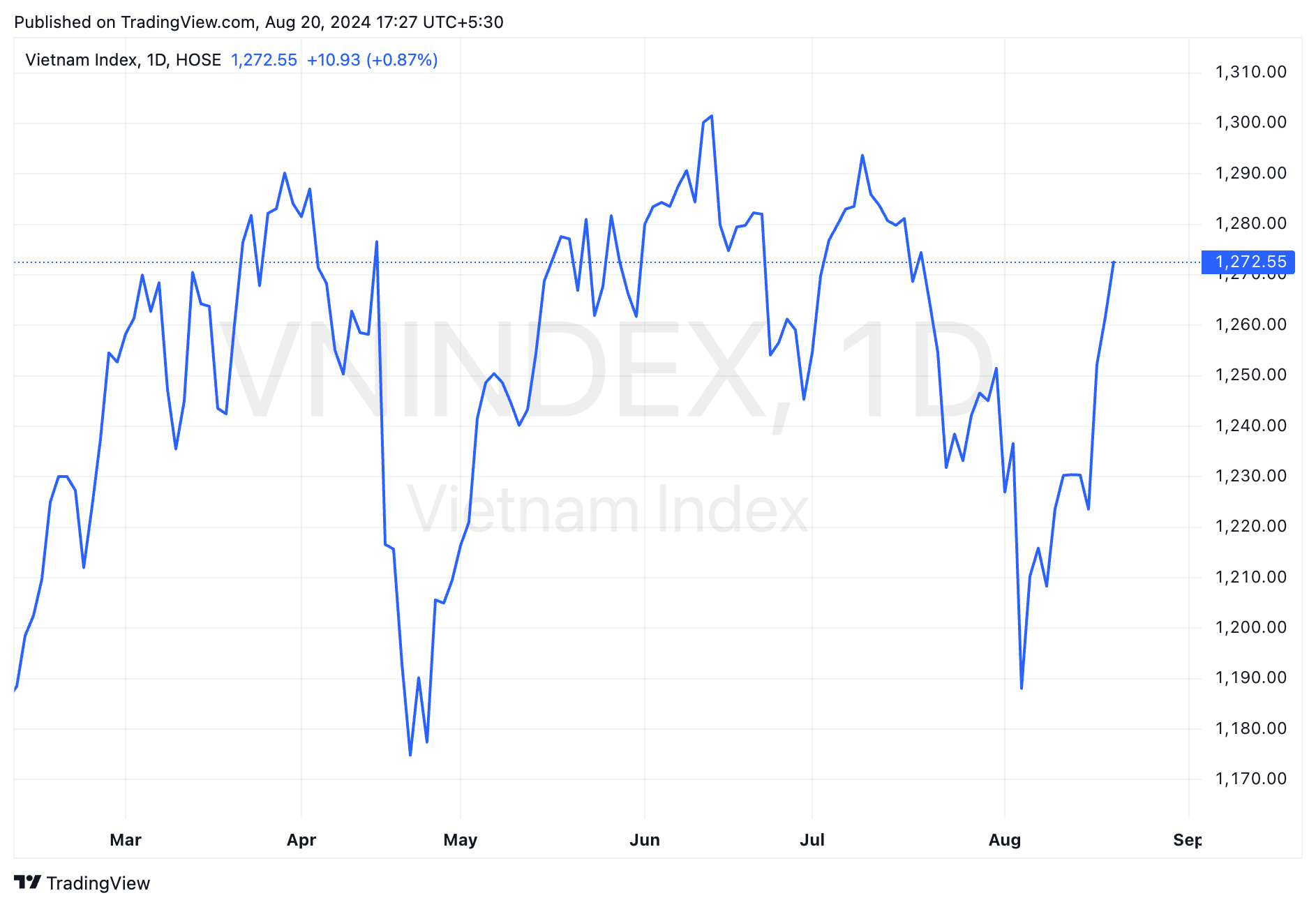

The Ho Chi Minh Stock Exchange (HoSE), Vietnam’s main stock market, witnessed another robust performance on August 20, building on the previous session’s strong gains. The VN-Index, the market’s benchmark index, climbed nearly 11 points to close at 1,272.55, breaching the 1,275-point threshold. Real estate stocks took center stage, attracting substantial trading volume, with some even hitting the daily limit-up of 10% with buy-side dominance.

The market narrowed its gains slightly towards the closing bell, but the overall sentiment remained upbeat. Foreign investors were net buyers, injecting nearly VND 313 billion into the market, providing further impetus to the rally.

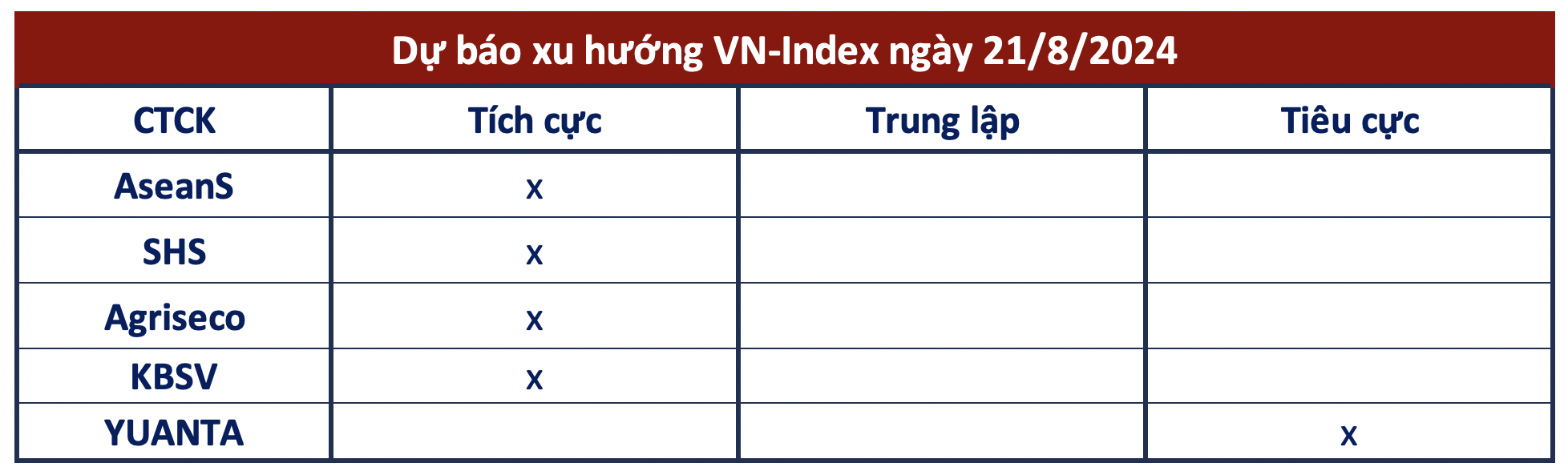

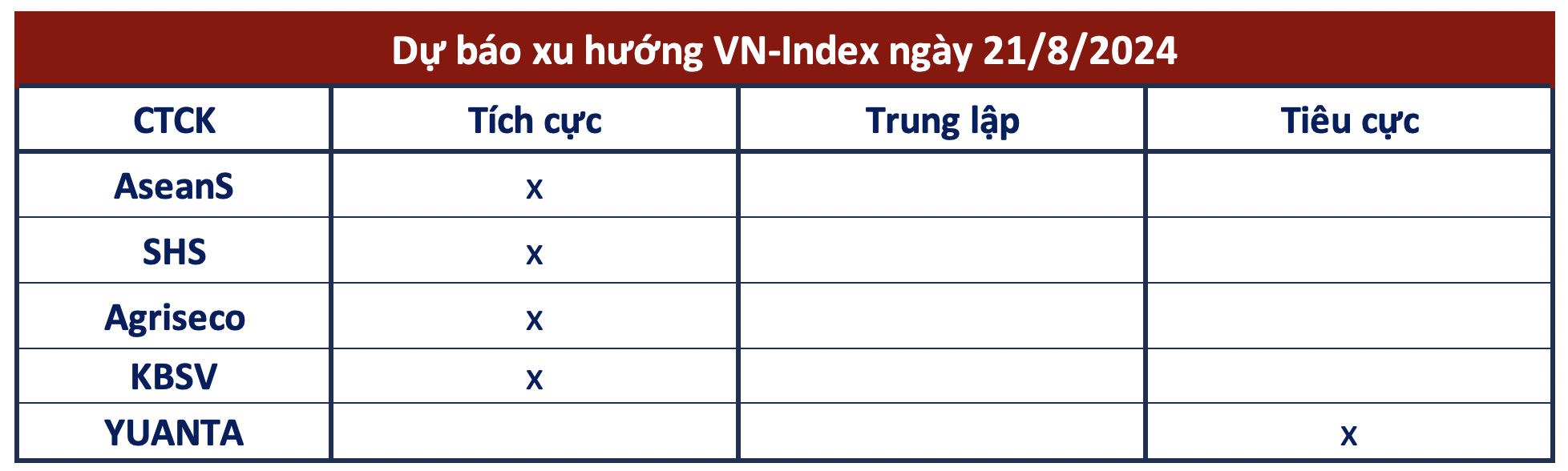

With this extended upswing, most securities firms foresee the VN-Index sustaining its upward trajectory before encountering resistance at higher levels. However, investors are advised against chasing rallies, and it is recommended to preserve profits and deploy capital during consolidations rather than buying at elevated levels.

According to SHS Securities, the short-term downtrend of the VN-Index has concluded, and the market has re-entered a positive consolidation phase within the 1,250 – 1,300 range. A positive development is the reduced selling pressure on low-priced stocks, with a low T+2 balance, leading to many profitable long positions. SHS anticipates that, influenced by the recovery of various sectors, the VN-Index will advance towards the 1,280 – 1,300 zone.

Nevertheless, SHS cautions against aggressive buying at this juncture, as the index is prone to sharp corrections, and the current price levels are not particularly attractive. Investors are advised to focus on leading stocks with robust second-quarter earnings and promising prospects for the remainder of the year.

Sharing a similar outlook, Asean Securities foresees the VN-Index marching towards the previous peak region of 1,280 – 1,300. The market is expected to undergo a period of consolidation as profit-taking and cautious sentiment come into play. However, a decisive breakout could occur once supportive factors are confirmed at these levels. Investors are advised to safeguard their gains and consider rebalancing their portfolios towards stocks with robust price action and positive short-term business prospects.

Agriseco Research, concurs with the positive sentiment, anticipating that the market will ascend towards the 1,290 zone in the upcoming sessions, propelled by the ongoing V-shaped recovery dynamics. Agriseco recommends that investors increase their trading positions during intraday dips, focusing on leading stocks in sectors attracting strong capital inflows, such as real estate, securities, and retail.

KB Vietnam Securities attributes the market’s resilience to the sustained enthusiasm in leading sectors, providing crucial support to the broader market. The firm predicts that the VN-Index is likely to maintain its recovery momentum in the near term before encountering stronger headwinds and corrections around the upper boundary of the nearby resistance zone. Investors are encouraged to average down when the overall market or their target stocks undergo corrections towards nearby support levels.

Yuanta Vietnam Securities adopts a more cautious stance, suggesting that the market may undergo a corrective phase in the next session, with immediate support located at 1,260. However, they acknowledge that the market remains in a dynamic and positive transformation phase, implying that any corrections will likely be short-lived and primarily technical in nature, coinciding with heightened profit-taking as many stocks have already achieved substantial gains since the recent lows.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.