Illustration

According to the State Bank of Vietnam, as of the end of June, the country’s credit outstanding balance reached nearly VND 14,400 trillion, up 6% compared to the end of last year, completing the Government’s set target.

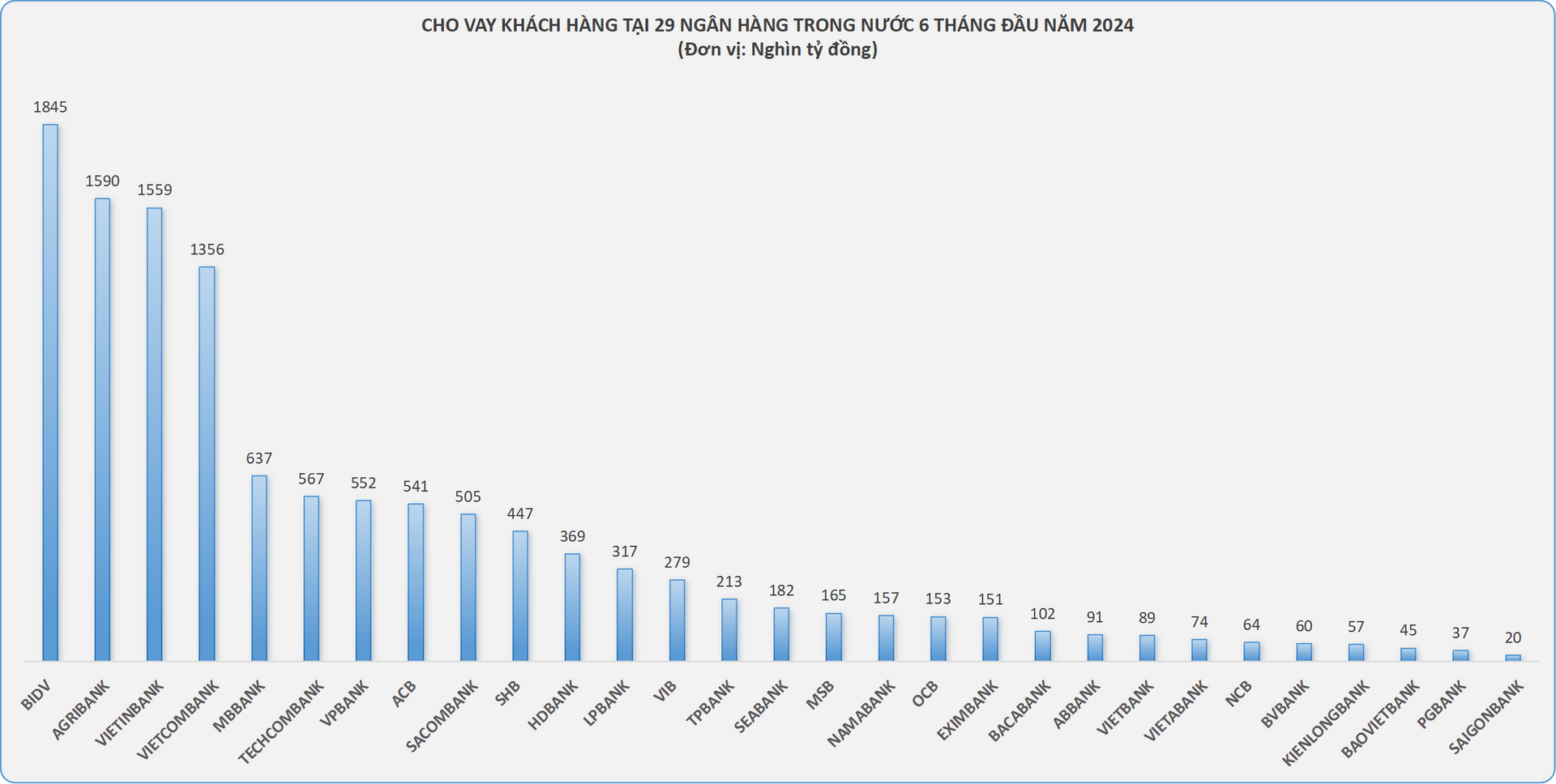

According to the financial reports of 29 banks in the first half of 2024, loans to customers reached more than VND 12,200 trillion, with outstanding loans increasing by over 7% in the first six months. Notably, 11 banks achieved double-digit growth, while only one bank experienced negative growth during this period.

In terms of scale, the four state-owned commercial banks, including BIDV, Agribank, VietinBank, and Vietcombank, continue to dominate customer lending, far surpassing the private banks.

Specifically, BIDV leads in customer lending with a scale of more than VND 1,880 trillion, up 5.9% compared to the end of last year.

Agribank ranked second with outstanding loans of nearly VND 1,600 trillion, up 3% year-on-year. This is followed by VietinBank with outstanding loans of over VND 1,500 trillion, an increase of 5%.

Vietcombank took fourth place with a total outstanding loan balance of over VND 1,300 trillion, up 8% year-on-year.

Among the private banks, MBBank maintained its leading position with a total outstanding loan balance of nearly VND 637 trillion, up 10% compared to the end of last year. Techcombank and VPBank followed with outstanding loans of nearly VND 567.4 trillion (up 13%) and VND 552.2 trillion (up 11%), respectively.

The next positions were held by ACB with VND 541 trillion (up 12%), Sacombank with VND 505 trillion (up 7%), and SHB with VND 447 trillion (up 5%).

Source: Financial Statements of Banks. Compiled by N.Nga

In terms of growth rate, several banks recorded double-digit loan growth, including LPBank (15%), Techcombank (13%), HDBank (13%), MSB (13%), ACB (12%), and VPBank (11%), among others.

Notably, a small-scale bank, NCB, also achieved a surprising 16% growth in lending in the first half of the year, with customer loans reaching nearly VND 64.2 trillion.

On the other hand, ABBank was the only bank to record a decline in customer loan balances. After the first six months, ABBank’s loan balance decreased to VND 91 trillion, a 7% drop compared to the end of the previous year.

Lending activities at banks are expected to improve in the second half, supported by positive signs from the macroeconomic environment and new policies.

Notably, the State Bank of Vietnam (SBV) recently issued Circular No. 12/2024 amending and supplementing a number of articles of Circular No. 39/2016. According to this new regulation, from the beginning of July 2024, individuals borrowing small amounts of less than VND 100 million from banks will not be required to provide a feasible capital usage plan.

Instead, customers only need to commit to using the capital for legal purposes and demonstrate their ability to repay the loan to receive the disbursement. This move is expected to boost lending for personal and consumer purposes while curbing the prevalence of “black credit.”

“Inspecting Bank Deposits and Loans”

A bank is a financial intermediary that specializes in accepting deposits from surplus units and lending to deficit units. In traditional thinking, deposits must precede loans on the balance sheet of banks. However, the modern money creation system by the banking system has made those rules not always true. The credit expansion and deposit growth in Q4-2023 is evidence of the diversity in the operation of the banking system.

Explaining the reasons behind the negative credit growth in the first two months of the year, Deputy Governor of the State Bank of Vietnam (SBV) offers insights.

The Deputy Governor revealed that the actual implementation by early 2024, after monitoring for 2 months, showed slower credit growth compared to the same period in previous years, despite ample liquidity.