Retail stocks rode the wave of the broader market’s upswing on August 21st, with a host of stocks in the sector witnessing robust gains. Among the notable performers were PET (Petrosetco), PSD (PetroVietnam General Services Joint Stock Corporation), DGW (Digiworld), MWG (The Gioi Di Dong), and PNJ (Phu Nhuan Jewelry Joint Stock Company), all of which posted solid increases.

FPT Retail’s stock, FRT, stood out with a dazzling 6.82% surge, even touching its daily limit at one point, as it soared to 188,000 VND per share. This marked a new all-time high for FRT since its listing on the exchange. Likewise, PNJ continued its upward trajectory, climbing to a historic peak of 108,400 VND per share, a modest 0.4% gain. It’s worth noting that PNJ had also reached a new high in the previous session. Meanwhile, MWG closed at 69,800 VND per share, its highest level in 23 months since September 2022.

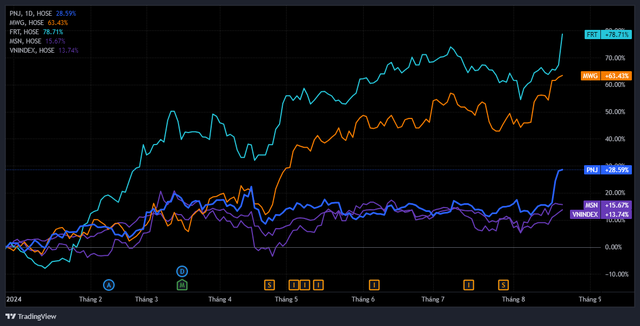

The influx of cash into the retail sector resulted in impressive gains for the group, with double-digit percentage increases compared to the beginning of the year. Specifically, MWG and FRT have rallied significantly, surging 63% and nearly 80%, respectively, since the start of 2024. On a more modest note, PNJ, MSN, and others have witnessed increases ranging from 15% to 30% year-to-date, outperforming the broader market.

The retail industry’s resurgence after a challenging period has been supported by several favorable factors. Since the beginning of 2024, the government, ministries, and local authorities have implemented various measures to stimulate domestic consumption, including salary reforms and VAT reductions.

These initiatives resulted in an 8.6% year-over-year increase in the total retail sales of goods and service revenue in the first six months of the year, reaching nearly 3.1 quadrillion VND. The growth trend, which has been increasing with each passing month, indicates a positive recovery in consumer spending, albeit at a modest pace.

In the first half of 2024, Vietnam’s retail and consumer goods sector witnessed several notable foreign investment deals, such as Bain Capital’s investment in MSN and CDH Investments’ investment in BHX (a subsidiary of MWG). Additionally, well-known international retail brands like UNIQLO, MUJI, and Starbucks expanded their presence in Vietnam by opening new stores.

Consequently, the financial performance of many companies in the industry improved during the first half of the year. Bach Hoa Xanh (BHX) turned profitable, and the growth of the electronics chain contributed to MWG’s second consecutive quarter of exceptional growth compared to the previous year, with a 5,200% surge in net profit for the first six months, nearly completing its full-year plan. Similarly, FRT, driven by its Long Chau pharmacy chain, reported profits for the second consecutive quarter, with a net profit of 109 billion VND for the first six months, a significant improvement compared to the loss of 213 billion VND in the same period last year. PNJ also recorded record-high profits for the first half of the year.

“Vietnam’s retail industry presents numerous opportunities to attract substantial capital in the future”

Moreover, the business outlook for the retail and consumer goods sector remains positive in the upcoming period.

In the second half of the year, the retail sector is expected to continue its recovery, bolstered by positive signals from the macroeconomy and the low base from the previous year. As the Fed moves closer to a potential rate cut, it is anticipated to ease pressure on exchange rates, providing room for the SBV to maintain its accommodative monetary policy. This, in turn, is expected to stimulate consumption and revive domestic purchasing power.

Additionally, the government’s supportive policies, including the base salary increase and the ongoing 2% VAT reduction until the end of 2024, will continue to yield positive results. The economic recovery is expected to positively impact consumer sentiment, and an optimistic spending attitude is likely to encourage spending in a low-interest-rate environment.

According to KBSV, modern grocery chains are benefiting from the shift in consumer behavior from traditional to modern channels, leveraging their advantages in quality and service. Similarly, in the future, retail pharmacy chains are expected to outperform small, independent stores due to their scale, service, and assured product quality.

Regarding the ICT retail industry, KBSV anticipates growth drivers in the second half of 2024, including (1) the replacement cycle of phones and laptops, and (2) the discontinuation of 2G and 3G networks. However, this industry is already quite saturated and highly competitive, leading many retail chains to aim for single-digit growth this year.

In the jewelry retail segment, the analysts expect that the government and the State Bank’s determination to cool down the gold market will contribute to a decrease in gold prices and stabilize them over time.

Given the optimistic outlook, KBSV believes that Vietnam’s retail industry presents numerous opportunities to attract substantial capital in the future. In the long term, the market anticipates significant IPOs from prominent domestic retail companies, such as MSN’s IPO of The CrownX, FRT’s IPO of Long Chau, and MWG’s potential IPO of BHX and EraBlue.