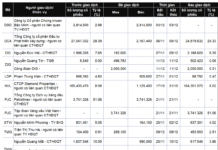

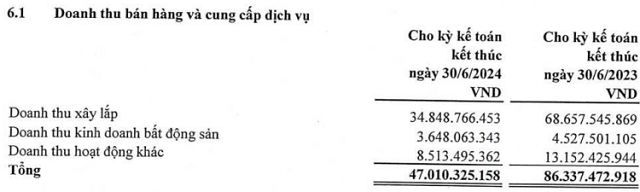

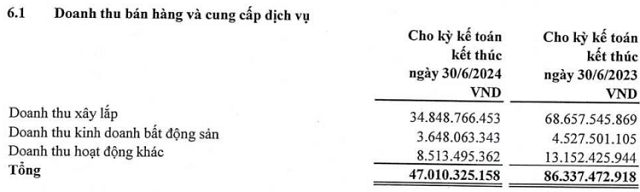

HU1’s net revenue for the first half of 2024, according to its audited separate financial statements, was only VND 47 billion, with a profit after tax of over VND 24 million. This marks a 46% and 71% decrease, respectively, compared to the same period last year. The company’s revenue primarily came from construction activities, amounting to nearly VND 35 billion, a 49% drop.

|

Source: HU1

|

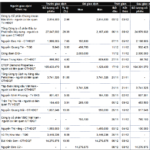

These results come as no surprise, as HU1’s profit for the past six quarters (Q1/2023 – Q2/2024) has not exceeded VND 100 million per quarter.

Explaining the reasons behind these figures, the company attributed the challenges in the real estate market and construction activities to a continued decline in their business opportunities, resulting in a decrease in profit after tax compared to the previous year.

Amidst its struggling performance, HU1 also faced several issues in its latest financial statements, leading to qualified conclusions from CPA Vietnam Audit Company Limited.

As of June 30, 2024, the auditing company was unable to obtain sufficient evidence to evaluate and determine the impact of the company’s construction work in progress for projects that have not had balance fluctuations over the years, amounting to over VND 4.5 billion in the separate financial statements.

Regarding this matter, HU1 stated that they are working with investors to proceed with the settlement of these projects.

Additionally, the auditing company could not gather adequate appropriate evidence related to the existence, accuracy of balances, and assessment of collectability as of June 30, 2024, for accounts receivable amounting to over VND 2 billion in the separate financial statements.

HU1 explained that all debt confirmations and reconciliations for accounts payable and receivable have been sent to the relevant customers, and the company is in the process of reconciling the data. They aim to recover the amounts as soon as possible and continue providing information to the auditing company.

Furthermore, as of June 30, 2024, the auditing company had not obtained sufficient appropriate audit evidence related to the management’s assessment of the impairment of the investment in Dai Thien Loc Company Limited, with an original value of VND 13 billion. Therefore, the auditors could not determine if any adjustments were necessary.

|

On May 19, 2021, HU1 and Dai Thien Loc signed a contract for cooperation in investing, constructing, and operating the Dai Thien Loc Long-distance Vehicle Rest Stop Project in Lien Bao, Tien Du, Bac Ninh province. Currently, HU1 is adjusting the detailed planning of the project and looking for partners to transfer its capital contribution, valuing no less than VND 13.5 billion. |

HU1 explained that they have received debt confirmation and plans to transfer the business cooperation with Dai Thien Loc to another unit in 2024.

HU1’s stock has been on the warning list since April 25, 2024, due to the auditing company’s qualified opinion on the audited consolidated financial statements for 2023, which falls under the category of securities subject to warning according to regulations.

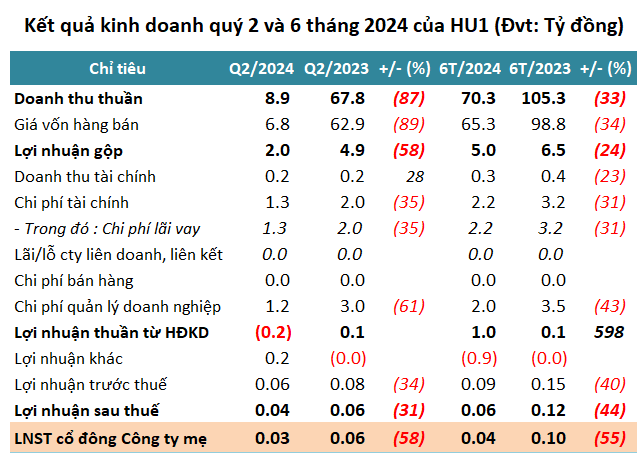

Consolidated profit decreased by nearly 60% in Q2

According to HU1’s consolidated financial statements for Q2/2024, the company recorded a net revenue of nearly VND 9 billion and a profit after tax of almost VND 30 million, marking an 87% and 58% decrease, respectively, compared to the same period.

For the first six months, HU1’s profit after tax reached nearly VND 45 million, a 55% drop. Compared to the plan to achieve a profit before tax of VND 3.8 billion in 2024, HU1 has only achieved 2% of its target so far.

|

Source: VietstockFinance

|

As of June 30, 2024, HU1’s total assets were nearly VND 713 billion, a 13% increase from the beginning of the year. This includes cash and cash equivalents of nearly VND 48 billion, almost five times higher. Inventories amounted to over VND 126 billion, an 18% increase.

On the liability side of the balance sheet, payables stood at VND 564 billion, a 17% increase, due to a 24% rise in short-term financial debt from over VND 233 billion at the beginning of the year to nearly VND 290 billion. The company does not have any long-term financial debt.

According to plans, HU1 will pay a 2022 cash dividend of 3% (equivalent to VND 300 per share), with an expected payout of VND 3 billion, to shareholders on August 22. The company also intends to distribute dividends at a rate of 3% for 2023 and 2024.

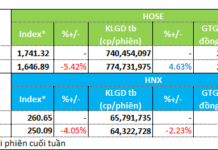

In the morning session on August 22, HU1’s share price traded around VND 6,500 per share, an 8% decrease compared to the beginning of 2024, with an average liquidity of just over 4,000 shares per session.

HU1’s share price movement since the beginning of 2024

Thanh Tú

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.