Amid geopolitical shifts and trade partnerships, industrial real estate in Vietnam continues to attract FDI due to its competitive costs compared to other countries in the region. These competitive advantages include labor, land rental, and electricity costs.

Total registered FDI into Vietnam in the first half of 2024 reached nearly $15.2 billion, a 13% increase compared to the same period last year. Disbursed FDI exceeded $10.8 billion, an increase of over 8%. During this period, FDI inflows into real estate amounted to nearly $2 billion, 4.7 times higher than the same period last year, accounting for nearly 20% of the total registered capital.

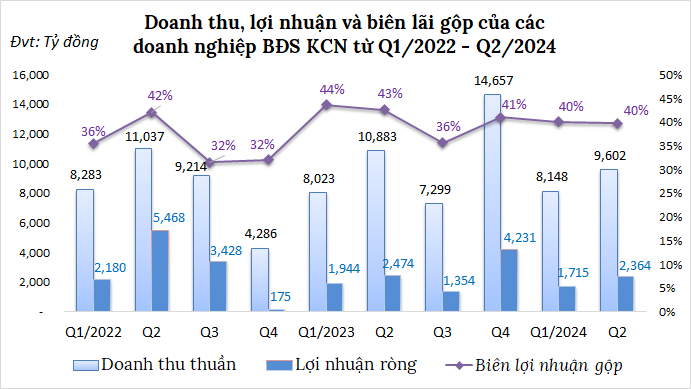

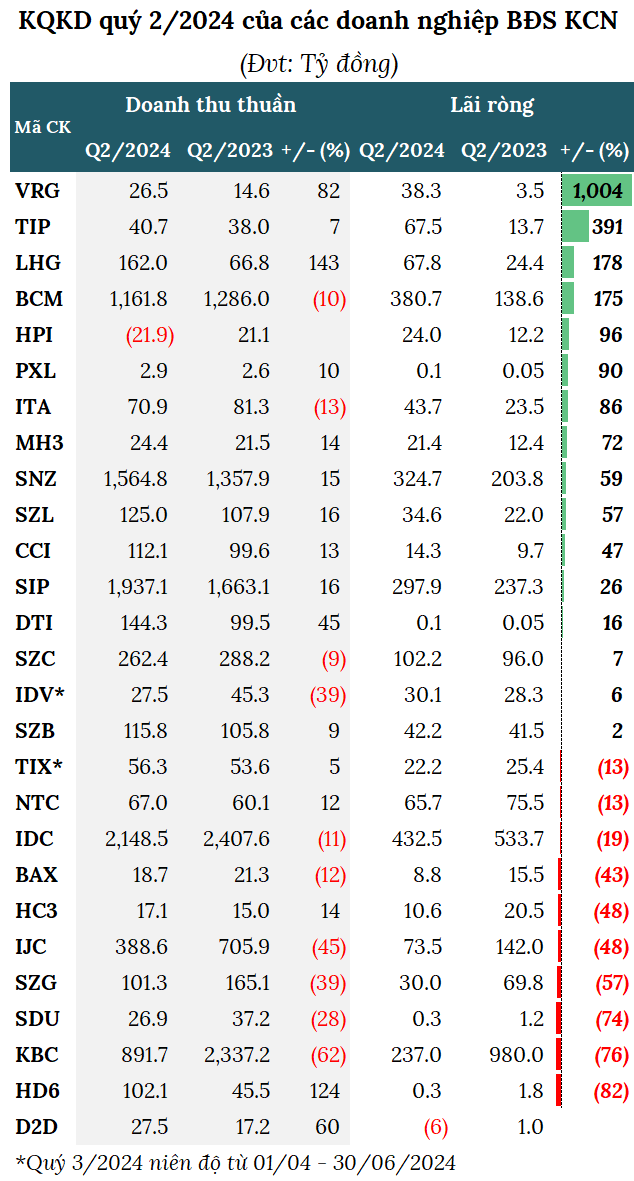

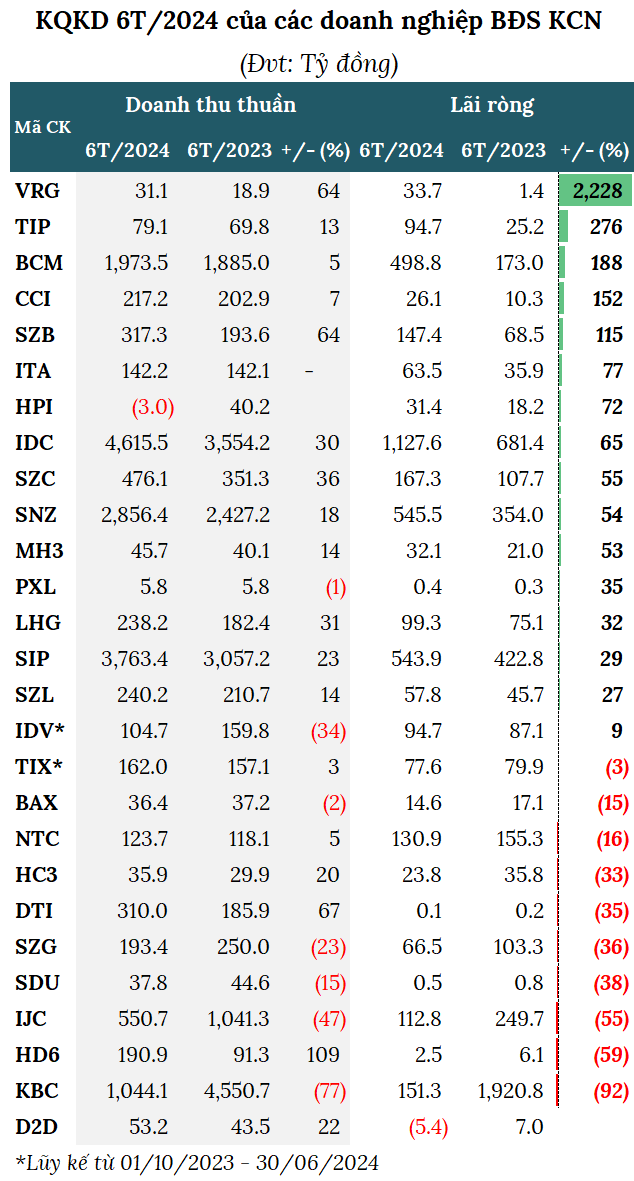

In terms of business performance, financial statements from 27 industrial real estate enterprises listed on the stock exchange (HOSE, HNX, UPCoM) showed a total revenue of VND 9,602 billion and a net profit of over VND 2,364 billion, representing a 12% and 4% decrease, respectively, compared to the previous year. However, compared to the previous quarter (Q1/2024), both revenue and net profit increased by 18% and 38%, respectively.

These enterprises have maintained a relatively high gross profit margin, ranging from 32-44% over the past 10 quarters (since Q1/2022), with Q2/2024 recording a gross profit margin of 40%.

Source: VietstockFinance

|

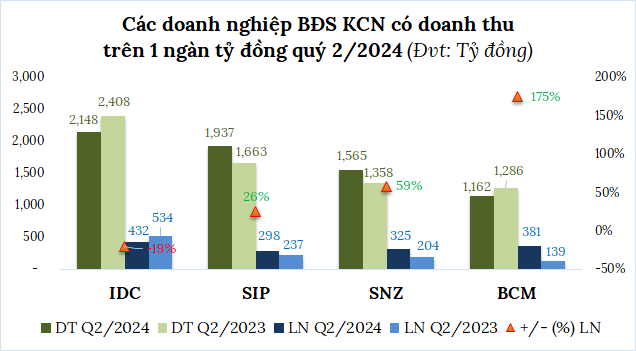

Enterprises with Revenue Over VND 1,000 Billion

In Q2/2024, only 4 out of 27 enterprises achieved revenue above VND 1,000 billion, compared to 5 enterprises in the same period last year. This decrease was due to the decline of Kinh Bac City Development Holding Corporation (HOSE: KBC), which reported revenue of nearly VND 892 billion and a net profit of VND 237 billion, representing a 62% and 76% decrease, respectively. In the first half of 2024, KBC’s profit decreased by 92%, mainly due to a downturn in its industrial park business.

Total IDC Corporation (HNX: IDC) continued to lead in terms of revenue in Q2, with over VND 2,148 billion, an 11% decrease, and a net profit of nearly VND 433 billion, a 19% decrease. IDC attributed the profit decline to lower revenue from infrastructure rental contracts in industrial parks compared to the previous year. In the first six months, the company recorded revenue of nearly VND 4,616 billion and a net profit of almost VND 1,128 billion, representing increases of 30% and 65%, respectively. Regarding its 2024 targets, IDC has accomplished 56% of its revenue goal and 69% of its pre-tax profit goal.

Following IDC, Saigon VRG Corporation (HOSE: SIP) achieved revenue of VND 1,937 billion, a 16% increase, and a net profit of nearly VND 298 billion, a 26% increase. These positive results were attributed to increased revenue from industrial park utility services and gains from investment sales in the second quarter compared to the same period last year. In the first six months, SIP’s revenue exceeded VND 3,763 billion, a 23% increase, and its net profit was nearly VND 544 billion, a 29% increase. The company has achieved 75% of its annual revenue target and 74% of its profit target.

Sonadezi Corporation (UPCoM: SNZ), another leading industrial developer, reported a 15% increase in revenue to nearly VND 1,565 billion in Q2, while its net profit surged by almost 60% to VND 325 billion. Becamex IDC Corporation (HOSE: BCM), another major player, saw its revenue decrease by 10% to VND 1,162 billion, while its net profit increased by 170% to nearly VND 381 billion. As a result, BCM’s six-month post-tax profit reached over VND 513 billion, more than ten times higher than the previous year. However, with an ambitious 2024 post-tax profit target of VND 2,350 billion, BCM has only achieved 22% of its annual plan.

Source: VietStockFinance

|

Nearly 60% of Enterprises Achieved Profit Growth

In Q2, 16 out of 27 enterprises (59%) witnessed profit growth, 10 enterprises reported profit declines, and one enterprise turned losses into profits. Notably, four enterprises experienced profit increases of over 100%.

The enterprise with the highest profit growth in Q2 was Vietnam Rubber Corporation (UPCoM: VRG), with a net profit of over VND 38 billion, an impressive eleven-fold increase compared to the same period last year. This significant growth was attributed to the recognition of 10% of the remaining contract value from 2023 using the one-time revenue recognition method and adjustments to the cost of infrastructure in industrial parks recorded in 2023.

Tien Nghia Industrial Zone Development Joint Stock Company (HOSE: TIP) also experienced a remarkable surge in net profit, which increased fivefold to VND 68 billion, thanks to gains in financial revenue.

Long Hau Corporation (HOSE: LHG) reported a net profit of nearly VND 68 billion, a 2.3-fold increase and the highest since Q4/2022. This improvement was due to revenue generated from leasing industrial land with developed infrastructure and built-to-suit workshops, which was not present in the same period last year.

Source: VietstockFinance

|

While not among those with profit increases of over 100%, many other industrial park enterprises still achieved double-digit growth. For instance, Tan Tao Industrial Park Joint Stock Company (HOSE: ITA) reported a net profit of nearly VND 44 billion in Q2, an 86% increase, thanks to the reversal of provisions for doubtful accounts receivable and reduced bank interest expenses.

Along with its parent company, Sonadezi, three other subsidiaries also recorded growth: Sonadezi Long Thanh (HOSE: SZL) with a net profit of nearly VND 35 billion, a 57% increase; Sonadezi Chau Duc (HOSE: SZC) with a net profit of over VND 102 billion, a 7% increase; and Sonadezi Long Binh (HNX: SZB) with a net profit of over VND 42 billion, a 2% increase.

Only One Enterprise Reported Losses

While most of the Sonadezi group companies were profitable, its subsidiary, Industrial Urban Development Corporation No. 2 (HOSE: D2D), reported the highest quarterly loss since its listing on HOSE in August 2009. D2D suffered a loss of over VND 6 billion in Q2, compared to a profit of VND 1 billion in the same period last year, making it the only loss-making industrial park enterprise in Q2/2024. This loss was primarily due to a nearly 90% decline in financial revenue and a 60% increase in management expenses. In the first six months, D2D recorded a loss of over VND 5 billion, compared to a profit of VND 7 billion in the same period last year.

In contrast to the positive performance of the four Sonadezi companies, Sonadezi Giang Dien (UPCoM: SZG) experienced a 57% decrease in net profit, amounting to VND 30 billion. In the first six months, SZG’s revenue and net profit declined by 23% and 36%, respectively, to VND 193 billion and nearly VND 67 billion.

Vietnam Rubber Group (VRG) achieved the highest profit growth among industrial park enterprises in the first six months, with a net profit of nearly VND 34 billion, a remarkable 24-fold increase compared to the same period last year. VRG attributed this significant growth to the previous year’s under-accrual of corporate income tax expenses. However, compared to its 2024 target of VND 83 billion in post-tax profit, VRG has only achieved 41% of its goal.

TIP also reported impressive results, with a net profit of nearly VND 95 billion in the first six months, a 3.7-fold increase compared to the same period last year. Regarding its 2024 target of VND 165 billion in post-tax profit, TIP has accomplished 58% of its annual plan.

Cu Chi Industrial, Commercial, and Urban Development and Investment Joint Stock Company (HOSE: CCI) recorded a net profit of over VND 26 billion in the first half of 2024, a 2.5-fold increase compared to the previous year and the highest in its history since its listing in 2010. This outstanding performance was due to the reversal of provisions for securities investments, leading to reduced financial expenses. In relation to its 2024 target of VND 26.5 billion in post-tax profit, CCI has achieved an impressive 98% of its annual plan.

Source: VietstockFinance

|

Which Enterprises Have the Largest Industrial Land Bank for Lease?

5 Competitive Advantages of Investing in Industrial Parks in Vietnam

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.