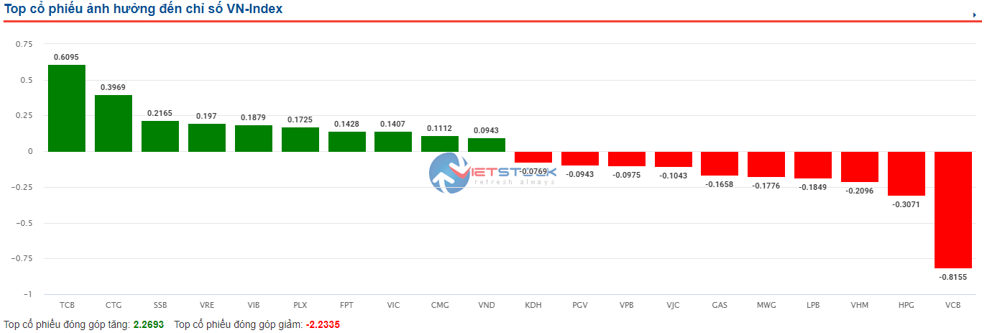

The market breadth tilted towards the red, with large-cap stocks such as BID, HPG, VNM, and VCB exerting significant pressure. These top 10 negative-impact stocks took away over 4 points from the index, while the top 10 positive contributors could only bring in around 2.7 points.

Morning Session: Banking and real estate sectors pushed the VN-Index back into positive territory

After facing multiple pressures around the mid-morning session, the VN-Index quickly regained its positive momentum, driven by the rebound of banking and real estate stocks.

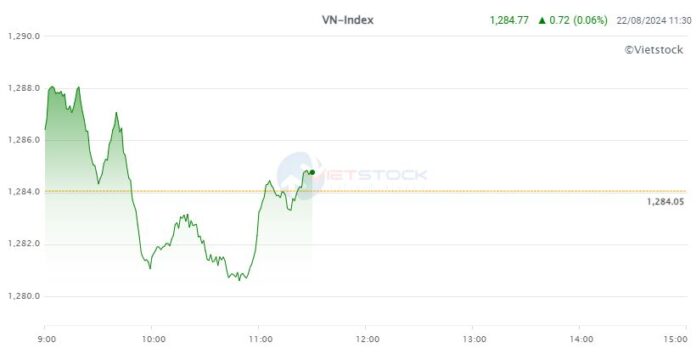

At the end of the morning session, the VN-Index posted a slight gain of 0.72 points, closing at 1,284.77. Meanwhile, the other two indices showed less positive performance, with HNX dropping 0.28 points to 238.13 and UPCoM falling 0.04 points to 94.44. The total trading value of the three exchanges reached VND 7,998.47 billion, similar to the previous session.

Source: VietstockFinance

|

The VN-Index regained its positive momentum, driven by the rebound of banking and real estate stocks.

In the banking sector, TCB led the gains with a 2.5% increase, followed by CTG (+0.88%), SHB (+0.47%), VIB (+1.37%), and SSB (+3.46%). In the real estate sector, several stocks witnessed strong upward movements, notably VRE (+5.29%), NVL (+2.38%), DIG (+1.02%), PDR (+2.14%), and CEO (+1.8%).

The best-performing sector in the morning session was food and essential retail, rising by 4.92%. This was followed by household goods and personal items, which increased by 1.46%, supported by gains in LIX (+1.07%) and NET (+2.16%).

The only sector that declined by more than 1% was the automotive and components industry, dragged down by tire stocks, including SRC (-3.23%), CSM (-1.49%), and DRC (-0.87%).

Foreign trading activities were not particularly active, with a net sell value of over VND 460 billion, resulting from a buy value of more than VND 461 billion and a sell value of over VND 921 billion.

Foreign investors net sold mainly in HPG, HSG, VHM, and VPB, while their net buy focus was on FPT.

10:40 am: The market turned red, with banking stocks displaying mixed performances

The market faced significant pressure from 9:40 am onwards and continued to decline. As of 10:30 am, the VN-Index dropped 2.71 points to 1,281.34. The HNX and UPCoM indices also witnessed similar downward trends.

The number of declining stocks increased considerably compared to the start of the morning session, with 348 codes in the red and 2 floor prices, while 253 codes were in the green and 15 ceiling prices.

The market turned red due to the substantial pressure exerted by many banking stocks that failed to maintain their upward momentum from the early morning session. Examples include MBB, HDB, STB, and VCB… Additionally, several securities stocks faced corrections, such as VIX, SHS, VCI, and SSI…

Speaking of market dominance, the banking sector had the most noticeable impact, appearing in both the positive and negative contribution groups.

Specifically, numerous banking stocks like TCB, CTG, SSB, and VIB were among the top 10 stocks with the most positive impact on the VN-Index. Conversely, VCB, LPB, and VPB were among the top 10 stocks with the most negative impact, with VCB alone taking away more than 0.8 points from the index.

Source: VietstockFinance

|

In terms of declines, the automotive and components industry witnessed the steepest drop of over 1%, led by the trio of tire stocks: DRC, CSM, and SRC.

Opening: Continuing the recovery trend

The VN-Index opened the session on August 22 with a predominantly green tone. Although it underwent a quick correction afterward, the index still managed to climb 1.87 points to 1,285.92 as of 9:25 am.

Market performance as of 9:25 am. Source: VietstockFinance

|

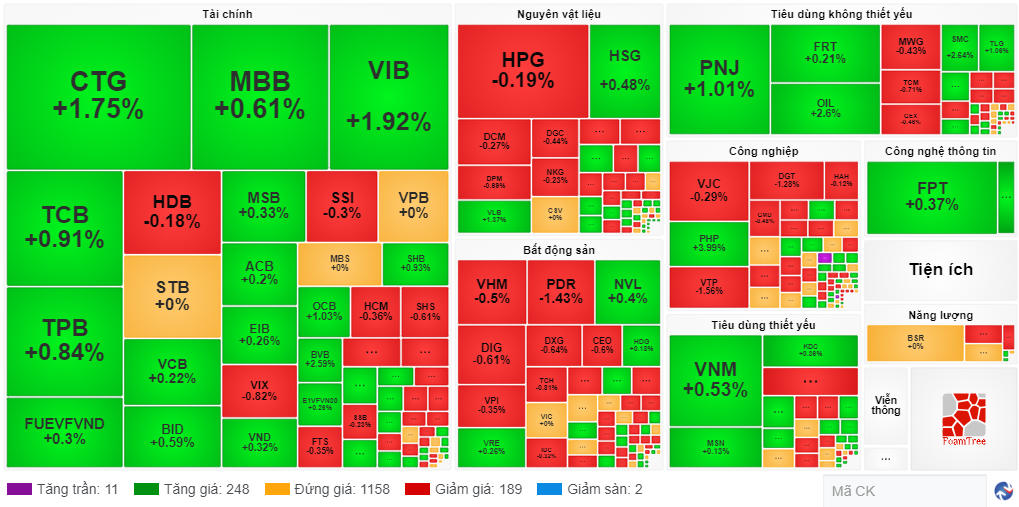

The positive sentiment spread across the market, with 259 rising codes, including 11 ceiling prices, while only 191 codes declined. The trading volume also witnessed an improvement compared to the previous session.

The banking sector once again stood out and acted as a driving force for the market, with notable gains in stocks like CTG (+1.75%), VIB (+1.92%), TCB (+0.91%), TPB (+0.84%), and MBB (+0.61%).

Most industry groups witnessed positive movements, with the food and essential retail group leading the gains. On the other hand, only a few industry groups declined, and the decreases were relatively modest, all below 1%.