An Khang pharmacy chain of The Gioi Di Dong (Illustrative image)

The “Major Overhaul” at An Khang

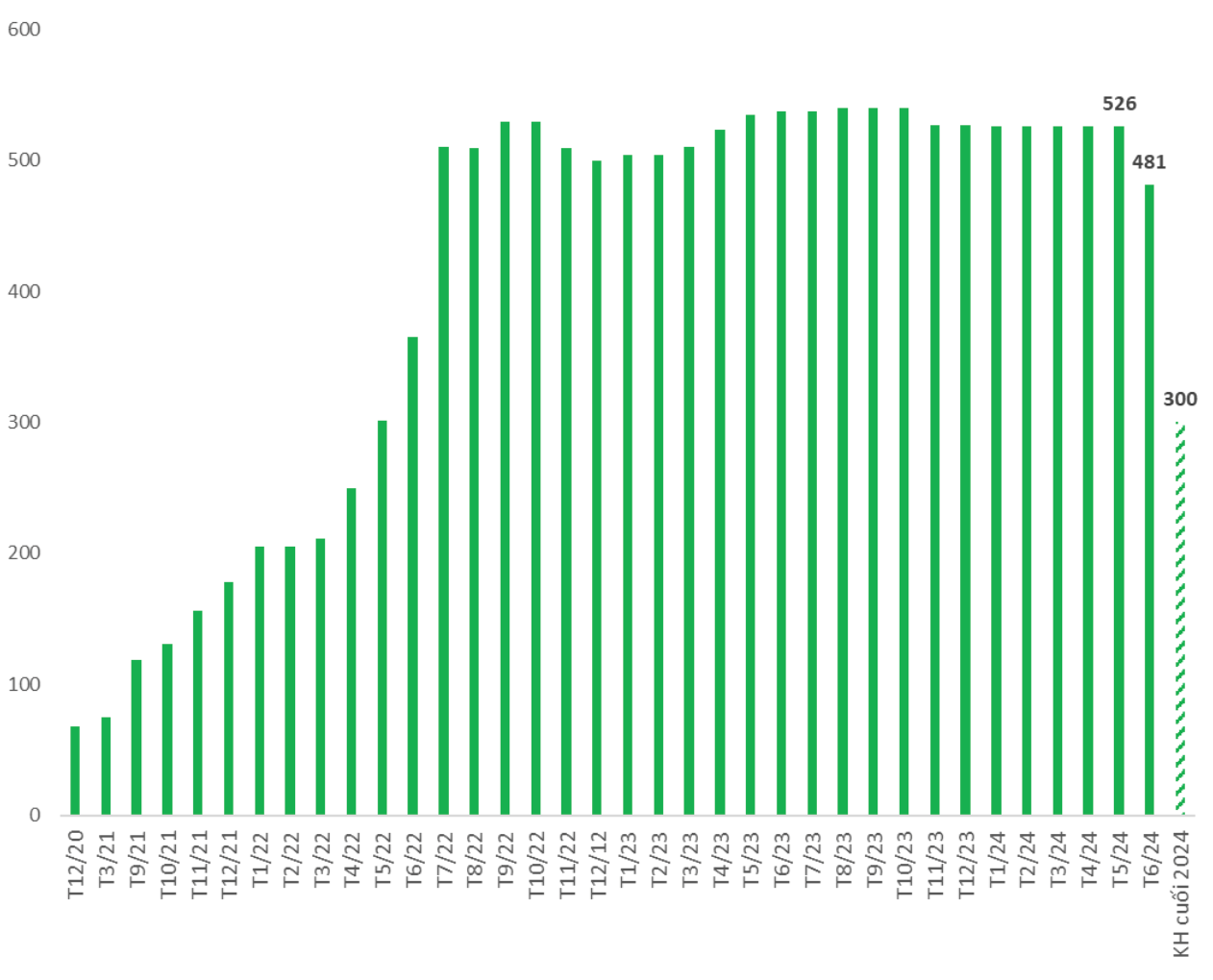

Although it ventured into the pharmaceutical industry in 2017, it was not until 2022 that The Gioi Di Dong (coded MWG) fully committed to the An Khang chain by continuously expanding its scale and opening hundreds of new stores. At that time, the management of The Gioi Di Dong set ambitious milestones, targeting 800 stores by the end of 2022 and 2,000 stores by the end of 2023.

However, the disappointing financial results led to a temporary halt in An Khang’s expansion plans. In 2023, An Khang only added 27 pharmacies, bringing the total to 527. By 2024, the scale remained mostly unchanged in the first half of the year before a significant contraction was observed from June onwards. As of the end of June 2024, there were 481 An Khang pharmacies in operation.

According to Mr. Doan Van Hieu Em, Member of the Board of Directors and CEO of Duoc Pham An Khang, the An Khang chain is undergoing a restructuring process, evaluating each pharmacy and closing down those that are underperforming and contributing less to revenue and profits.

The plan is to reduce the number of An Khang pharmacies to around 300 by the end of 2024, which means that approximately 180 An Khang pharmacies will have to be shut down by the end of this year. Prior to this, in the first half of 2024, An Khang had already closed nearly 50 pharmacies.

An Khang plans to close 181 stores, leaving 300 pharmacies by the end of 2024

For the remaining operational An Khang pharmacies, revenue has now surpassed VND 500 million per store per month, an improvement from the VND 450 million figure at the end of 2023. Meanwhile, the breakeven point for the pharmacy chain is a revenue of over VND 550 million per store per month.

According to a representative of The Gioi Di Dong, the two main goals that An Khang is striving to achieve are ensuring sufficient medicine supply for customers and enhancing the qualifications of pharmacists. In terms of orientation, the first step is to reduce the number of stores to operate with the lowest possible cost, then to perfect the business model to reach the breakeven point before accelerating expansion.

During the period of 2022-2023, the An Khang chain incurred losses of over VND 300 billion each year. In the first half of 2024, An Khang lost VND 172 billion, bringing the cumulative loss as of the end of June 2024 to nearly VND 834 billion.

For 2024, The Gioi Di Dong sets targets for An Khang to achieve double-digit growth, increase market share, and reach the breakeven point before December 31, 2024.

In a report on the retail industry, SSI Research stated that the stagnant business performance of the An Khang pharmacy chain was due to an unreasonable product structure. An Khang faces intense competition from modern commercial pharmacies such as Long Chau, Pharmacity, and thousands of other retail pharmacies in the market. The operating model of An Khang has many similarities with the Long Chau chain but has not achieved the expected results.

Additionally, since An Khang does not focus heavily on prescription drugs for chronic diseases like Long Chau, it will be challenging for An Khang to capture market share from hospital pharmacies.

SSI Research forecasts that the An Khang pharmacy chain will incur losses of VND 339 billion and VND 243 billion in 2024 and 2025, respectively. The closure of An Khang pharmacies may not significantly impact the total net profit of MWG.

“Copy & Paste” the Successful Model of Bach Hoa Xanh

The formula that An Khang is currently pursuing, which involves closing down underperforming stores, finding the breakeven point, and then accelerating expansion, is what The Gioi Di Dong has already done and initially succeeded with the Bach Hoa Xanh supermarket chain.

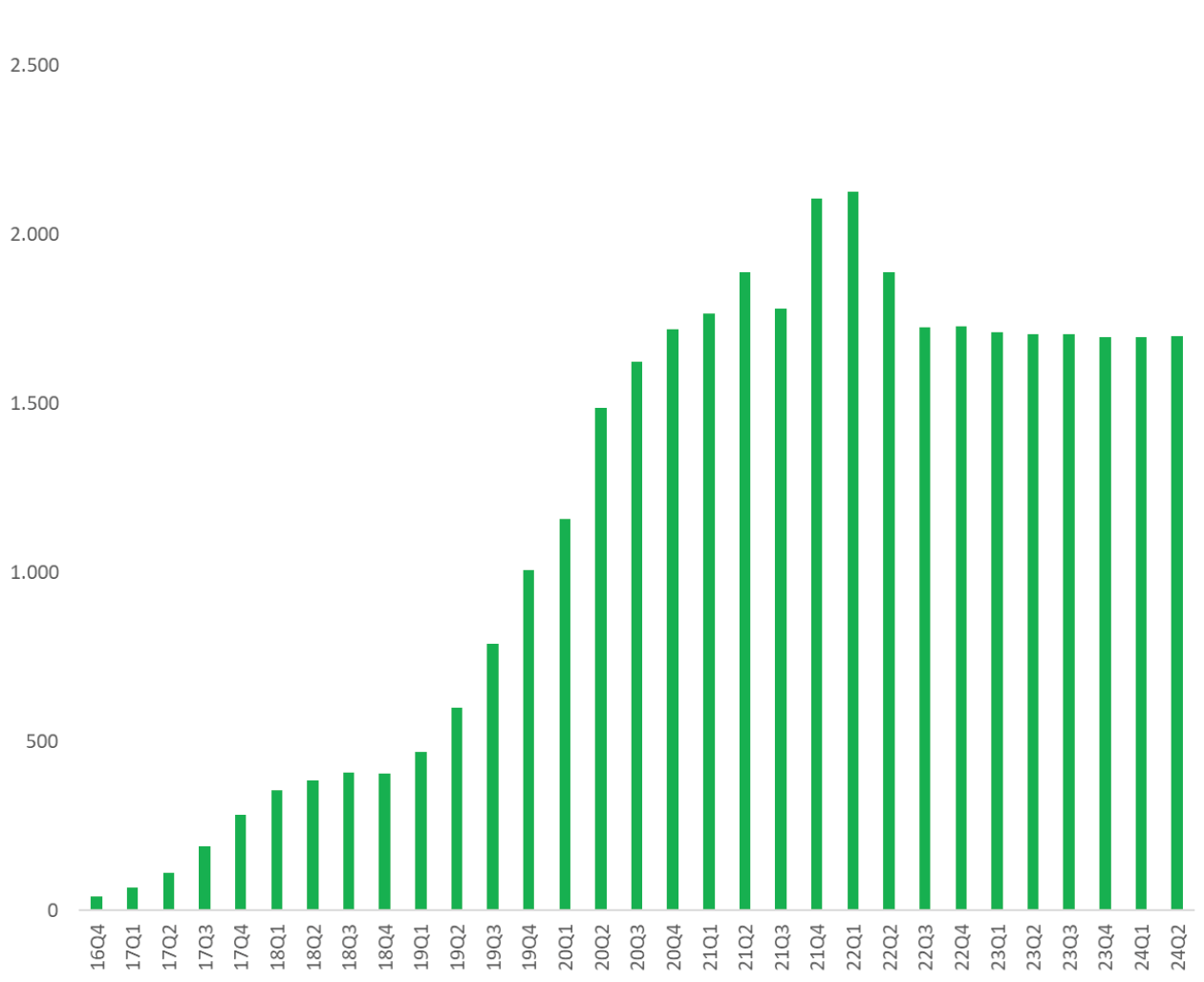

Recently, Bach Hoa Xanh announced plans to open seven new stores in four provinces and cities: Ho Chi Minh City (3 stores), Long An (1 store), Binh Duong (1 store), and Dong Nai (2 stores). While the number of new openings is not significant, it is considered positive news as the scale of Bach Hoa Xanh stores has mostly remained unchanged for over two years. As of the end of the second quarter of 2024, Bach Hoa Xanh had 1,701 stores, an increase of only 3 stores compared to the beginning of 2024.

Previously, Bach Hoa Xanh had closed down hundreds of stores as part of its restructuring process, along with a rebranding strategy that shifted its positioning from a “modern market” to a “mini-supermarket.”

During the restructuring and repositioning phase, Bach Hoa Xanh closed down hundreds of stores

The opening of new Bach Hoa Xanh stores in the four provinces and cities took place shortly after the supermarket chain of The Gioi Di Dong (coded MWG) turned profitable for the first time. In recent news, the management of Bach Hoa Xanh indicated a high possibility of opening 50 to 100 new stores this year.

The Gioi Di Dong’s financial report for the second quarter of 2024 showed that Bach Hoa Xanh’s revenue for the first half of 2024 reached VND 19,400 billion, a 42% increase compared to the same period last year, and the highest ever achieved since its operation. Specifically, in the second quarter of 2024, Bach Hoa Xanh’s revenue was approximately VND 10,300 billion. As a result, Bach Hoa Xanh earned a profit of VND 7 billion in the second quarter.

Notably, the average revenue per Bach Hoa Xanh store hit a record high of VND 2.1 billion per store per month, the highest ever, except for the period of July 2021 when the COVID-19 pandemic caused a sudden spike in revenue, reaching this level.

At the 2024 Annual General Meeting of Shareholders, Mr. Nguyen Duc Tai, Chairman of MWG, stated that Bach Hoa Xanh was the first unit to undergo the group’s restructuring process, resulting in the closure of up to 900 stores.

Looking back on An Khang’s 2-year journey: From rapid expansion and optimism to sudden stoppage and a loss of over 300 billion VND per year

In 2022, Thế Giới Di Động incurred a loss of 306 billion dong after implementing an extensive expansion strategy. In 2023, the company temporarily halted its expansion to focus on increasing revenue per sales point, controlling costs, and aiming for profitable operations. However, the result was a further loss of 343 billion dong.