The expression of fear on this man’s face could be a reflection of the risks and uncertainties in the real estate market. However, recent land auction deals are igniting a much-needed spark in the industry.

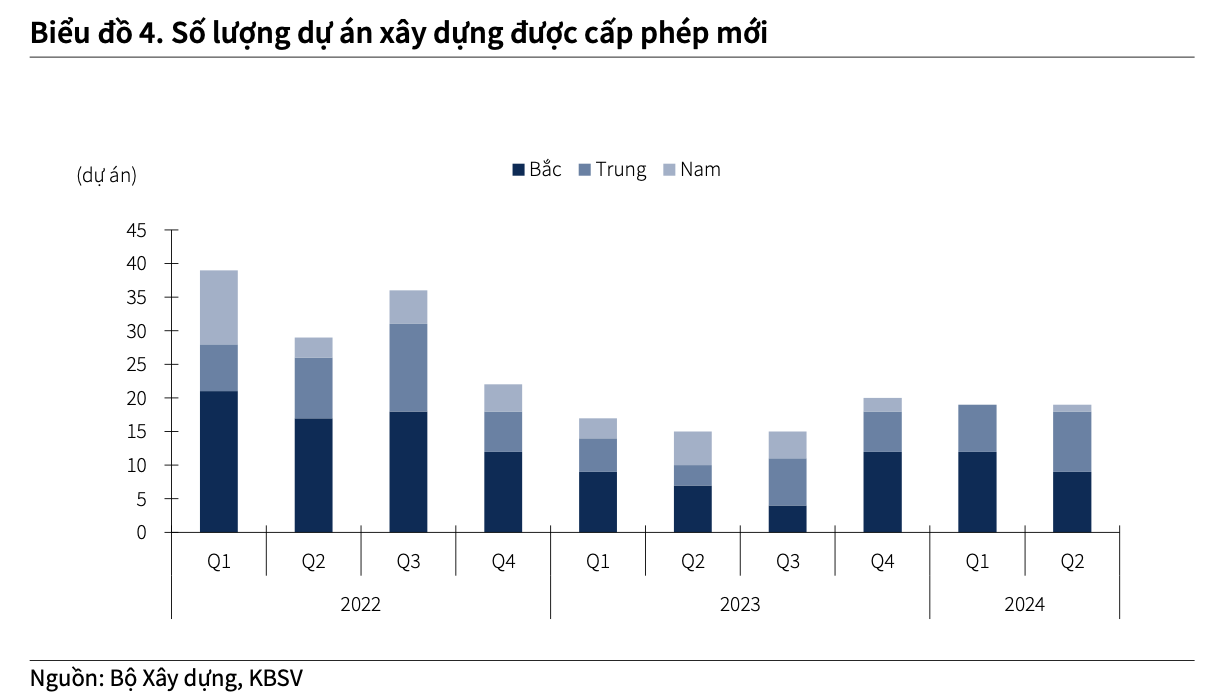

The real estate sector in Vietnam is experiencing a buzz of activity, with high-profile land auction deals making headlines. Beyond the paperwork, there’s a tangible sense of optimism in the residential property and construction markets, which are showing signs of improvement and are expected to continue their recovery trajectory in the second half of 2024.

A vibrant cityscape with modern buildings and a clear blue sky.

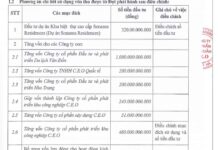

According to KBSV, the number of new and resumed real estate projects in the latter half of 2024 is expected to surpass the first half. Additionally, the amended Land Law and Business Law will streamline legal processes, improving supply and fostering a more sustainable real estate market.

This market recovery is anticipated to boost the demand for construction materials, particularly plastic pipes. KBSV believes that the domestic construction materials industry’s rapid rebound is a leading indicator of future plastic pipe consumption.

Binh Minh Plastic Joint Stock Company (BMP), a leading manufacturer of plastic pipes in Vietnam with a dominant market share, is poised to benefit significantly from this trend. KBSV estimates that BMP’s consumption volume in the second half of the year could reach 44,625 tons, reflecting a 25% increase compared to the first six months.

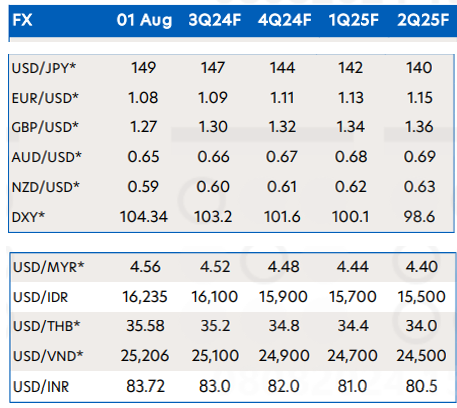

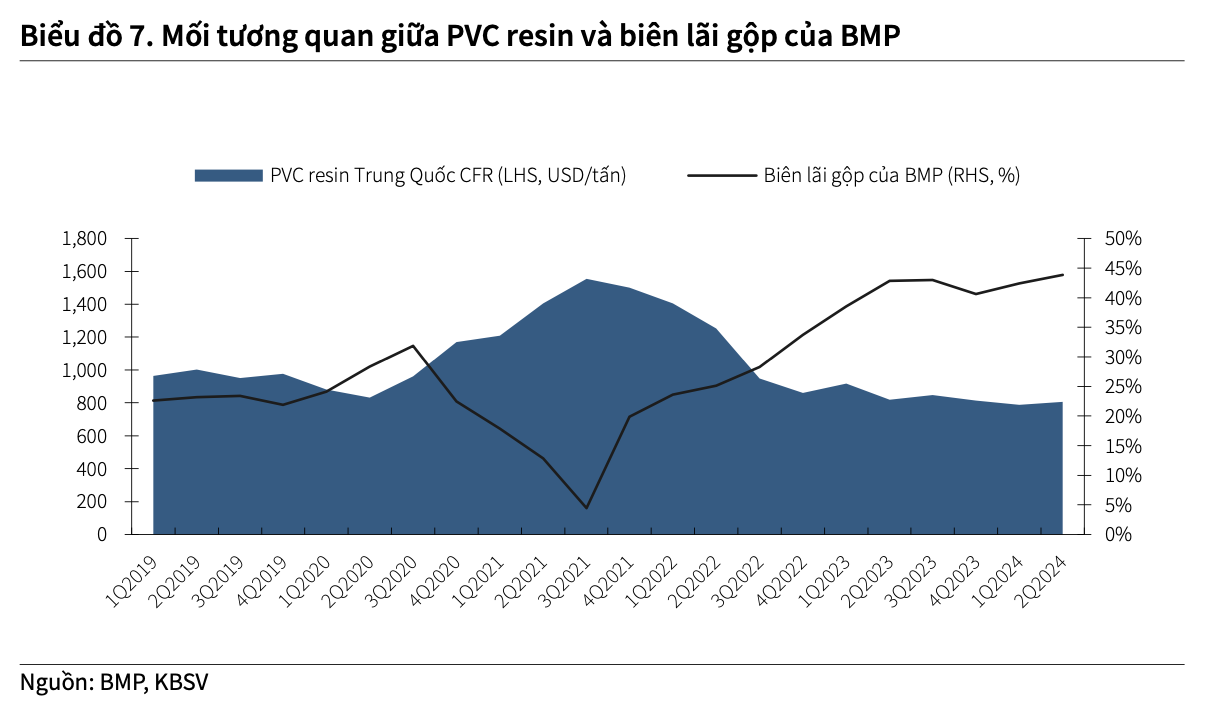

Short-Term Profit Margin Expectations: Riding on Low Input Costs

In the short term, Binh Minh Plastic is expected to further enhance its gross profit margin as PVC resin prices remain low due to subdued demand in China, where the real estate market is yet to recover. KBSV anticipates that the company’s input costs will likely stay at a low level for the next 6-9 months.

A graph showing a potential short-term profit margin boost for BMP due to low input costs.

However, this favorable situation may not persist in the long term. The Chinese real estate sector is forecast to experience a robust recovery from 2025 onward, and geopolitical risks remain elevated. Additionally, the company’s strategy of increasing basic discounts for agents to boost revenue could impact its gross profit margin.

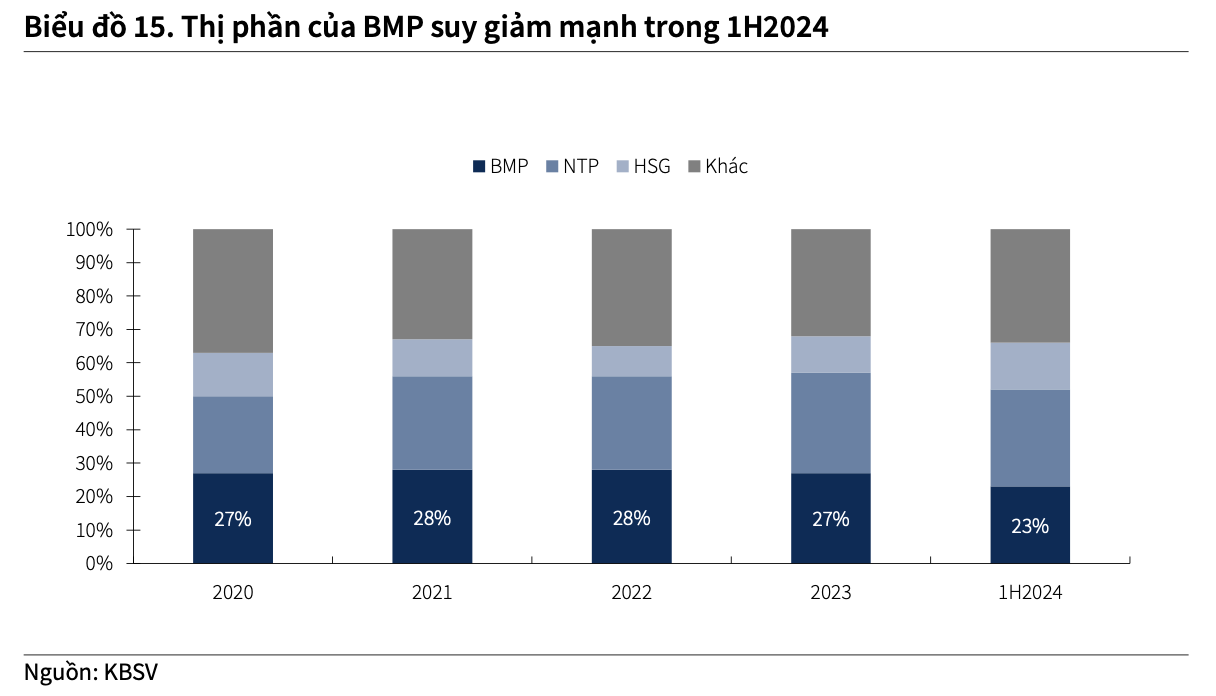

Compared to its competitors, Binh Minh Plastic’s business strategy focuses on maintaining profitability in a saturated domestic pipe market. The company’s historical discount rate for distribution channels tends to be lower than its peers, optimizing profitability. KBSV suggests that sales expenses may rise as BMP intensifies its sales programs with agents to capture the returning demand.

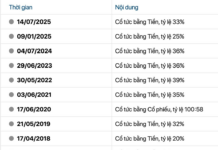

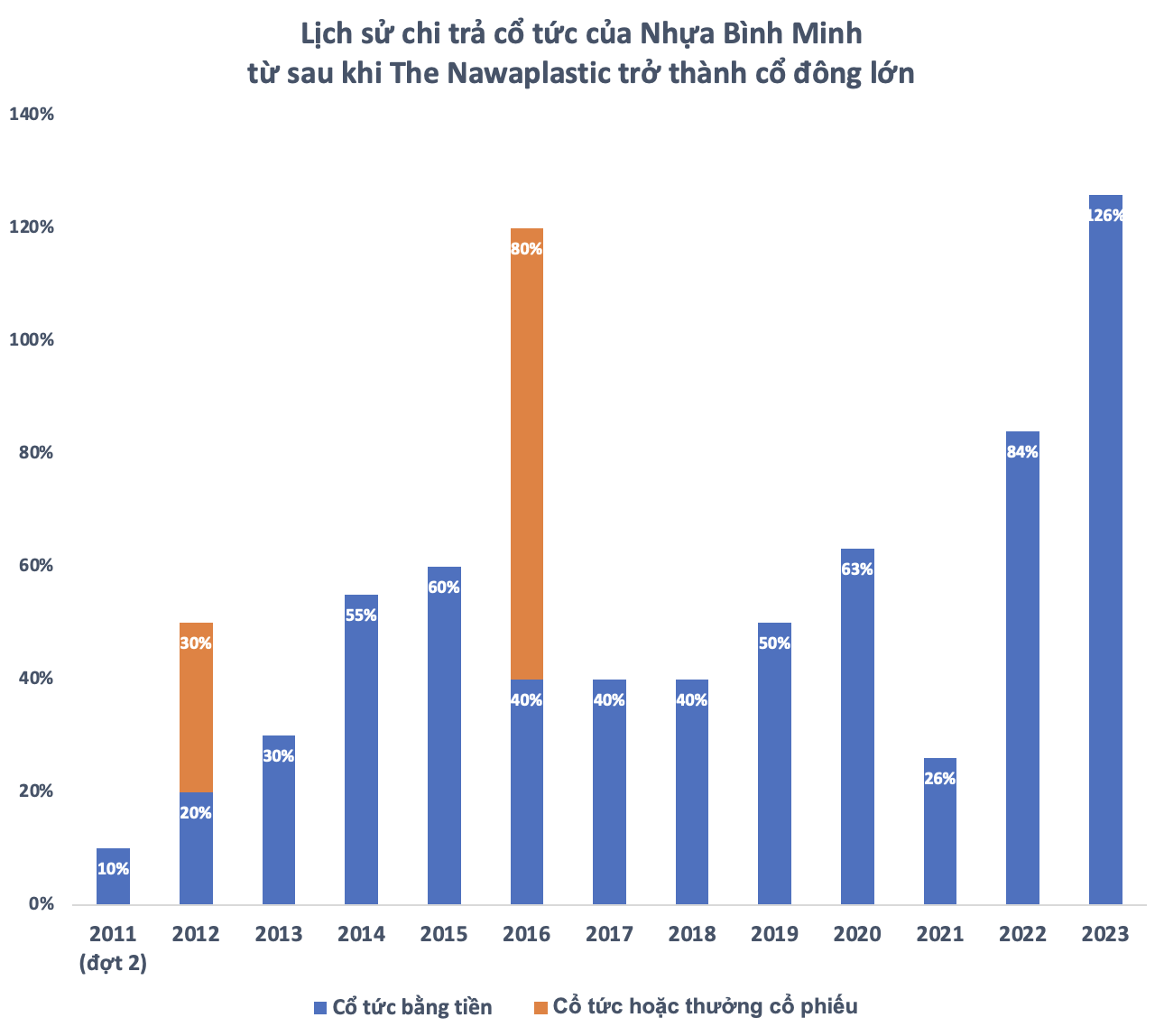

Generous Dividend Policy: A Sweetener for Investors

One of the most attractive features of Binh Minh Plastic for investors is its generous dividend policy. In the last five years, the company has distributed almost all of its profits as dividends. In 2023, shareholders received a record-high cash dividend totaling 126% after two rounds of payments.

A graph showcasing BMP’s impressive dividend payout ratio, expected to continue delighting investors.

KBSV anticipates that Binh Minh Plastic will maintain its dividend policy, with an average payout ratio of 97% of post-tax profits in the future. The estimated cash dividend yield for 2024/2025 is projected to be 11.6%/11.2%. This is supported by the company’s healthy asset structure and high business efficiency, with a projected net profit margin of 21.5%/18.2% for the same period.

However, the company’s focus on maintaining high profitability to maximize cash dividends could lead to a loss of market share. Binh Minh Plastic’s discount policies are often less competitive compared to its rivals, Nhua Tien Phong (NTP) and Hoa Sen Group (HSG), which may impact its revenue in an already saturated and oversupplied market.

A cityscape at night with illuminated buildings, reflecting the potential for a vibrant and thriving real estate market.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.