Illustrative image

Vietcombank, BIDV, and VietinBank Awaiting Approval for Dividend Payout Plans from Previous Years

While private joint-stock banks have been rushing to pay dividends in recent months, the three state-owned banks, Vietcombank, BIDV, and VietinBank, have been quiet despite having approved profit distribution plans.

After issuing nearly 857 million bonus shares for the remaining 2019 and 2020 dividends in August 2023, Vietcombank has not announced any information related to the implementation of dividend payments in 2024.

At the 2024 Annual General Meeting of Shareholders (AGM), Vietcombank reported a standalone after-tax profit of VND 32,438 billion in 2023. After adjustments for profit carry-forwards from previous years and fund allocations, the remaining profit was VND 24,987 billion. According to the proposal approved by the AGM, Vietcombank will use all of this profit for dividend distribution. However, the form of dividend distribution (shares or cash) was not mentioned in the document. At the same time, the bank also needs approval from the competent state agency to distribute dividends.

Previously, Vietcombank also announced similar plans to distribute dividends in shares for the remaining profit of VND 21,680 billion in 2022. At the same time, the 2023 Extraordinary General Meeting of Shareholders approved the plan to increase capital by approximately VND 27,700 billion from the remaining profit in 2021 and the remaining accumulated profit up to before 2018.

If all these capital increase plans are implemented, Vietcombank’s charter capital may increase by a maximum of more than VND 74,000 billion.

Similarly, BIDV has not announced the implementation of dividend payments in 2024. The last time BIDV distributed dividends was in December 2023, with the source of payment coming from the remaining profit after tax and fund allocations for 2021.

Currently, BIDV has two profit distribution plans approved by shareholders but not yet approved by competent authorities.

At the 2024 Annual General Meeting of Shareholders, BIDV approved the plan to issue nearly 1.2 billion shares to pay dividends for 2022, equivalent to a ratio of 21% of the circulating shares at the end of 2023. The implementation time is expected to be in 2024 – 2025.

Regarding the 2023 profit distribution plan, BIDV’s remaining profit after fund allocations is more than VND 15,491 billion. The bank plans to spend VND 12,347 billion on share dividends (subject to the approval of the competent state agency).

At VietinBank, although the capital increase proposal has been submitted for quite a long time, the process is rather slow. The last time this “giant” paid dividends was in December 2023, with the source of payment being the remaining profit from 2020, which increased its charter capital to VND 53,700 billion.

At the recent shareholders’ meeting, VietinBank’s management continued to present to shareholders the plan to use all of the profit after fund allocations in 2023, amounting to more than VND 13,900 billion, for dividend distribution and increasing charter capital.

“The bank expects to be able to pay dividends in shares, but the final plan will depend on the approval of the competent state authorities,” said Mr. Tran Minh Binh.

Chairman Tran Minh Binh also said that VietinBank had received feedback from the State Bank of Vietnam (SBV) and the Ministry of Finance allowing the bank to retain all of its 2022 profits (VND 11,678 billion) to increase capital through share dividends.

In addition, the bank also plans to increase its charter capital by VND 12,330 billion from the remaining profit from 2021 and the remaining accumulated profit up to the end of 2016.

If approved and all the above plans are implemented, VietinBank’s charter capital will increase to over VND 91,000 billion.

VietinBank has also proposed that the competent authorities approve the proposal to allow the bank to retain all of its annual profits from 2024 to 2028 to increase capital, enhance financial capacity, and expand credit growth potential.

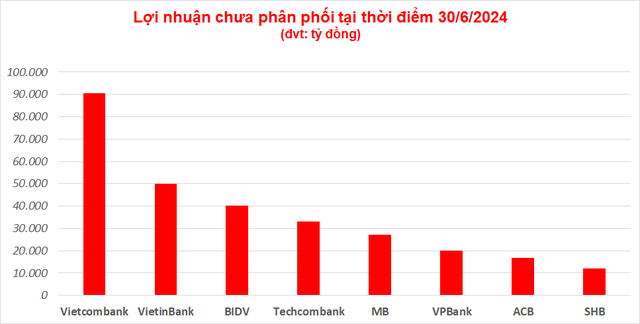

The Big 3 Have Hundreds of Thousands of Billions of Dong in Undistributed Profits

As the pillars of the banking system, contributing to the implementation of the government’s policies and promoting economic development, the Big 4 group urgently needs to increase capital to maintain its leading role in the Vietnamese banking industry. However, due to the nature of their operations, the capital increase of these banks must be approved by the SBV, the Ministry of Finance, the Government, and the National Assembly. Moreover, this process must be requested annually, following a specific procedure, which prolongs the approval time.

As a consequence, the undistributed profit fund of the group of state-owned commercial banks has been continuously increasing over the years, while their charter capital has been surpassed by large private banks such as Techcombank and VPBank.

Source: Separate Financial Statements for the First Half of 2024 of the Banks

As of the end of Q2/2024, the undistributed profits of Vietcombank, VietinBank, and BIDV were VND 90,613 billion, VND 49,924 billion, and VND 40,141 billion, respectively, far surpassing those of large private banks such as Techcombank and VPBank. This indicates that the Big 3 still have a lot of room to distribute dividends and increase their charter capital.

In the report submitted to the National Assembly on the implementation of Resolution No. 43/2022 on fiscal and monetary policies to support the Program for Recovery and Sustainable Development, the Government updated the progress of charter capital increase of joint-stock commercial banks with more than 50% state-owned capital.

Accordingly, for Vietcombank, the State Bank is organizing the collection of comments from relevant Ministries on the Draft Report to the Government and the Draft Report to the National Assembly on additional state capital investment in Vietcombank through dividend payment in shares from the remaining profit accumulated up to the end of 2018 and the remaining profit in 2021 (VND 20,695 billion).

Thus, the plan expected to be submitted to the Government and the National Assembly is lower than the plan to increase capital by nearly VND 27,700 billion approved by the 2023 Extraordinary General Meeting of Shareholders.

Regarding BIDV, the report submitted to the National Assembly states that on September 25, 2023, the Prime Minister approved the plan to invest additional state capital in BIDV through the issuance of shares to pay dividends from the source of profit remaining after tax and fund allocations for 2021.

As for VietinBank, the State Bank is also collecting comments on the Draft Report to the Prime Minister and the Draft Decision of the Prime Minister on the plan to invest additional state capital in Vietinbank through dividend payment in shares from the source of profit remaining in the period of 2009 – 2016 and 2021 (VND 7,948 billion).