Source: SBV

|

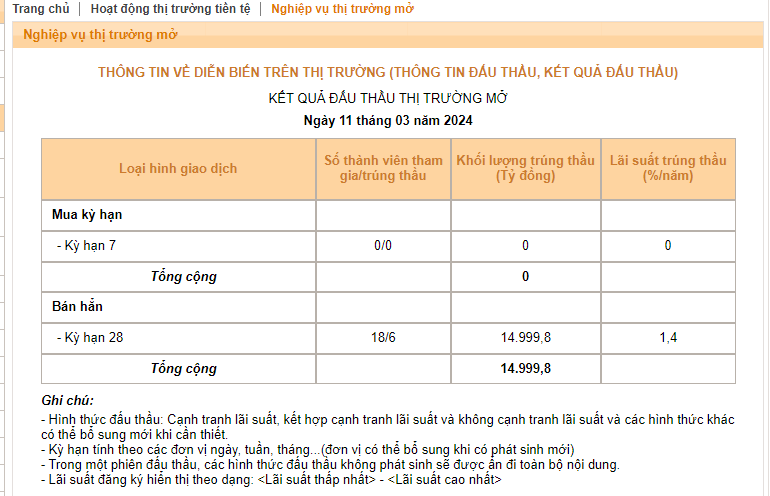

Specifically on March 11, the operator completed the issuance of nearly 15 trillion dong of 28-day term bonds in the form of auctions at an interest rate, with a total volume of 15 trillion dong with 6/18 members participating winning the bid.

The winning bid interest rate of the session on March 11 was 1.4% per year, much lower than the 2.13% 1-month term interest rate in the interbank market.

The winning bid interest rate is relatively much lower than the 1-month term interest rate in the interbank market, indicating that the system liquidity is quite surplus.

In general, the bond issuance action of the operator is similar to in September last year when the USD/VND exchange rate was under pressure in an abundant liquidity environment as credit growth remained low.

In the regular meeting in February, the SBV has stated that credit in the first 2 months of the year grew slower than in the same period of previous years, while the liquidity of the credit system was abundant. Specific data has not been published, but credit in February also decreased less, equivalent to growth if compared to January. The SBV emphasized that it will continue to monitor credit growth in March, Q1/2024 and subsequent months to have specific solutions to promote credit growth, support borrowers and economic growth.

|

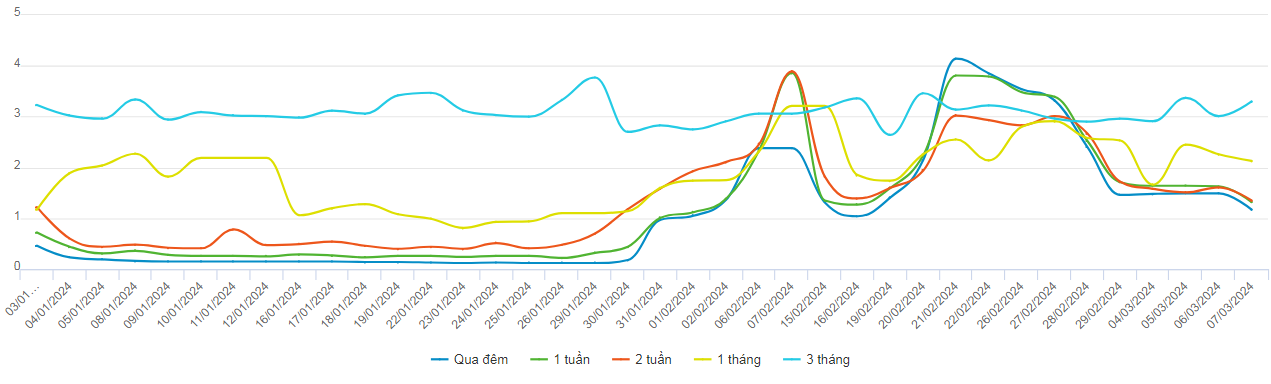

Interbank interest rates from the beginning of 2024 to March 7, 2024

Source: VietstockFinance

|

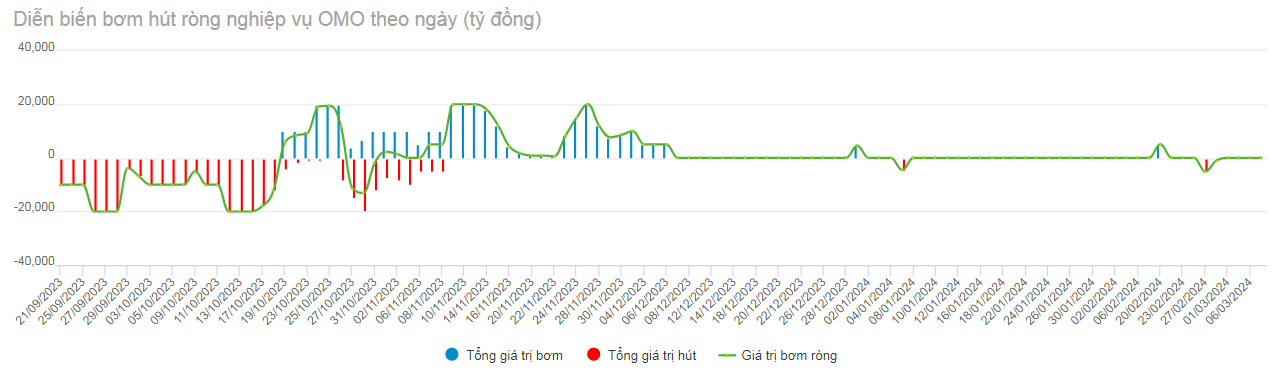

On the other hand, the SBV has reopened the channel to absorb money through bonds after more than 4 months of suspension (since November 1) when interest rates in the market have stabilized more after the SBV injected liquidity support to the system in mid-February.

|

Daily operations of OMO net injection and absorption. Unit: Trillion dong

Source: VietstockFinance

|

According to the latest announcement by the SBV, the average interbank VND interest rate for overnight term (the main term, accounting for about 80-90% of transaction volume) in the session on March 7 was 1.17%, a decrease of 30 basis points compared to the previous week (March 1) and a decrease of 297 basis points compared to the level of 4.14% on February 21.

Prior to that, in the session on February 21, the interbank overnight term interest rate increased sharply to 4.1% – the highest level since April 2023.

In the context of unexpected pressure on the liquidity system when people’s consumption increased sharply during the Lunar New Year holiday, the SBV provided liquidity to the system by buying 6.03 trillion dong of 7-day term papers with an interest rate of 4% on February 20 and 21. Only 1 member participated in the 2 above-mentioned auctions and traded on the OMO channel returned to a calm state since then.

The assessment of SSI Research experts stated that the above developments show that the shortage may only come from short-term local causes.

Accordingly, by the end of February, more than 6 trillion dong had matured on the open market collateralized bond channel (OMO), equivalent to this money returning to the SBV system.