Starbucks Reserve on Han Thuyen Street in Ho Chi Minh City’s District 1 saw a steady stream of customers on August 21st, with tables both upstairs and downstairs almost fully occupied. With the announcement of its impending closure on August 26th, the staff and security guards of this upscale Starbucks outlet noted an increase in footfall. It is expected that the cafe will be packed on the weekend of August 24th and 25th as young patrons flock to bid farewell to the only premium Starbucks location in the city.

Competing for Prime Locations

The news of Starbucks’ decision to close its high-end cafe in a prime location in Ho Chi Minh City, which has been consistently busy since its opening, came as a surprise to many. However, industry insiders view it as an inevitable development.

Brand expert Dr. Vo Van Quang points out that Starbucks Reserve has been operating for seven years, implying that the brand has been incurring losses during this period to cover the costly rent, estimated at 750 million VND per month. “Starbucks Reserve offers a few unique coffee options, featuring rare and exotic beans. However, the location isn’t exceptionally attractive, and the interior design and visual effects are standard for the brand, following a self-service model. This experimental version of Starbucks in the premium coffee segment, with an average drink price of 100,000 VND and above, hasn’t achieved the desired success,” Dr. Quang analyzes.

The expert also highlights a trend among coffee chains to vacate central areas and relocate to newer, modern urban districts with a younger customer base. The city center in District 1 is now yielding to heritage brands that offer a more cultural, artistic, and aesthetic experience.

Starbucks Reserve in Ho Chi Minh City will close its doors on August 26th.

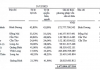

A market report on the F&B industry in Vietnam for the first half of 2024, released by research firm iPOS.vn on August 21st, reveals a significant decrease in spending on coffee outings, along with a reduced frequency compared to 2023. Notably, the proportion of consumers willing to spend over 100,000 VND per cup has dropped sharply from 6% to 1.7%, impacting premium brands like Starbucks, %Arabica, and The Coffee Bean & Tea Leaf.

Consumers are also cutting back on coffee outings due to increased work pressures and economic challenges, prompting them to reconsider non-essential spending. Consequently, 41.7% of respondents indicated that they only occasionally go for coffee, while 32.3% visit cafes 1-2 times a week, and 16.2% go 3-4 times a week.

Meanwhile, data from market research company Mibrand shows that Vietnam boasts over 500,000 coffee shops, generating approximately 1.46 billion USD in revenue. Major coffee chains continue to expand, ensuring uniformity in ambiance, service, and quality across their outlets. Smaller chains are also vying for key locations, making the industry more competitive than ever.

For instance, while prominent coffee chains like Trung Nguyen Legend, Highlands Coffee, and Phuc Long Coffee & Tea House report profits, The Coffee House and Ca Phe Ong Bau struggle with consistent losses. According to Vietdata, The Coffee House has accumulated losses of several hundred billion VND, with negative equity in the tens of billions of VND. Its parent company recently confirmed the closure of all outlets in Can Tho and, soon, in Da Nang, as part of their business strategy. As of July 31st, The Coffee House operates 117 stores nationwide, a significant reduction from approximately 150 stores at the end of 2023. “In the current context, optimizing costs to enhance operational efficiency has become a priority. This decision aims to adapt to changing conditions and ensure the overall profitability of the system,” a representative from The Coffee House explained.

Another analysis suggests that after the COVID-19 pandemic, many investment funds suddenly faced liquidity issues due to investor withdrawals. Additionally, their portfolio startups, amidst expansion and scale-up, encountered challenges in keeping up with the required capital, leading to a sudden slowdown and the need to retrench to survive until new funding arrives.

Opportunities for Chains with a Distinctive Identity

Commenting on the recent developments in the coffee chain landscape, Mr. Do Duy Thanh, Director of FnB Director – Horeca Business School and an F&B industry expert, noted that for chain models, there will be “flagship stores” in ultra-prime locations to build brand awareness. Even under favorable conditions, these stores may struggle to turn a profit. Some brands choose to subsidize these locations until they can no longer sustain the losses.

For instance, the rent for the Starbucks Reserve store on Han Thuyen Street ranges from 25,000 to 32,000 USD per month, making it challenging for F&B businesses to turn a profit. When economic conditions deteriorate, the operational challenges intensify, leading to the need for restructuring.

In the case of The Coffee House, while they are downsizing, Katinat, Phuc Long, and Highlands are expanding, indicating a redistribution of the market share within the industry. “Previously, coffee had a low cost of goods sold (usually below 20% of the selling price), but it has now increased to 25%-30% for chain models and 40%-50% for sidewalk kiosk models. The rising selling prices have made coffee businesses more challenging, prompting owners to either tightly manage costs or accept minimal profits,” Mr. Thanh remarked.

According to experts, the F&B industry has moved past its high-growth phase. In the current stage, the market will weed out chains lacking brand identity, financial foundations, and more. The iPOS.vn report shows that as of June 2024, there were approximately 304,700 eating and drinking establishments in Vietnam, a nearly 4% decrease compared to 2023 data. This translates to at least 30,000 closures across the country, with limited new openings. Ho Chi Minh City has been the most affected, witnessing a nearly 6% decline in the number of establishments, while Hanoi experienced a slight growth of 0.1%. “Changing consumer trends and exorbitant rental costs mean that only self-owned cafes (either standalone brands or franchises) can thrive, while chains that rent spaces face significant risks,” said expert Vo Van Quang.

He cited the example of Milano, a budget-friendly chain that quietly but steadily expanded through franchising, offering freshly ground coffee beans. Similarly, the Trung Nguyen Legend Group has established a distinct identity with three brands: Trung Nguyen Legend, Trung Nguyen E-Coffee, and The World of Trung Nguyen Legend. “The core menu of the Trung Nguyen Legend chain always features expert-crafted coffee, innovated from the world-renowned Vietnamese phin coffee, shaping the country’s coffee drinking culture,” said a representative from Trung Nguyen Legend, highlighting their competitive advantage.

Notably, The World of Trung Nguyen Legend, a premium coffee segment, was introduced in 2021 and has since established a strong presence in major Vietnamese cities and made inroads into China and the United States.

3 Key Trends

Looking ahead, Mr. Do Duy Thanh foresees three main trends in the coffee business landscape: small shops relying on high volume and low margins, established coffee chains expanding their presence, and a new segment of specialty coffee emphasizing quality. This niche market, favored by young consumers, accounts for approximately 3%-5% of the market share, and they demand transparency in sourcing and brewing methods.

The Rise of Chinese F&B Chains in Southeast Asia: Brand Identity and Revenue Transformation

In addition to bubble tea, Chinese hot pot brands have also been making waves in Southeast Asia in recent years. Not only are their menus in Mandarin, but the logos and slogans of these brands are also getting a makeover, using English to better connect with customers.