The recently published 2023 online food delivery market report by Momentum highlights the trend of Chinese F&B brands entering the Southeast Asian market. Specifically, last year witnessed an increase in both the variety and number of restaurant chains expanding internationally. It is not difficult to list dozens of names such as Luckin Coffee, Cotti Coffee, Bingz Crispy Burger, Xiabu Xiabu Hotpot, Tianlala Buble Tea,…

Among them, many brands chose Southeast Asian countries as their first destinations. While Hai Di Lao, Shoo Loong Kan, Tongue Tip,… opened their first stores in Singapore, Suji Suan Cai Yu chose Jakarta (Indonesia), and Mixue chose Vietnam as their first country to develop the international market. Many of these brands have continued to expand. A typical example is Mixue, which now has 4,000 stores in Southeast Asia, with over 1,000 locations in Vietnam. Or the “young” brand Cotti Coffee, which owns a network of 6,000 stores worldwide, all of which entered the markets of Indonesia, Thailand, Vietnam, Myanmar, and Singapore in 2023.

Many Chinese F&B brands choose Southeast Asian countries as their first destinations in their international expansion strategy (Source: Momentum)

“Chinese F&B brands not only bring culinary art but also a new F&B management model to the region,” Momentum said. This includes everything from marketing strategies, brands, operations, to technology and franchise models.

There are even companies specializing in advising Chinese enterprises in exploring the Southeast Asian market, such as HUA & HUA. This company has advised Mixue Milk Tea, Hai Di Lao Hotpot, and Dian Xiao Er Herbal Roast Duck Tea Chain.

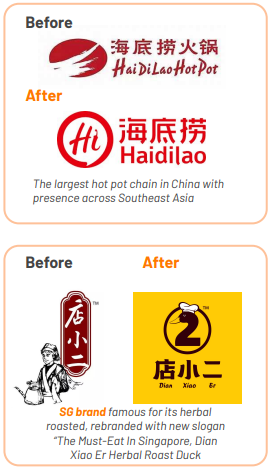

In their home country, these F&B chains all have Chinese-language images, logos, or brand slogans.

However, in order to expand overseas, Mixue has changed its brand identity with an image of a snowman and the English phrase “Since 1997 – Ice cream & Tea”. In addition, the brand actively carries out viral campaigns on social media featuring the Snow King mascot – a snowman wearing a cloak and holding a scepter, with a red-and-white color scheme and a chubby, humorous, mischievous appearance. For example, in Vietnam, Mixue’s TikTok account has more than 80,000 followers and 1.8 million likes, regularly posting funny and entertaining content associated with the snowman character. This mascot also appears prominently on all products of the brand.

Mixue changes brand identity and conducts viral campaigns on social media when entering the Southeast Asian market (Source: Momentum)

In a similar vein, Hai Di Lao and Dian Xiao Er Herbal Roast Duck Tea Chain have both undergone brand identity changes to become more familiar to local customers.

Think China magazine believes: “After the increasing popularity of Chinese technology brands with consumers, Chinese beverage chains such as Mixue Ice Cream & Tea, ChaGee, and Luckin Coffee are rapidly expanding in Southeast Asian countries, while hot pot restaurants have become a new favorite food among food connoisseurs worldwide.”

Famous for offering affordable ice cream and drinks, Mixue opened its first overseas store in Vietnam in 2018 and sold nearly 1,400 cups of milk tea on its opening day.

Entering the Malaysian market in 2019, ChaGee currently has 50 stores there, with each store earning about 300,000 to 400,000 RMB (41,000 to 54,900 USD) per month, 1.5 to 2 times higher than the average monthly revenue in China.

In addition to bubble tea, hot pot restaurants have also been popular in Southeast Asia in recent years. According to statistics from the DXT360 media monitoring platform, 11 Chinese hot pot restaurants were opened in Bangkok in just 12 days from August 31st to September 11th, 2023.

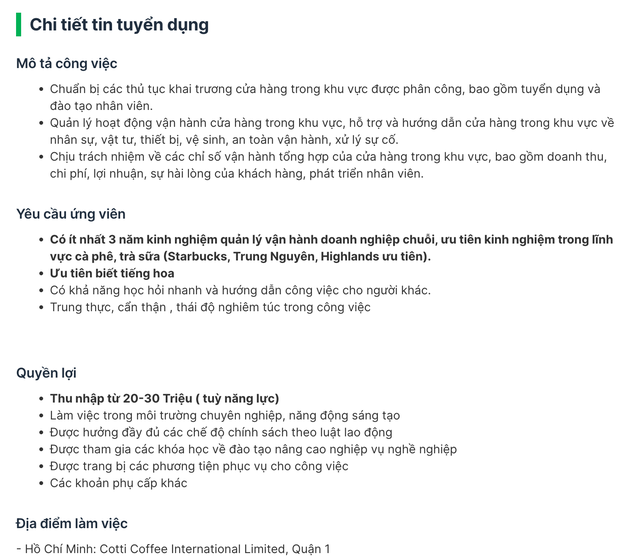

In Vietnam, after the successful expansion of Mixue in just 2 years, Cotti Coffee has also entered the market. Since the end of 2023, Cotti Coffee has been actively recruiting personnel such as store managers and baristas. On the TopCV recruitment website, Cotti Coffee International Limited has posted job openings for operations managers with a salary range of 20-30 million VND/month. This brand prefers employees who can speak Chinese, with at least 3 years of experience in chain enterprise operations management, and prioritizes experience in the coffee and milk tea industry. It is noteworthy that Cotti Coffee prioritizes candidates who have worked at Starbucks, Trung Nguyen, or Highlands Coffee.

In another job posting, Cotti Coffee is recruiting a procurement manager position and also requires “at least 3 years of purchasing experience in the coffee chain industry, with experience in purchasing from Highlands, Trung Nguyen, Starbucks being preferred”.

A Cotti Coffee job posting

In a rare media interview, a representative from the coffee chain said that in the late December 2023 and early 2024, they will open 9 more stores. “Cotti’s plan in Vietnam is to have “many, many” stores in 2024-2025,” the brand representative told The Saigon Times.