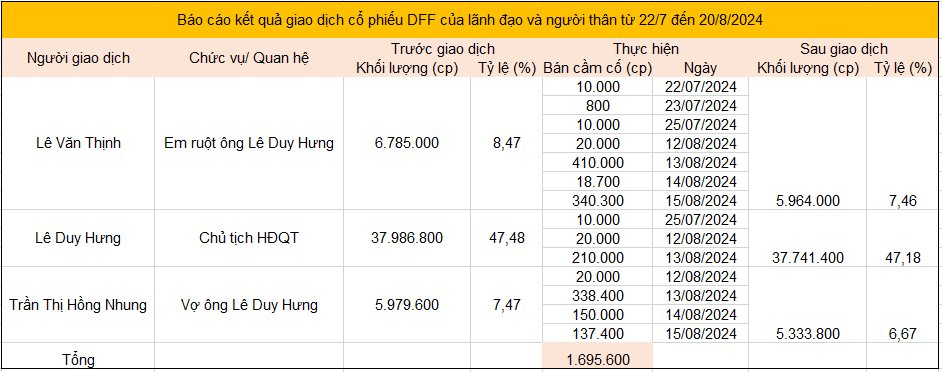

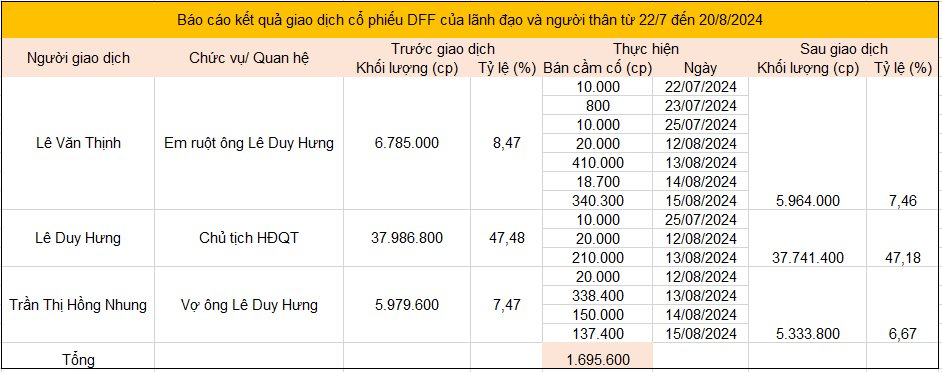

According to information from HNX, DFF – the stock symbol for Fat Racing Group Joint Stock Company – has recently reported on transactions involving DFF shares held by its leaders and their relatives. Specifically, securities companies have forcibly sold a total of nearly 1.7 million DFF shares within a month, from July 22 to August 20. Here are the details:

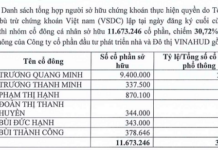

Mr. Le Duy Hung, Chairman of the Board of Directors of Fat Racing Group Joint Stock Company, had 240,000 DFF shares sold by the securities company from July 25 to August 13. After this transaction, Mr. Hung’s ownership decreased from 37.99 million units to 37.74 million units (equivalent to 47.18% of charter capital).

Similarly, Mr. Le Van Thinh, Mr. Hung’s brother, had nearly 810,000 DFF shares forcibly sold by the securities company, reducing his ownership from 8.47% to 7.46%. Mrs. Tran Thi Hong Nhung, Mr. Hung’s wife, also had more than 645,000 DFF shares sold, leaving her with 5.3 million units (6.67%) after the transaction.

This is not the only period in which forced sales of DFF shares held by the Chairman’s family have occurred. Mr. Hung himself has been subject to such sales since May 2, with a few thousand to ten thousand shares sold each time. In total, nearly 300,000 shares of the Chairman of Fat Racing Group have been forcibly sold by securities companies.

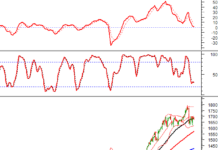

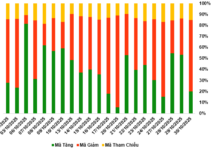

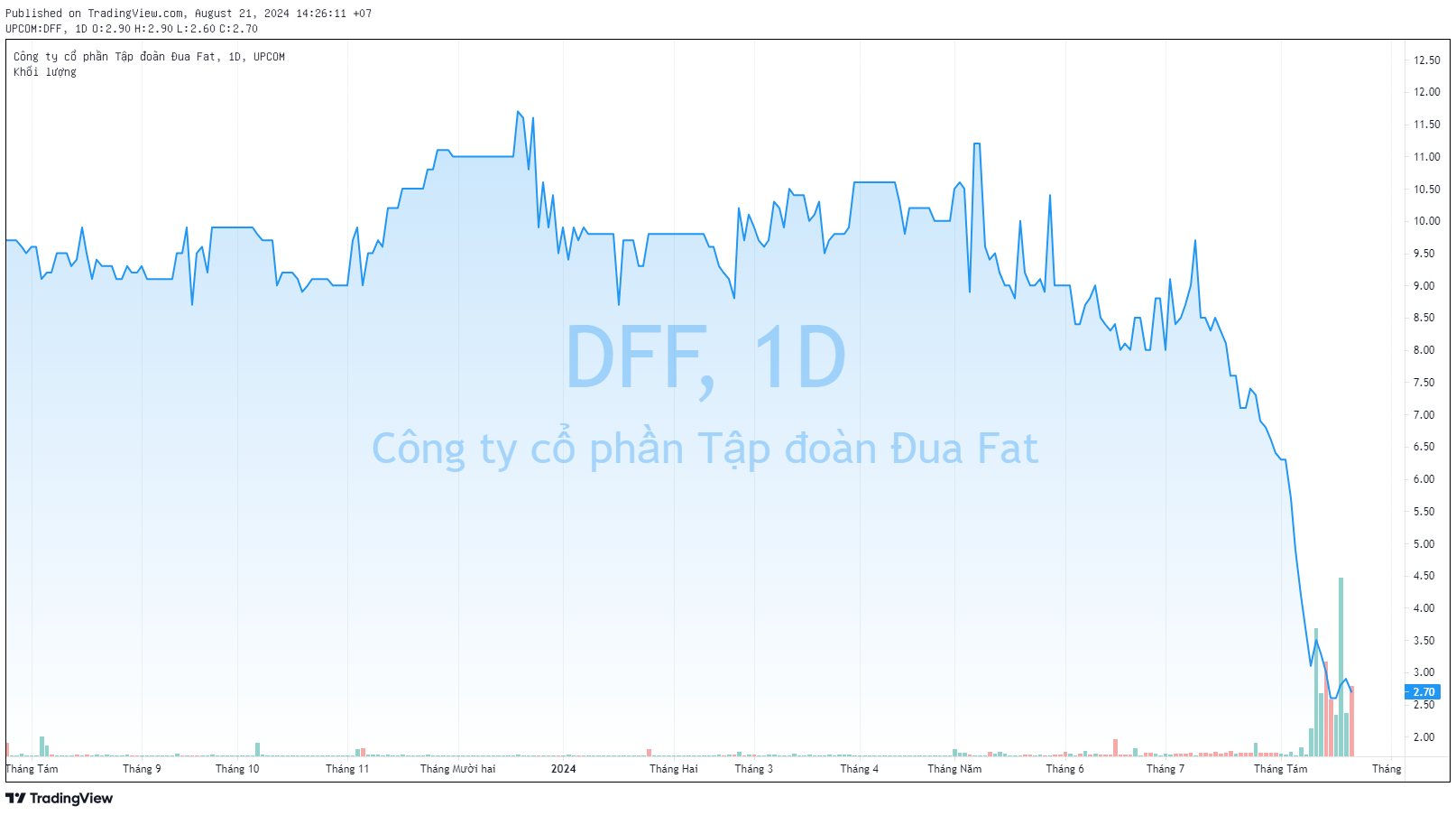

These consecutive forced sales of the Chairman of Fat Racing Group’s family’s shares come amid volatile DFF stock prices on the stock market. This stock has witnessed a 29-session losing streak, with numerous floor sessions since the beginning of July, before stabilizing and trading sideways from the beginning of August until now. Currently, the DFF share price has dropped to the 2,700 VND/share mark, a nearly 65% “plunge” within just one month.

Previously, on May 2, Bao Viet Securities Company (BVSC) announced the sale of 40.08 million DFF shares through matching or negotiated transactions. These shares were used by the leaders of Fat Racing Group and their relatives as collateral for the DFFH2123001 bond issue of the company.

Of the 40.08 million DFF shares sold by BVSC, 28.2 million shares belonged to Mr. Le Duy Hung, Chairman of the Board of Directors of Fat Racing Group, 6.8 million shares belonged to Mr. Le Van Thinh (Mr. Hung’s brother), and 5.08 million shares were owned by Mrs. Tran Hong Nhung (Mr. Hung’s wife).

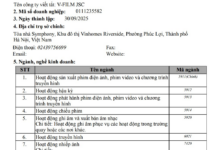

Regarding Fat Racing Group, this enterprise was established in 2009 and mainly operates in the fields of land leveling, foundation treatment for works, demolition of structural works, and construction components… The company started trading its shares on UPCoM in mid-2021. In March 2022, Fat Racing Group doubled its charter capital from 400 billion VND to 800 billion VND.

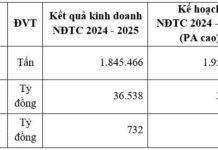

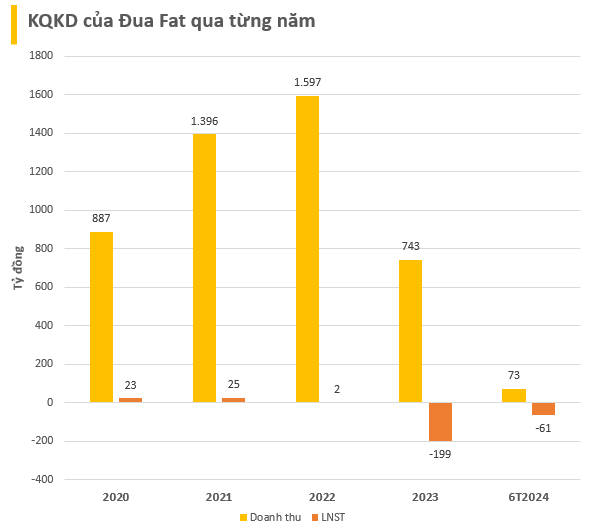

In recent years, Fat Racing Group has been experiencing a decline in business performance. In 2023, the company recorded a significant decrease in revenue compared to the previous year, and after deducting expenses, it incurred a hefty loss of nearly 200 billion VND. In the first half of 2024, the company continued to report losses.

In addition to facing challenges in its business performance, Fat Racing Group is also struggling with its debts. Firstly, the company issued the DFFH2123001 bond on September 1, 2021, with a maturity date of March 1, 2023, an interest rate of 11.75%/year, and a scale of 150 billion VND. However, by the due date of March 1, 2023, there was still an outstanding balance of 89.52 billion VND that had not been repaid to the bondholders.

According to a resolution passed by the bondholders on March 2, 2023, and announced by Fat Racing Group, the company and the bondholders agreed on a repayment schedule that extended the maturity date to July 14, 2023, four months later than planned. The interest rate during the overdue period was set at 17.625%/year, a significant increase compared to the initial rate.

According to Fat Racing Group’s Q2/2024 financial report, the remaining balance of the DFFH2123001 bond issue was approximately 81.3 billion VND.

In addition, the company also has another bond issue, DFFH2124002, with a value of 299.8 billion VND, which will mature on December 31, 2024.

As of Q2/2024, Fat Racing Group’s total liabilities stood at 3,248 billion VND (equivalent to 82.7%), five times its owner’s equity. The company’s financial borrowings alone amounted to nearly 2,300 billion VND.

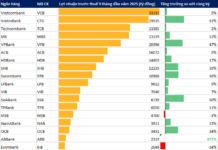

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.