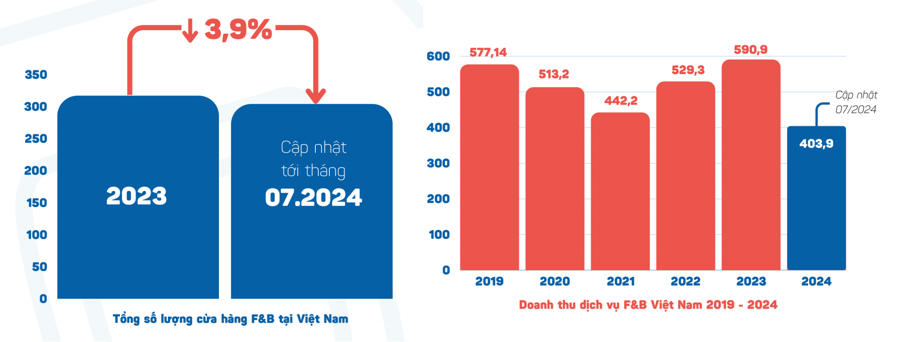

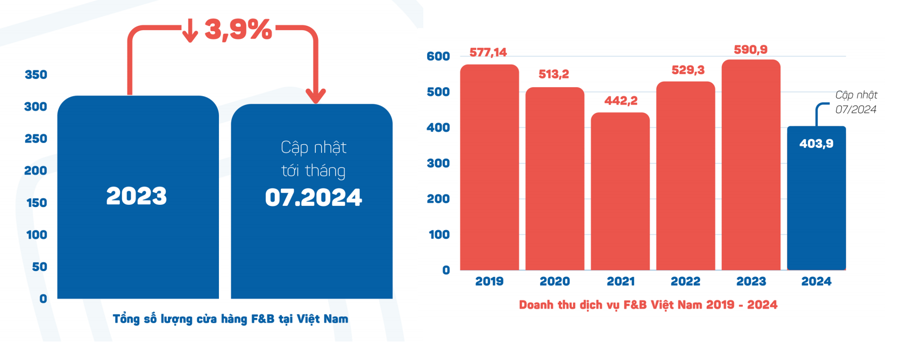

iPOS.vn’s report on the food and beverage (F&B) market in Vietnam for the first half of 2024 revealed an interesting contrast. While there was a 3.9% decrease in the number of stores nationwide, the industry witnessed a positive growth in revenue.

This report is based on research and analysis of data from nearly 1,000 restaurants and cafes, over 2,300 diners, and 1,307 F&B industry professionals in Vietnam, along with references to market research data and expert opinions.

RESISTING THE TIDE

Mr. Vu Thanh Hung, CEO of iPOS.vn, shared that the first half of 2024 presented significant challenges for the service industry, particularly the F&B sector. However, Vietnamese F&B businesses displayed remarkable agility by swiftly adjusting their operations, cutting unnecessary costs, and optimizing cash flow. They also continuously innovated their product offerings, providing unique dining experiences that attracted a large number of customers.

During this period, the country recorded approximately 304,700 stores, a 3.9% decrease compared to 2023. At least 30,000 stores nationwide closed down, while the number of new openings was limited.

Ho Chi Minh City was the most affected area, with a 5.97% decline in the number of stores across the city. In contrast, Hanoi experienced a slight growth of 0.1% in the number of stores.

iPOS.vn representatives noted that the first six months were challenging for the economy in general and the F&B industry in particular. There was a notable presence of short-lived stores with an operating lifespan of less than three months in major cities. This period was considered a significant purge for the F&B industry.

Despite the challenges, the total revenue of the F&B industry reached an impressive 403,900 billion VND, equivalent to 68.46% of the total revenue for the year 2023.

Explaining the industry’s positive growth in revenue, iPOS.vn representatives attributed it to the proactive promotional programs and discounts offered by F&B stores to stimulate demand. As a result, customers were more inclined to make purchases.

Additionally, Vietnam is witnessing a trend towards smarter consumption. Diners are willing to spend more on each outside dining occasion but with a more defined plan rather than impulsive dining decisions. This shift in consumption could be a positive factor during the industry’s challenging period.

In the face of fierce market competition, businesses are exploring ways to improve their performance, stay ahead of consumer trends, and adapt to macroeconomic policies. They are also focusing on attracting and retaining customers.

According to iPOS.vn’s survey, 25% of stores believed that promotional programs were an effective tool to increase customer footfall.

F&B businesses are becoming more strategic with their promotions. For example, offering a 10% discount for advance bookings (for full-service restaurants) or a “buy three get one free” deal (for buffet-style restaurants) are popular promotions that attract customers and enhance their dining experiences.

The online F&B business landscape is also witnessing intense competition. Amid the mounting pressure, businesses on online food delivery applications are striving to strike a balance between operating costs and revenue to sustain their presence and tap into the market’s potential. Mr. Nguyen Van Hau, CEO of Com Tho Anh Nguyen, acknowledged the shift in the online business landscape and emphasized the need for enterprises to optimize their operations and control costs to achieve better efficiency.

iPOS.vn also noted the continued impact of Decree 100/2019/ND-CP, dated December 30, 2019, which imposes administrative penalties in the road and railway transport sectors. Despite the decree’s implementation over the years, only 10.8% of businesses believed that customers had fully adapted to not driving after drinking alcohol.

This indicates that changing consumer habits is a long-term process that requires the collaboration of various stakeholders, including government agencies, businesses, and the public.

CHALLENGING TIMES, BUSY RESTAURANTS

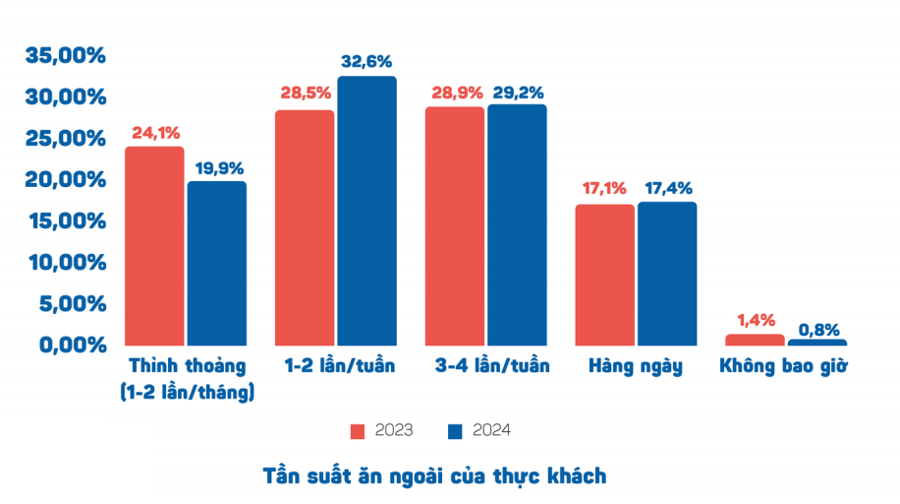

The iPOS.vn report also highlighted that economic challenges did not dampen the culinary enthusiasm of the Vietnamese people. Consumers remained resilient and adaptive, finding ways to indulge in their love for food despite the difficulties. Instead of reducing their spending on dining out, many respondents opted to maintain their frequency of dining out but with a more defined plan for their expenses.

“The survey revealed that high-frequency dining occasions (3-4 times a week and daily) remained almost unchanged from 2023. Additionally, there was a slight increase of 4.1% in the group of customers who dined out 1-2 times a week. Overall, loyal customers maintained their dining habits, showcasing the strong appeal of the F&B industry,” iPOS.vn stated.

A notable trend observed by iPOS.vn this year was a distinct shift towards higher-end segments when it came to dining out for dinner, which is traditionally the time when Vietnamese consumers spend the most on outside dining.

Specifically, the proportion of consumers willing to spend between 51,000 and 71,000 VND for dinner increased by 5.7% compared to the previous year. Moreover, 20% of Vietnamese consumers were ready to spend more than 100,000 VND for dinner, reflecting a 5.1% increase from 2023.

These figures indicate that Vietnamese consumers’ purchasing power is on the rise, and they are willing to spend on daily culinary experiences without hesitation.

While lunch on-the-go is becoming increasingly expensive due to rising raw material costs, 61.4% of diners surveyed were comfortable spending between 31,000 and 51,000 VND on lunch, representing a significant increase of 13.7% compared to the 2023 study. This price segment is highly competitive, providing consumers with a wide range of choices while eroding the profits of quick-service restaurants in Vietnam.

On the other hand, spending on coffee experiences witnessed a significant decline in the first half of 2024, accompanied by a decrease in frequency. The proportion of consumers spending over 100,000 VND per cup dropped sharply from 6% to 1.7%. This shift reflects how economic challenges have prompted consumers to be more cautious with their spending on non-essential services.

Leveraging Over 2,000 Night Flights, Airlines Target Cooling Airfares

To cater for the increasing travel demand during the upcoming April 30th – May 1st holiday and the summer peak season, Vietnam Airlines has announced that it will operate and offer an additional 2,000 flights departing after 9 pm daily on routes connecting Hanoi, Ho Chi Minh City, Da Nang, Nha Trang, Quy Nhon, and other destinations.