Source: VietstockFinance

|

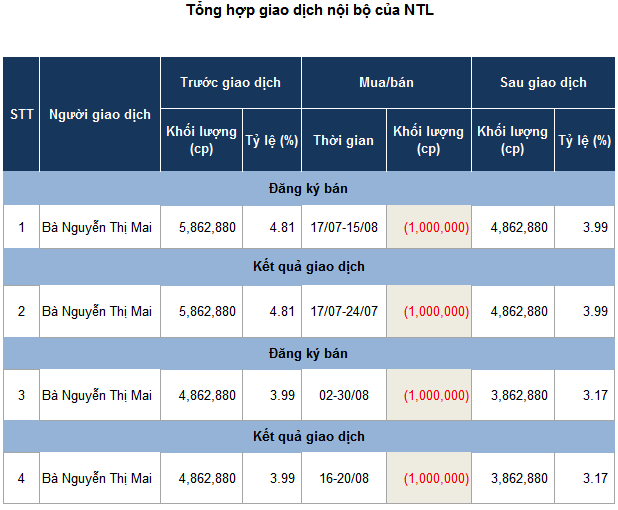

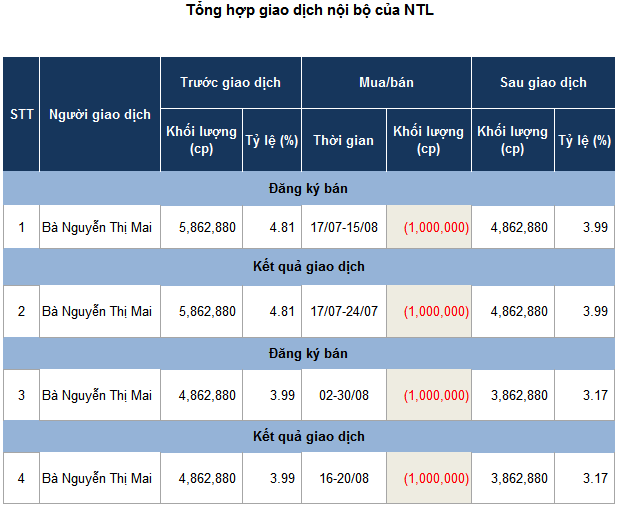

According to reports, the transaction took place between August 16 and 20, 2024. Based on the closing price on August 20, Ms. Mai could have earned more than VND 24 billion after reducing her ownership in NTL from 3.99% (4.9 million shares) to 3.17% (3.8 million shares).

In terms of relationships, Ms. Nguyen Thi Mai is the mother of Mr. Dinh Duc Tiep, CEO of NTL. Mr. Tiep does not hold any shares in the company.

Source: VietstockFinance

|

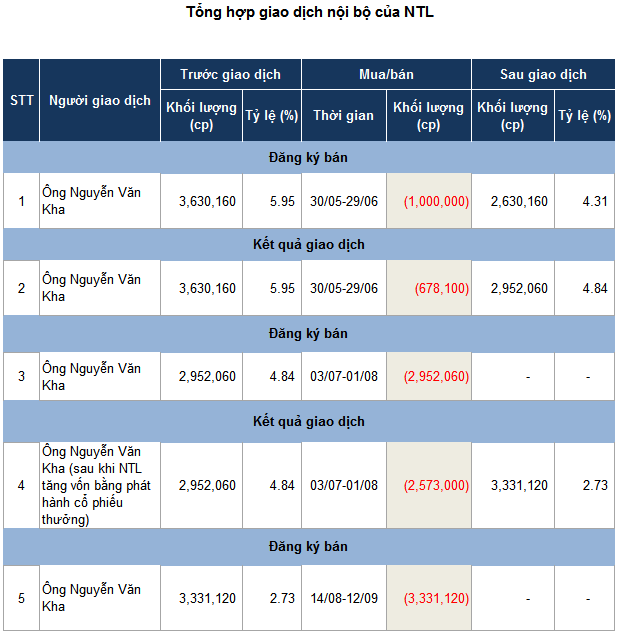

In addition to the CEO’s mother reducing her stake, Mr. Nguyen Van Kha, father of Mr. Nguyen Hong Khiem, a member of the Board of Directors and Deputy CEO of NTL, has also made a similar move.

Since the beginning of 2024, Ms. Mai and Mr. Kha have been frequent traders of NTL shares. Ms. Mai sold 1 million shares in July and another 1 million in August, as mentioned in the report. Meanwhile, after ceasing to be a major shareholder of NTL in June, Mr. Kha registered to sell all of his nearly 3 million NTL shares between July 1 and August 1.

However, due to the price not meeting his expectations, Mr. Kha only managed to sell approximately 2.6 million shares out of the nearly 3 million shares registered. Based on the average closing price (VND 27,086/share), it is estimated that this shareholder earned nearly VND 70 billion from the transaction.

During the period when he sold 2.6 million NTL shares, Mr. Kha received nearly 3 million shares through a bonus share program with a 1:1 ratio from NTL. As a result, instead of holding just over 379,000 shares, Mr. Kha now holds more than 3.3 million shares.

Therefore, Mr. Kha has registered to divest his entire stake of more than 3.3 million NTL shares (2.73%) from August 14 to September 12, 2024, for personal financial needs.

| NTL Share Price Movement from the Beginning of 2024 to August 22 |

The successive divestment by family members of the leadership takes place against the backdrop of NTL share price maintaining a continuous upward trend from the beginning of 2023 until it reversed in mid-July last year. From the beginning of 2024 to the present, the share price has increased by nearly 77%.

| NTL’s Business Results for the First Half of 2024 |

NTL’s positive business results for the first half of 2024 could be a reason for the strong rise in its share price. According to the company’s second-quarter 2024 financial report, NTL recorded cumulative results for the first six months with VND 878 billion in net revenue and nearly VND 401 billion in net profit, respectively 7.3 times and 145.2 times higher than the same period last year.

In 2024, NTL plans to reduce its revenue and pre-tax profit by 18% and 31%, respectively, compared to 2023 results, to VND 750 billion and VND 320 billion. Compared to this conservative plan, the company has exceeded its revenue target by 17% and its profit target by 57% in the first half of the year.