The number of declining stocks has risen significantly compared to the morning session, with 348 codes in the red and 2 floor codes, while there were 253 green codes and 15 ceiling codes.

The market also turned red due to significant pressure from many bank stocks that could not maintain their upward momentum from the morning session, typically MBB, HDB, STB, and VCB… and many securities group stocks such as VIX, SHS, VCI, and SSI…

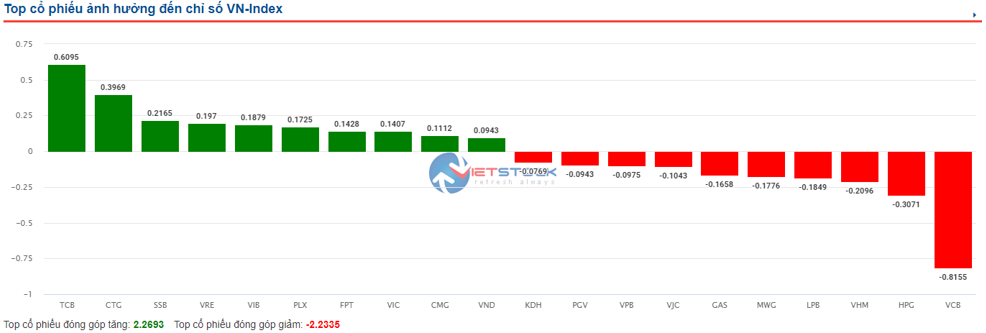

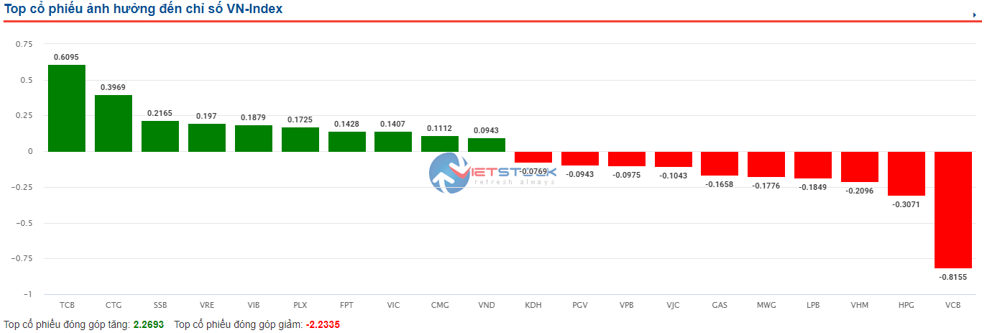

Speaking about the market dominance, the banking sector is having the most significant impact as it appears in both positively and negatively impacting groups.

Specifically, a series of bank stocks such as TCB, CTG, SSB, and VIB are in the top 10 stocks with the most positive impact on the VN-Index. Meanwhile, VCB, LPB, and VPB are in the top 10 stocks with the most negative impact, with VCB alone taking away more than 0.8 points from the VN-Index.

Source: VietstockFinance

|

In terms of declines, the automotive and components group decreased by more than 1%, the sharpest decline in the market, due to pressure from the trio of tire stocks, DRC, CSM, and SRC.

Opening: Continuing the recovery trend

VN-Index opened on August 22 with a predominantly green tone. Although there was a quick adjustment soon after, the index still gained 1.87 points to reach 1,285.92 as of 9:25 am.

Market performance as of 9:25 am. Source: VietstockFinance

|

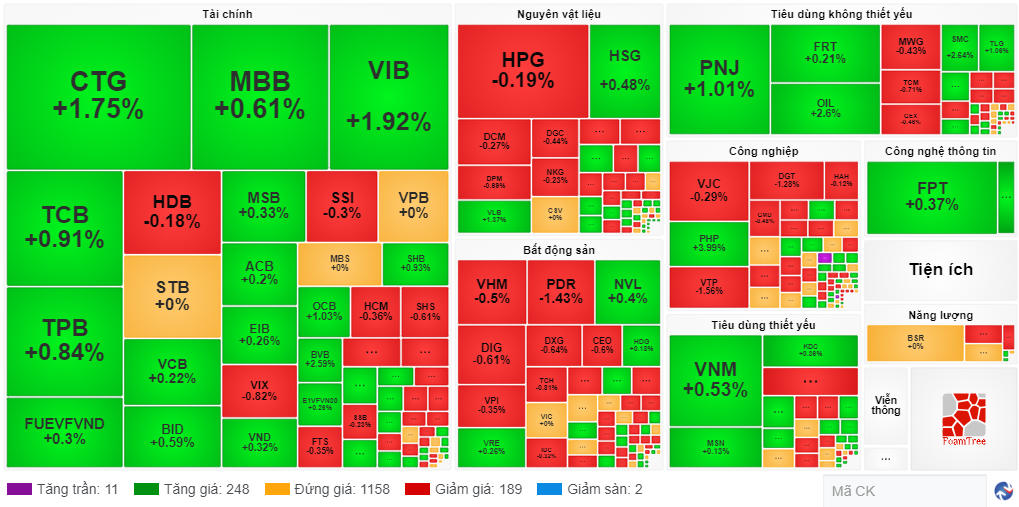

The green spread with 259 advancing codes, including 11 ceiling codes, while only 191 codes declined. Liquidity also improved compared to the previous session.

The banking group continued to stand out and provide significant momentum for the market, with notable mentions such as CTG up 1.75%, VIB up 1.92%, TCB up 0.91%, TPB up 0.84%, and MBB up 0.61%.

Most industry groups posted gains, with food and essentials retail recording the strongest increase. On the other hand, only a few industry groups declined, and the declines were insignificant, all below 1%.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.