The market is facing challenges near the old peak due to the volatile nature of blue-chip stocks, especially banking stocks. While the VN-Index showed a minor decline of 1.27 points today, the HoSE liquidity dropped by a significant 21%, hitting the lowest level in the last five sessions.

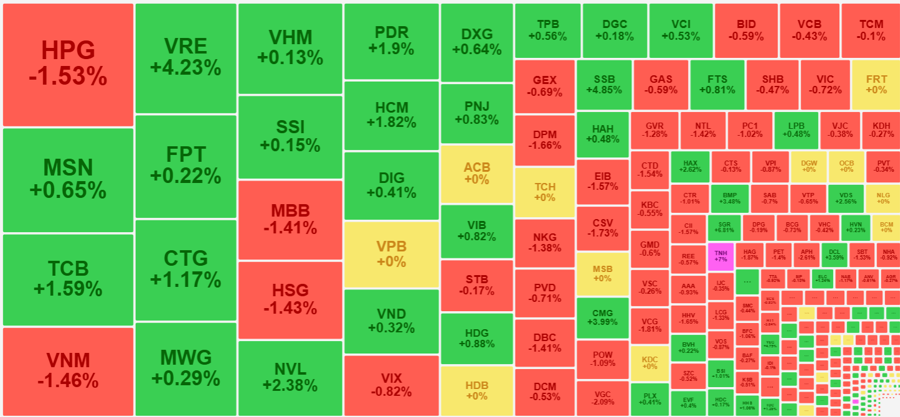

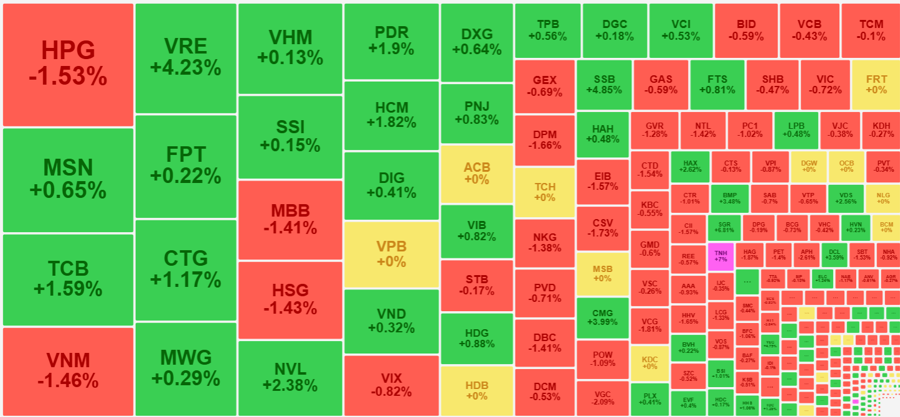

Interestingly, the banking sector still played a crucial role in minimizing the index’s loss today. SSB, TCB, and CTG were the top three performers, increasing by 4.85%, 1.59%, and 1.17%, respectively, and contributing 1.8 points to the VN-Index. Including two other major stocks, VRE and MSN, which rose by 4.23% and 0.65%, respectively, these top five stocks added a total of 2.4 points to the index. Despite this, the VN-Index still ended the day 1.27 points lower than the previous close.

The main reason for this is the divergence among the large-cap stocks. VCB and BID, the two largest banking stocks, ended in the red, decreasing by 0.43% and 0.59%, respectively. Other large-cap stocks that witnessed declines include HPG, GAS, VIC, VNM, and GVR, with decreases ranging from 0.59% to 1.53%. This lack of consensus among the top stocks has been a contributing factor to the VN-Index’s three previous failures to break through the 1300-point peak.

Today marked the first session where the index closed below the previous day’s level after a sharp four-day rally. Despite the significant rise in the VN-Index yesterday, the number of declining stocks increased notably, indicating a potential propping up by the large-cap stocks. However, as these stocks also weakened today, the VN-Index turned genuinely negative, and for the first time, the number of declining stocks outnumbered the advancing ones, with 171 gainers and 228 losers.

Although this breadth ratio is not overly negative, many stocks have struggled to rise over the last three sessions, fluctuating and underperforming the index. This is evident in the breadth data. Additionally, it signals that investors are increasingly focusing on profit-taking, especially as the VN-Index approaches the 1300-point level for the fourth time in 2024.

The HoSE and HNX matching liquidity dropped by nearly 21% compared to the previous session, indicating weak trading activity throughout the day. The afternoon session witnessed a slight increase in liquidity of almost 9% compared to the morning session, but it still remained the lowest in the last five sessions. The market’s lack of funds inevitably leads to weak demand, and this is most evident in the blue-chip stocks.

The VN30-Index ended the day with a slight gain of 0.88 points, with 12 advancers and 14 decliners, but the overall price level declined. Specifically, 18 stocks in the basket fell from their morning session closing prices, while only eight improved. Not only were the advancers outnumbered, but their gains were also modest and insufficient to offset the losses in terms of market capitalization.

SSB stood out as the most notable stock in the afternoon session, witnessing a sudden surge after 2:00 PM. If we consider the afternoon session alone, SSB rose by an additional 1.34%, closing the day 4.85% above the previous close, becoming the strongest stock in terms of index contribution, despite its market cap not yet reaching the Top 20 on the HoSE. Additionally, only MSN and MWG showed relatively positive improvements. MSN rose by 0.65%, recovering from the morning session’s loss. In fact, this gain can be considered a failure for MSN, as it witnessed a sharp increase of 2.71% above the previous close within about ten minutes after 1:30 PM. MWG rose by approximately 0.57% in the afternoon session, reversing the morning’s loss and ending the day 0.29% higher. The remaining stocks barely managed to climb a few price steps compared to the morning session.

With limited funds in the market, only a small number of stocks were able to attract significant capital and maintain a decent upward momentum. While the HoSE still recorded 171 gainers, only 20 stocks achieved liquidity of over VND 10 billion with an increase of more than 1%. Seven stocks stood out with liquidity exceeding VND 100 billion: TCB, VRE, CTG, NVL, PDR, HCM, and SSB. In the mid-cap range, CMG rose by 3.99% with a matching volume of VND 87 billion, HAX increased by 2.62% with VND 50.9 billion, BMP climbed by 3.48% with VND 45.3 billion, VDS gained 2.56% with VND 42.8 billion, SGR rose by 6.81% with VND 36.7 billion, and TNH increased by 7% with VND 31.2 billion.

At the close, 86 stocks witnessed sharp declines of more than 1%, accounting for 23.1% of the total matching value on the HoSE. While this proportion is not overly high, some stocks experienced noticeable selling pressure: HPG decreased by 1.53% with a matching value of VND 621.1 billion, VNM fell by 1.46% with VND 449 billion, MBB dropped by 1.41% with VND 322.2 billion, HSG declined by 1.43% with VND 315 billion, DPM decreased by 1.66% with VND 121.5 billion, and NKG fell by 1.38% and 1.41% with matching values of VND 116.1 billion and VND 114.5 billion, respectively.

The VN-Index closed at 1282.78 points, and there are no clear signs yet of an imminent short-term peak. The possibility of the index breaking through or at least reaching the 1300-point mark still exists, but it requires the consensus of large-cap stocks. Weak liquidity remains a significant constraint at this point.