The VN-Index managed to edge above the reference level by 0.72 points in the morning session, thanks to the upward pull of some large-cap stocks. However, the breadth confirmed more red than green stocks. Notably, the HoSE matching liquidity decreased by 21% compared to yesterday morning, indicating a significant decline in buying demand.

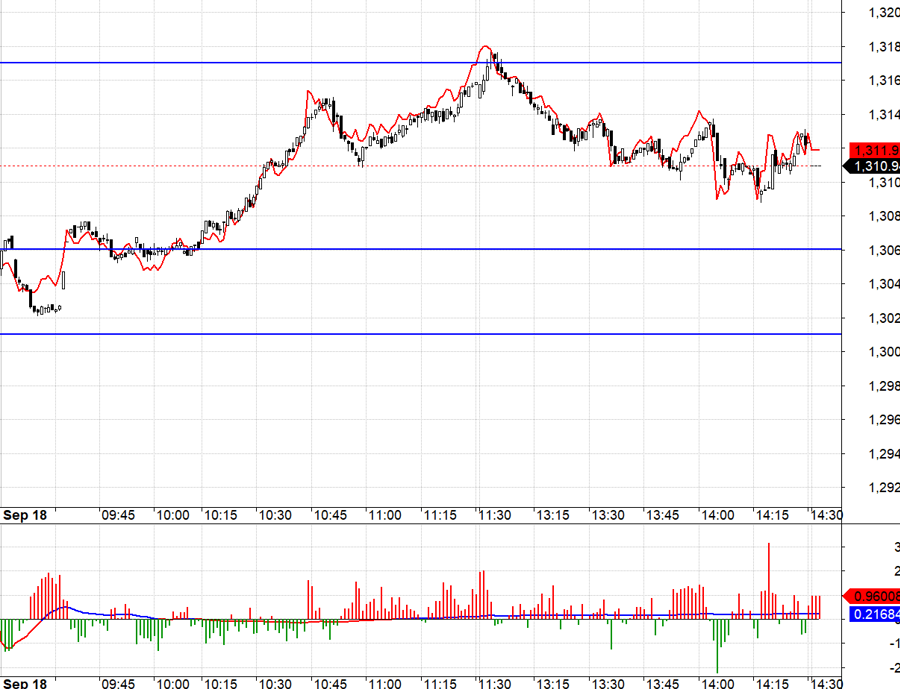

The sharp rise in the last four sessions has pushed the VN-Index closer to the 1300-point peak. This level has thrice halted the index’s advance this year, so it’s understandable that investors are becoming cautious again. In reality, many stocks are still far from reclaiming their highs, despite the VN-Index flirting with old peaks.

On the other hand, the strength of the leading banking stocks in this rally appears to be waning quickly. This morning, TCB rose 2.5% and contributed 0.95 points, while the total increase in the VN-Index was 0.72 points. However, other banking blue chips showed weakness: VCB fell 0.11%, BID fell 0.59%, MBB fell 0.2%, and STB fell 0.17%, while many other stocks rose meagerly. SSB, BVB, VIB, ABB, and VAB are still up over 1%, but their impact on the index is very limited.

The VN30-Index ended the morning session up 0.29% with 11 gainers and 16 losers. The breadth was poor, but the index stayed in positive territory thanks to some large caps. In addition to TCB, VRE also surged 5.29%. Furthermore, while SSB’s increase was almost insignificant in the VN-Index, it had a more substantial impact on the VN30-Index, as its 3.46% rise contributed over 1.1 points to this index while only adding 0.4 points to the VN-Index.

The VN30 blue chips are still trying to maintain the pace, but their strength is no longer as robust. Apart from SSB, all 29 other stocks have declined to varying degrees. Even the strongest, VRE, has retreated by approximately 1.24% from its peak, and TCB has given back around 0.44% from its highest level.

The inflow of funds into the blue-chip group is also waning, with the total matching value in the VN30 basket about 7% lower than yesterday morning, even with VRE’s surge. This stock’s liquidity was 7.1 times higher than yesterday morning, reaching nearly VND 334.1 billion. TCB also increased its matching value by 2.5 times. This means that the remaining stocks in the basket have declined significantly. Weak buying power caused prices to fall into a correction phase after the initial few minutes of rising.

Overall, the HoSE exchange also witnessed a 21% drop in trading compared to yesterday morning, reaching approximately VND 6,765 billion. The VN30 basket lost an absolute value of VND 229.8 billion, while the HoSE floor lost VND 1,801 billion. Thus, other stock groups are also experiencing a clear contraction in fund inflows.

The VN-Index’s breadth at the session’s close recorded 164 gainers and 228 losers, a slight improvement. When the index fell to its intraday low of 3.6 points, the breadth was 124 gainers and 256 losers. The final recovery rally pushed the index slightly above the reference level, but not many stocks reversed course.

On a positive note, only a few stocks experienced sharp declines, with just 54 stocks on the entire HoSE falling more than 1%. These stocks accounted for 7.7% of the floor’s total matching value. The small decline range, coupled with low liquidity, reflects weak price action due to a lack of demand rather than significant selling. Furthermore, only 10 out of these 54 stocks had liquidity exceeding VND 10 billion, led by VNM, which fell 1.2% with a matching value of VND 190.2 billion, and PVD, which declined 1.25% with a transaction value of only VND 56.4 billion.

Currently, the adjustment trend among small and medium-cap stocks is evident, although the polarized state still offers opportunities for some stocks to rise. Looking at the broader picture, the negative breadth in these groups implies higher risks, depending on the held stocks. The VN-Index heavily relies on large caps and banks, which have not demonstrated sustainable strength at this critical juncture.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.