With a payout ratio of 15% (1 share receives VND 1,500) and nearly 20.98 million shares in circulation, DP1 is estimated to pay out over VND 31 billion in dividends to shareholders. The expected payment date is September 27, 2024.

Source: VietstockFinance

|

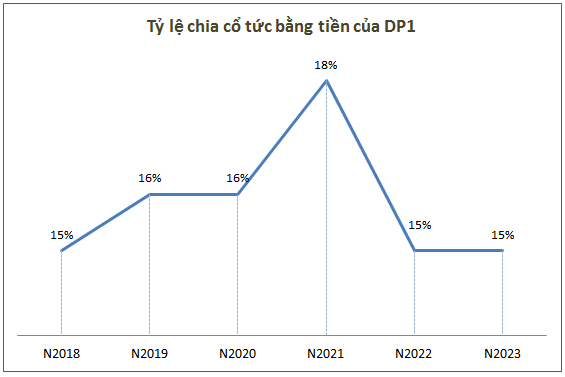

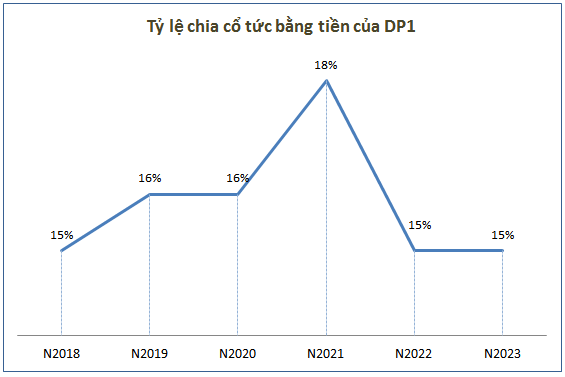

Since 2018, DP1 has consistently paid cash dividends to shareholders for six consecutive years, with dividend rates ranging from 15% to 16%. In 2021, the company increased the dividend rate to its highest level of 18%.

Source: VietstockFinance

|

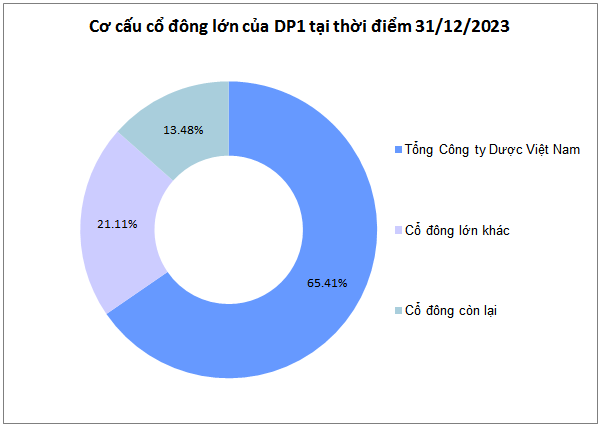

As of December 31, 2023, DP1 had four major shareholders holding 86.52% of the company’s capital, equivalent to nearly 18.2 million shares. Among them, the Vietnam Pharmaceutical Corporation, the parent company of DP1, holds 65.41% and is expected to receive nearly VND 21 billion.

| DP1’s business results for the first half of 2024 |

In terms of business performance, DP1 concluded the first half of 2024 with VND 1,019 billion in net revenue and over VND 58 billion in net profit, reflecting a 3% and 15% increase, respectively, compared to the same period last year.

For the full year 2024, DP1 targets VND 2,250 billion in revenue, a modest 4% increase from 2023, but forecasts a 17% decline in post-tax profit to over VND 96 billion. The company has achieved 45% of its revenue target and 60% of its profit target for the first six months.

| DP1’s stock price movement from the beginning of 2024 to the session on August 21 |

In the stock market, as the ex-dividend date approached, DP1’s share price reacted positively with four consecutive gaining sessions (from August 16), climbing to VND 39,300 per share (adjusted for dividend payout) by the end of the August 21 session.

HPX Expects 22% Decrease in Profit in 2024

In the market, HPX stock is still classified as a suspended stock due to the continued violation of disclosure regulations by the listed organization after being placed under trading restrictions…