The market continued to open with a gap up in the morning session and then witnessed narrow fluctuations amid selling pressure. In the afternoon session, buying pressure steadily increased, absorbing all selling pressure, helping the VN-Index close the August 21 session at 1,273 points, an 11-point gain.

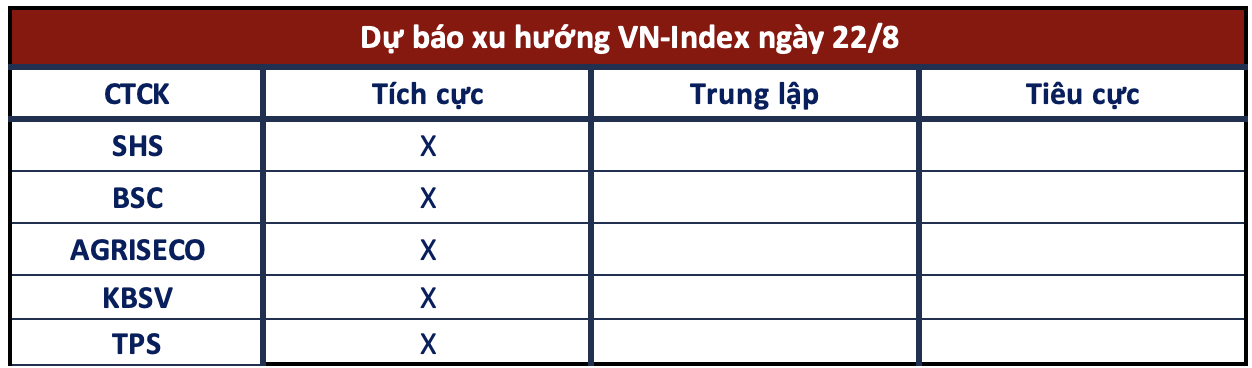

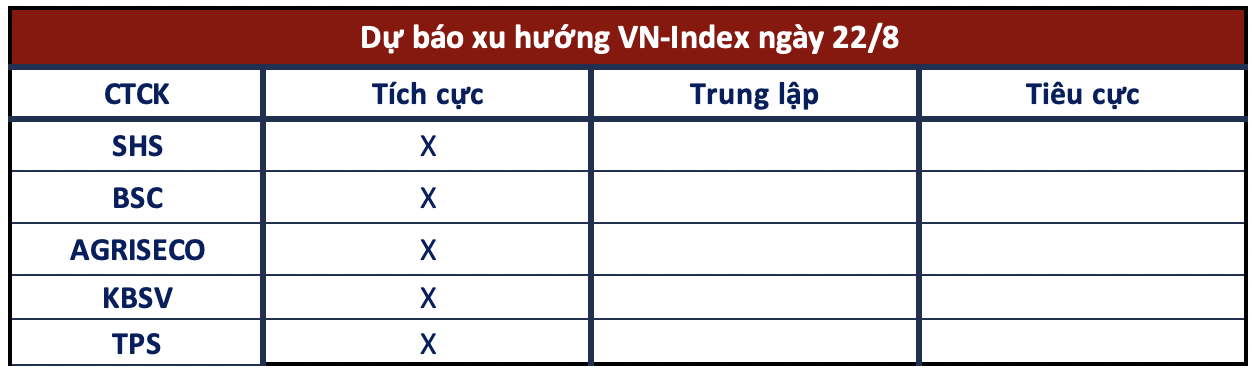

Looking ahead to the next trading session, most securities companies anticipate that the market may continue its upward trajectory to reclaim the 1,300-point mark, but caution is advised due to potential profit-taking at higher price levels.

Market Aims for the 1,300-Point Target

SHS Securities

The VN-Index is currently trading within the 1,280-1,300 range, with immediate support around 1,280 points and stronger support at 1,255-1,260 points. SHS expects the VN-Index to continue targeting the strong resistance zone of 1,300 points and potentially extending towards the 1,320 zone, corresponding to the highest price level of June 2022.

BSC Securities

The market is in the midst of a recovery, heading towards previous resistance levels. In the upcoming sessions, the index may advance towards the 1,290-1,300 zone, but investors should remain vigilant about profit-taking at higher price levels.

Consider Accumulating Stocks

Agriseco Securities

From a technical perspective, the market continued its upward trajectory as new buying demand absorbed most of the short-term selling pressure. The Bollinger Bands indicator is expanding, and prices are trending towards the upper band. Agriseco Research believes that the market will head towards the 1,290 zone in the upcoming sessions, exhibiting a V-shaped recovery. Investors are advised to increase their trading positions during intraday fluctuations, prioritizing leading stocks in sectors that are currently attracting capital inflows, such as real estate, securities, and retail.

KBSV Securities

In a scenario where enthusiastic capital inflows continue to buoy large-cap stocks and propel the market higher, the index will confirm a breakthrough of the nearby resistance zone. While technical profit-taking may occur after steep gains, the VN-Index has a good chance of conquering the 1,300 resistance level. Investors are recommended to gradually buy back trading positions when the VN-Index or target stocks pull back to nearby support zones.

TPS Securities

The VN-Index maintained its impressive upward momentum, surpassing the 1,280-point threshold and aiming for higher price levels. The combination of rising trading volume and the index’s performance suggests that the current uptrend will persist in the upcoming sessions. Medium and long-term investors can take advantage of any corrections (if they occur) to enter the market. Current support levels are at 1,220 and 1,240 points. TPS foresees positive scenarios for the VN-Index unless significant fluctuations occur in the last two sessions of the week.