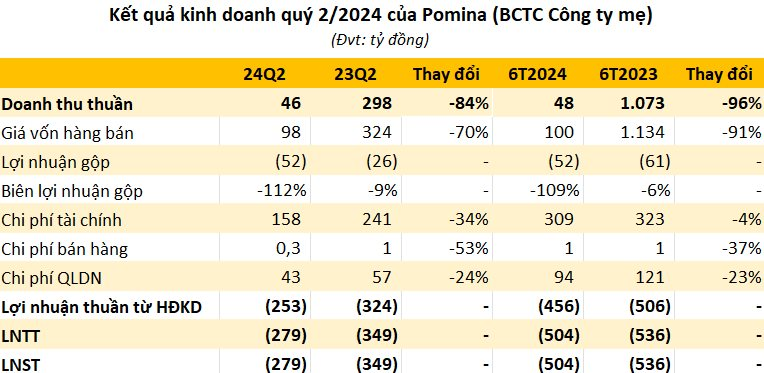

Pomina JSC (code: POM) has released its Q2 2024 financial statements, revealing an 84% decline in revenue compared to the previous year, totaling VND 46 billion. The company continues to operate at a loss, with a gross loss of VND 52 billion, an increase from the VND 26 billion loss in the same period last year.

While expenses have been reduced compared to the previous year, they still pose a significant challenge to the company’s performance. Notably, financial expenses amounted to VND 158 billion, a 34% decrease from Q2 2023, with over VND 131 billion attributed to interest expenses. In addition, administrative expenses decreased by 24% to VND 43 billion.

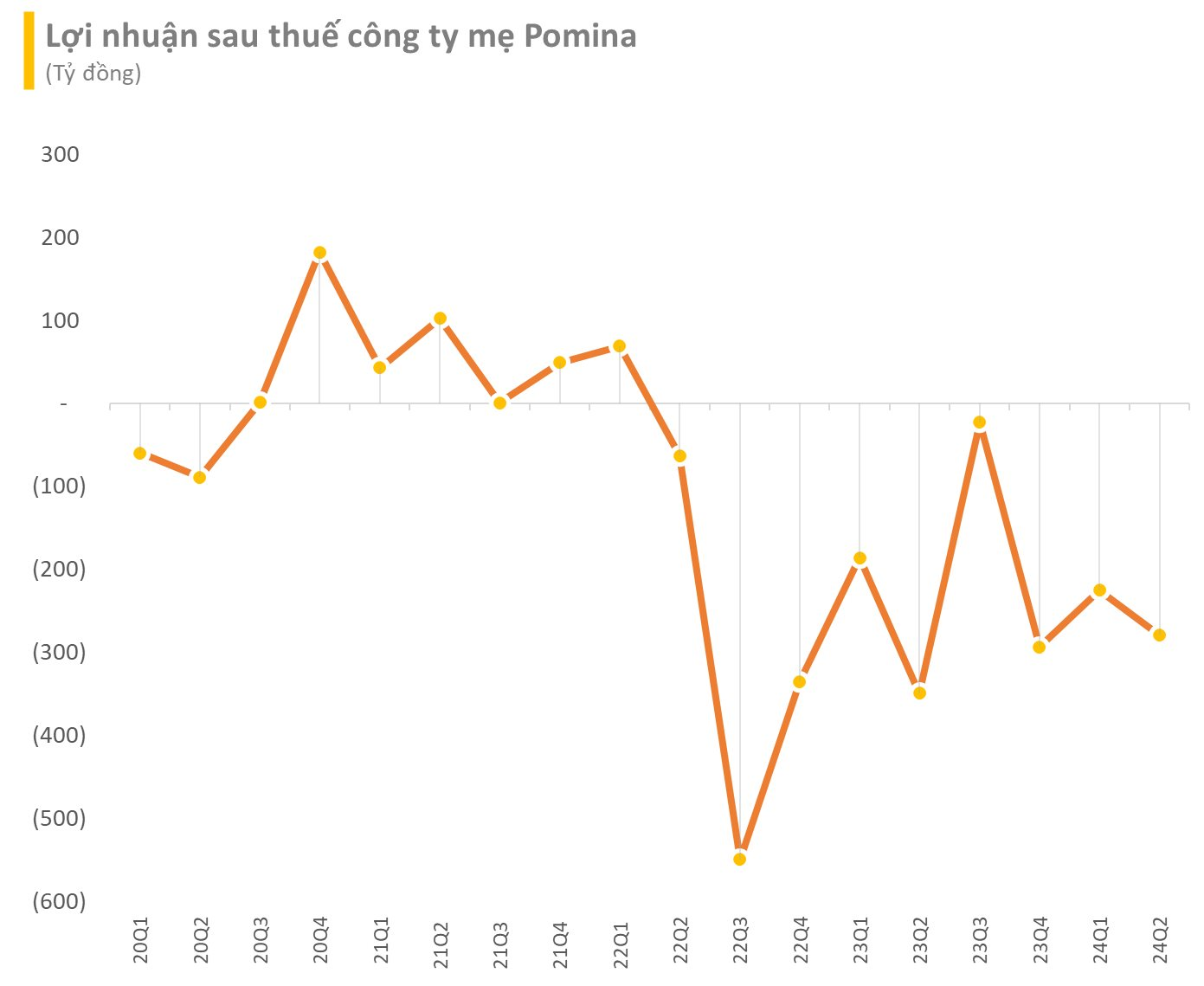

As a result, Pomina incurred a post-tax loss of over VND 279 billion, a slight improvement from the VND 349 billion loss in the same period last year. This marks the company’s ninth consecutive quarterly loss in the steel industry.

For the first six months of 2024, Pomina’s revenue plummeted by 96% from VND 1,000 billion to just VND 48 billion. The company reported a post-tax loss of over VND 504 billion.

According to Pomina’s explanation, the losses are attributed to the shutdown of Pomina 3 and Pomina 1 steel mills, which continue to incur management and interest expenses. The company is actively seeking investors to restructure and resume production as soon as possible.

As of Q2 2024, Pomina’s total assets amounted to VND 8,356 billion, with less than VND 8 billion in cash. The company’s construction in progress account stands at over VND 5,700 billion, constituting the largest proportion of its total assets.

Additionally, Pomina has invested over VND 800 billion in its subsidiary but had to allocate nearly VND 240 billion in provisions.

The company’s total liabilities stand at VND 7,263 billion, a slight increase from the beginning of the year. Of this, VND 4,343 billion is attributed to financial debt.

Once a leading manufacturer of construction steel in Vietnam, with a market share of nearly 30%, Pomina has faced increasing competition from Hoa Phat. As the industry cycle turned, Pomina’s profits declined, and the company began incurring losses. Pomina halted its blast furnace operations on September 23, 2022, and was forced to terminate employment contracts with some of its employees due to financial difficulties.

The years 2022 and 2023 saw record losses for the company. With the significant loss in the first half of 2024, the total cumulative loss as of June 30, 2024, reached nearly VND 1,800 billion, equivalent to 63% of the owner’s equity.

In early August, Pomina announced a strategic partnership with Nansei Steel Co., Ltd. (Japan). Nansei will provide the necessary raw materials for Pomina 2 to operate at maximum capacity starting in September 2024, meeting the growing market demand.

Additionally, Pomina signed an MOU with a large and professional investor, aiming to restart the blast furnace project in early 2025, anticipating the recovery of public investment and real estate projects. The identity of this new investor has not been disclosed.

The company expects to resume blast furnace operations in Q4 2024, positioning itself to capture the anticipated rebound in real estate projects towards the end of the year.

On the market, POM shares were delisted from HoSE and resumed trading on UPCoM in May 2024. The current market price is VND 3,000 per share.