FPT Retail’s FRT stock soared by almost 5% to reach 184,200 VND per share at the start of trading on August 21st. There was even a moment when FRT hit the ceiling price during the morning session. The trading volume at this time was nearly 2 million shares. This is also the record price that this stock has achieved since its listing.

FPT Retail’s market capitalization also reached over VND 25,000 billion (about $1 billion) at this time.

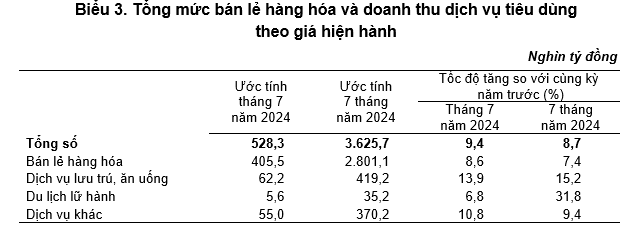

The continuous peak-breaking performance of FRT and a few other retail stocks in the past period is partly due to the favorable macroeconomic conditions in the country. According to data from the General Statistics Office, the total retail sales of goods and service revenue consumption in July 2024 is estimated at VND 528,000 billion, up 9.4% over the same period last year.

In the first seven months of 2024, the total retail sales of goods and service consumption revenue at current prices were estimated at VND 3.6 million billion, up 8.7% over the same period last year. If excluding the price factor, it increased by 5.2%.

Retail goods sales in the first seven months of 2024 were estimated at VND 2.8 million billion, accounting for 77.3% of the total and up 7.4% over the same period last year. This item compared to the same period last year of some localities is as follows: Quang Ninh increased by 10.2%; Da Nang increased by 7.8%; Can Tho increased by 7.6%; Hanoi increased by 6.6%; Ho Chi Minh City increased by 6.3%.

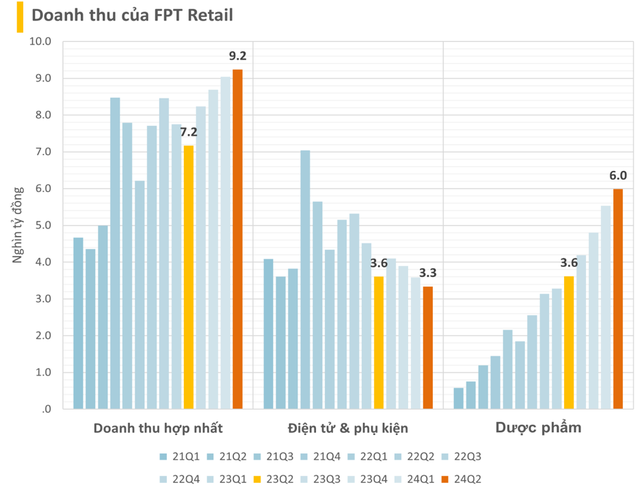

In addition to the advantages of macroeconomic factors, the continuous peak-breaking of FRT stock in the past period is also due to investors’ expectations about FPT Retail’s pharmaceutical business segment. Specifically, in the reviewed semi-annual financial statements for 2024, FPT Retail revealed the bright business results of the Long Chau chain.

Specifically, this pharmaceutical chain brought in VND 11,521 billion in revenue for this retailer, up 67% over the same period last year. The pharmaceutical segment currently accounts for 63% of FPT Retail’s revenue. Long Chau’s profit before tax, interest, and depreciation (EBTDA) reached VND 491 billion.

Although FPT Retail did not disclose specifics, the financial statements show that the profit before tax was more than VND 270 billion – while the consolidated profit after tax of the whole system was VND 160.5 billion.

FPT RETAIL’S POTENTIAL IN THE NEXT PHASE

In a recent report by SSI Research, this securities company expects FPT Shop’s profit to return to a positive trend after the large companies in the market reduced inventory. SSI Research estimates that FPT Retail will close 50 FPT Shop stores in 2024 and maintain the number of stores in 2025.

Although there are fewer stores, we expect FPT Shop’s revenue to recover in 2024-2025 along with the recovery of consumption and the replacement cycle of mobile phones starting in 2025 (i.e., 3-4 years after the abnormal demand in 2021). The pre-tax profit margin is forecast to improve in 2024 and 2025 due to less fierce price competition thanks to the reduction of inventory of the two largest companies (MWG and FRT) and cost optimization efforts.

Regarding the Long Chau pharmaceutical chain, SSI Research expects it to continue to record positive results thanks to new store openings and expanding profit margins. SSI Research forecasts that Long Chau will open 400 new drugstores each year in the period of 2024-2025, as modern commercial drugstores still have the opportunity to gain market share from small drugstores and hospital drugstores (currently accounting for more than 85% of the market share).

The opening of new stores will accelerate in rural areas, where public healthcare facilities are still limited, so patients may seek reputable private pharmacists. Thus, Long Chau will have 1,900 and 2,300 drugstores by the end of 2024 and 2025, respectively.

In the vaccine segment, Long Chau aims to have 100 vaccine centers by the end of 2024, followed by the opening of 150 centers in 2025 to capture the growing demand. SSI Research still believes that this segment will incur losses in 2024-2025. Vaccine revenue is expected to account for 4% and 9% of Long Chau’s revenue in 2024 and 2025, respectively.

The vaccine market size is much smaller than the drug market size (about $666 million compared to $8.5 billion in 2023). Therefore, the proportion of vaccine revenue in Long Chau’s total revenue may still be low by 2025.

According to statistics from SSI Research, the vaccine market size in Vietnam in 2023 reached VND 16,000 billion, up 14% over the same period last year. This securities company also believes that vaccine demand can maintain stable growth in the coming years due to the increasing demand for key vaccine types such as HPV vaccine, pneumococcal vaccine, and influenza vaccine (accounting for 33%, 22%, and 10% of the total vaccine market in Vietnam, respectively). This is because the vaccination rate in Vietnam is low (less than 5%) as these vaccines have not been included in the NMCR program (the free vaccination program provided by the government).

Therefore, SSI Research believes that private vaccination centers will have the opportunity to develop along with the increasing vaccination demand (growing at 10-15% in the next few years) and the trend of choosing private vaccination services instead of vaccination at public facilities. One of the companies that will benefit greatly from this is Long Chau.

Once a formidable competitor in the stock market, the total market capitalization of the entire real estate industry is now less than the combined market capitalization of three banks.

If you combine the market cap of Vietcombank and BIDV, along with the market cap of Vietinbank (which is approximately 960 trillion VND), it already surpasses the market cap of the top 30 largest real estate enterprises (which is around 788 trillion VND).