On August 21st, Mr. Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam’s Ho Chi Minh City Branch, announced that the city is implementing several preferential loan policies for social housing. Specifically, the Ho Chi Minh City Branch of the Social Policy Bank offers preferential loans for purchasing, lease-purchasing, or constructing social housing, as well as renovating or repairing existing houses, in accordance with current regulations. The interest rate applied by the Social Policy Bank’s Ho Chi Minh City Branch is determined for each period.

“This is one of the important policies that contribute to providing preferential credit support with preferential interest rates for low-income earners and policy beneficiaries as defined by the government,” said Mr. Lenh.

Commercial banks, under the direction of the Government and the State Bank, are also actively implementing preferential loans for social housing in accordance with Decree 100 and Decree 49. Four state-owned commercial banks, including Vietcombank, Vietinbank, Agribank, and BIDV, participate in the lending process using refinancing capital and prescribed interest rates.

Ho Chi Minh City Branch of the State Bank of Vietnam proposes solutions to support credit for purchasing social housing

Additionally, the social housing loan policy is implemented through a preferential credit package. Accordingly, the four state-owned commercial banks have registered and introduced a credit package for social housing loans, with an initial scale of VND 120,000 billion, targeting project owners and social housing buyers.

The current interest rate applied to buyers is 6.5%/year, while the rate for project owners is 7%/year. The State Bank of Vietnam has significantly reduced these rates compared to the initial implementation of the program, resulting in a decrease of 1.7%/year (the initial rates were 8.2%/year for buyers and 8.7%/year for project owners). As of now, the total outstanding loan balance stands at VND 108.8 billion for 290 customers.

“Based on the list of social housing projects eligible for the VND 120,000 billion credit package announced by the Ho Chi Minh City People’s Committee (including 6 social housing projects), 3 projects have already borrowed or are borrowing from banks. Specifically, the project to build housing for rent for workers in Thu Duc City, implemented by Thu Thiem Group Joint Stock Company, is borrowing from the VND 120,000 billion package and has disbursed VND 170 billion,” said Mr. Lenh.

To further expand and increase credit for social housing loans, Mr. Lenh suggested that Ho Chi Minh City continue to implement preferential credit policies, ensuring that they meet the requirements for preferential interest rates and loan terms that are suitable for the circumstances, abilities, and incomes of policy beneficiaries and low-income earners. He also emphasized the importance of promptly addressing legal difficulties faced by projects. Projects with complete legal documents and eligibility for borrowing can easily access bank credit in general and the VND 120,000 billion package in particular. It is crucial to organize the implementation of new points from the Housing Law, the Law on Real Estate Business, and the Law on Credit Institutions…

Proposed Planning for Adding 2 New Cities in Ho Chi Minh City

According to Architect Ngô Viết Nam Sơn, Ho Chi Minh City should consider planning two cities within the city in the south and north.

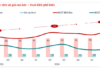

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Comprehensive regional connectivity

In addition to building strong physical infrastructure, Ho Chi Minh City needs to strengthen its soft connections with other provinces in the region in order to promote economic development. This includes prioritizing the training of skilled workforce and ensuring access to quality healthcare.