The 2024 Social Insurance Law, passed by the National Assembly, introduces

changes to retirement regimes, including reducing the minimum number of

years of contribution to qualify for a pension, making it easier for

late entrants to access retirement benefits. However, some argue that

the current pension calculation method lacks a sense of sharing.

Ms. Phan Thi Dung, a worker at a packaging company in Tan Binh

Industrial Park, shared that she has been consistently contributing to

social insurance for 24 years. As she aspires to receive a pension, she

has never considered withdrawing her social insurance once. With over

four years left until her retirement age, she will have contributed

approximately 29 years to social insurance, almost reaching the maximum

ratio for pension entitlement. Yet, she still has concerns about her

golden years.

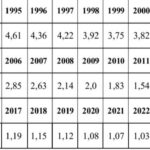

The reason for her worry is that the pension for employees in the

enterprise sector is calculated based on the average of their entire

social insurance contribution period. In the initial years of her

contribution, Ms. Dung’s social insurance contribution was very low,

less than VND 100,000, a significant disparity compared to her current

contribution base salary of over VND 6 million. Even with the maximum

entitlement ratio, her pension will still be relatively low due to the

averaging calculation.

Workers hope for continuous improvements in pensions, approaching the

regional minimum wage.

Due to this, Ms. Dung does not have high expectations from her

pension. “In the years before retirement, I will try to save up. As for

the pension, I just hope that it will cover some basic needs such as

electricity, water, and a portion of my food expenses,” she said.

Similarly, Ms. Le Thi Hong Loc, a security guard at Long Hai Service

Joint Stock Company in Phu Nhuan District, has consistently contributed

to social insurance for 27 years and will retire in less than three

years. As she has a single-parent family and needs to take care of her

elderly mother, her economic burden remains significant even as she

nears retirement.

Therefore, Ms. Loc plans to continue working to earn a living and

support her mother as long as her health permits. While she appreciates

having a pension and lifelong health insurance thanks to her consistent

social insurance contributions, she still has concerns. “I understand

that my pension won’t be high because my social insurance contributions

were low in the initial years, but I hope it won’t be too far from the

regional minimum wage at that time to cover some basic needs,” she

expressed.

Mr. Le Dinh Quang, Deputy Head of the Policy-Law Department of the

Vietnam General Confederation of Labor, acknowledged that the Social

Insurance Law demonstrates a clear emphasis on diversity, flexibility,

and multilayered approaches. However, he pointed out that while the

contribution-benefit principle in the retirement policy is evident, the

sense of sharing is still lacking. This leads to disparities in pension

amounts among contributors, especially for direct laborers with low

social insurance contributions who often have to retire early and face

percentage deductions, resulting in very low pensions. Therefore, he

suggested that while respecting the contribution-benefit principle, there

is a need to introduce mechanisms to minimize these disparities.

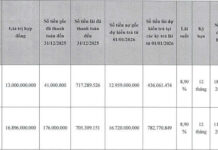

Salary Adjustments and Social Insurance Payments for 2024

The average salary and monthly income subject to social insurance paid will be the basis for calculating pensions, one-time retirement benefits, one-time social insurance, and one-time disability benefits…