LDG Investment JSC (LDG) recently reported on its bond principal and interest payments from January 1, 2024, to June 30, 2024. The company stated that no additional principal or interest payments were due during this period as the LDGH2123002 bonds had matured on December 10, 2023.

“However, for the outstanding debts, the Company has disclosed in the Report on Bond Principal and Interest Payment Situations in 2023 and the report on March 20, 2024. In addition, the Company is also working with bondholders to prepare for the payment of overdue debts in the future,” the report stated.

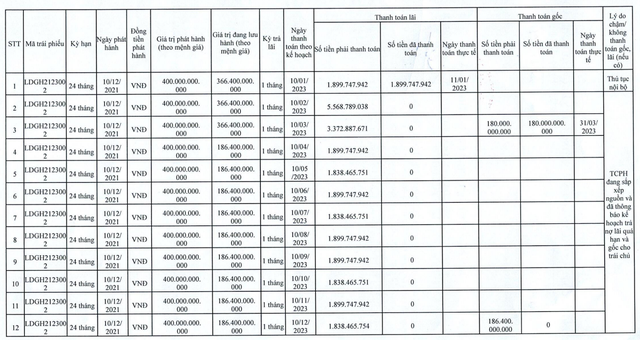

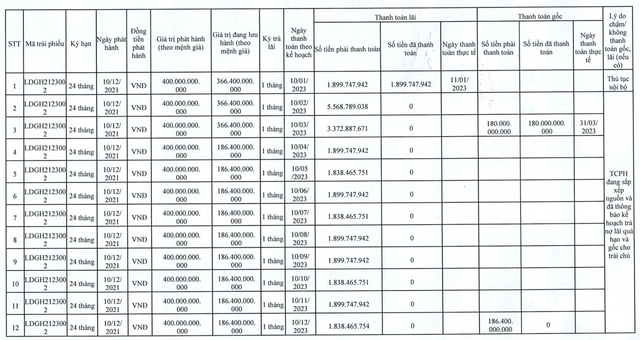

Thus, LDG’s outstanding bond principal and interest remain unchanged from the end of 2023. In the previously released report on the periodic bond principal and interest payment situation of LDGH2123002, LDG Investment had not paid 11 out of 12 interest payment periods, with outstanding interest amounting to nearly VND 26 billion. At the same time, the entire outstanding principal of over VND 186 billion that LDG had to pay to bondholders on December 10, 2023, remains unpaid up to now.

LDG Bond Interest and Principal Payment Report 2023

It is known that the LDGH2123002 bond issue was released on December 10, 2021, with a term of 24 months and a par value of VND 400 billion. The purpose of the issuance was to increase the scale of operating capital, with an interest rate of 11.5%/year for the first year, and interest paid monthly.

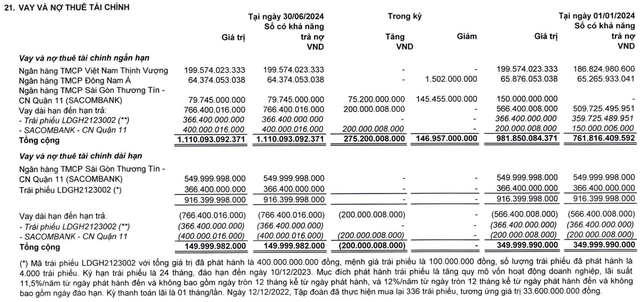

Notably, as of the end of Q2/2024, LDG’s total cash and cash equivalents stood at only VND 13.1 billion, while financial debt amounted to VND 1,260 billion, equivalent to 52% of total owners’ equity. This debt comprises mainly long-term loans due for repayment. Specifically, LDG Investment has a long-term loan of VND 400 billion due to Sacombank, VND 366.4 billion in LDGH2123002 bonds, and short-term borrowings of nearly VND 200 billion from Vietnam Prosperity Joint-Stock Commercial Bank and VND 80 billion from Sacombank.

LDG’s Q2/2024 Financial Statements

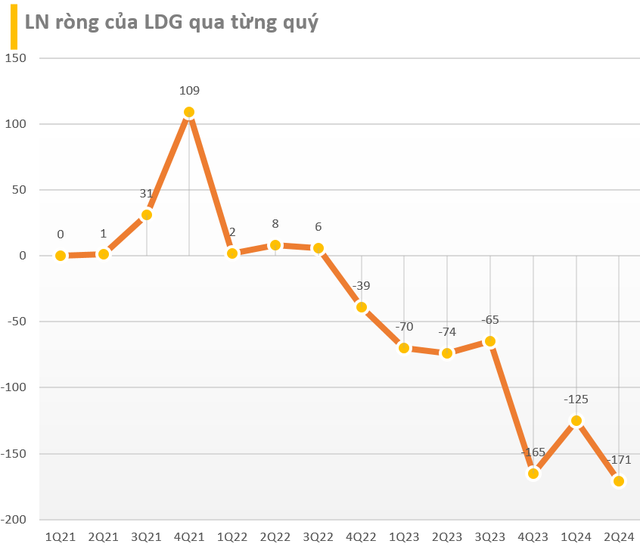

The company’s Q2/2024 business performance was rather lackluster. Revenue was negative at over VND 19 billion, compared to a positive figure of over VND 300 million in the same period last year. This negative revenue was mainly due to a reduction of VND 175 billion against recognized revenue of VND 156 billion. As a result, LDG incurred a gross loss of VND 96 billion from selling below cost.

Despite a reduction in expenses across the board, the company still posted a net loss of VND 171 billion in Q2/2024. This was also the highest loss the company had recorded since its inception.

For the first half of 2024, LDG Investment recorded a negative revenue of VND 149 billion and a net loss of VND 296 billion. This significant loss caused the company to shift from a cumulative profit of VND 121 billion at the beginning of the year to a cumulative loss of VND 175 billion as of the end of Q2/2024, effectively “wiping out” all the accumulated profits of previous years.

In the stock market, LDG shares have recently witnessed a series of consecutive floor price declines to historical lows before recovering in early August. Currently, LDG’s market price is trading below VND 2,000/share.

In a related development, on July 22, the People’s Court of Dong Nai province decided to initiate bankruptcy proceedings against LDG Investment JSC based on a request from Phuc Thuan Phat Trading and Construction JSC. However, on August 13, 2024, the Ho Chi Minh City High People’s Court decided to revoke the decision to initiate bankruptcy proceedings against LDG made by the People’s Court of Dong Nai province on July 22, 2024.

Additionally, the Ho Chi Minh City High People’s Court accepted the request to review the decision to initiate bankruptcy proceedings against LDG. The High Court’s decision also clarified that LDG’s debt to Phuc Thuan Phat Trading and Construction JSC is a debt for which the value and repayment method have not been agreed upon, and it does not indicate that LDG has lost its ability to pay; LDG’s operations are normal and stable.

LDG, for its part, argued that Phuc Thuan Phat’s request for the People’s Court of Dong Nai province to initiate bankruptcy proceedings against LDG had caused serious damage to the company, its shareholders, and customers.