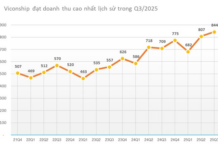

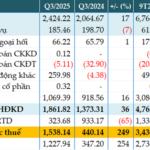

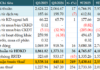

Mobile World Investment Corporation (MWG-HOSE) has announced its business results for the first seven months of 2024, with MWG’s revenue reaching VND 76,541 billion, a 15% increase compared to the same period in 2023, and completing 61% of the revenue plan (VND 125,000 billion).

According to MWG, in July alone, the revenue of The Gioi Di Dong (including Topzone) and Dien May Xanh was VND 7.2 trillion, a 5% increase compared to the same period last year, and a slight decrease from the previous month due to the off-peak season for air conditioners and the conclusion of the football event.

MWG stated that, with the advantage of operating a diverse product portfolio that meets varying needs and proactively implementing sales solutions that bring practical benefits to customers, the company recorded positive growth in some product categories entering their peak season, such as laptops and washing machines, in addition to the group of phones that have been maintaining a positive growth trend continuously for several months.

Online revenue for the first seven months reached nearly VND 6.3 trillion, accounting for 12% of the total revenue of both chains.

Regarding the Bach Hoa Xanh chain, cumulative results for the first seven months show a revenue of VND 23 trillion, a 40% increase compared to the same period last year.

In July, revenue exceeded VND 3.6 trillion, a nearly 28% increase compared to the same period last year and a slight increase from the previous month. Both fresh produce and FMCG categories maintained double-digit growth compared to July 2023. Notably, the average revenue per store in July reached VND 2.1 billion

As of the end of July, MWG operated 1,028 The Gioi Di Dong stores (including Topzone) – a reduction of 18 stores compared to the end of June. Similarly, the Dien May Xanh chain also decreased by 59 stores, resulting in a total of 2,034 stores. Meanwhile, the EraBlue chain in Indonesia witnessed a growth of 4 stores, reaching a total of 65.

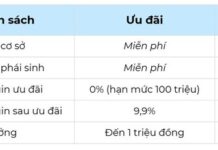

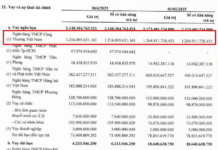

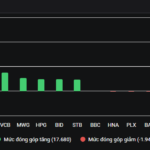

In the latest report by VCSC, they highlighted that the performance of The Gioi Di Dong and Dien May Xanh significantly outperformed the market, holding approximately 60% market share in ICT and around 50% in CE. Profit improvement was achieved through better negotiation with suppliers and support from brands. Additionally, restructuring efforts to streamline operations and close underperforming stores contributed to reduced operating expenses.

VCSC also provided insights into the outlook for the second half of 2024 for MWG, focusing on enhancing profit margins through optimizing product costs, introducing exclusive products, and controlling operating expenses. The plan to close unprofitable stores was completed in August 2024.

At the same time, VCSC shared their outlook for Bach Hoa Xanh in the latter half of the year. Accordingly, Bach Hoa Xanh is expected to turn profitable in Q3 and Q4 of 2024. The company will continue to concentrate on optimizing store and logistics costs to maintain and enhance profit margin improvement. The process of optimizing store costs has achieved 60%-70% of the target, while the optimization of distribution centers has generally met the company’s objectives.

Bach Hoa Xanh plans to open an additional 50-100 new stores in the second half of 2024. Approximately 50% of the recently opened stores have reached the breakeven point immediately after opening, and the remaining stores are expected to reach this milestone within three months.

VCSC noted that revenue per store in Ho Chi Minh City remains slightly higher than in other regions, with stores in the outskirts of Ho Chi Minh City achieving 80%-90% of the revenue recorded in the inner city. The company has restructured its online sales model from a centralized system to an integrated one at the store level, enhancing business efficiency and reducing costs.

Furthermore, Bach Hoa Xanh intends to increase capital investment in construction to expand the number of stores in 2025. However, the management has not finalized the detailed plan regarding the number of stores and their locations.

Regarding An Khang: As per VCSC, the restructuring plan is being implemented, and the company is focusing on closing inefficient stores, aiming to reach 300 stores by the end of 2024. Revenue per store reached VND 500 million in Q2 2024, with a breakeven target of VND 550 million per store per month.

As for Era Blue (Indonesia): Era Blue currently operates 61 stores in Indonesia, mainly focusing on mini and super mini store models. Monthly revenue per store is approximately VND 4.5 billion for mini stores and VND 2.5 billion for super mini stores, significantly higher than similar stores in Vietnam. However, the company has not turned a profit due to high initial and headquarter costs, structured to support over 100 stores. The goal for Q4 2024 is to reach the breakeven point. An initial public offering is being considered for 2027, depending on the company’s expansion plan to reach approximately 500 stores.