Vietfracht Joint Stock Company (VFR) has approved a resolution authorizing its subsidiary, Vietfracht Hanoi One-Member Limited Liability Company, to lend its idle funds to other companies to boost capital efficiency. The lending limit is set at VND 125 billion per contract, equivalent to 34% of VFR’s total assets as of Q2 2024, in the event of maximum lending by the subsidiary.

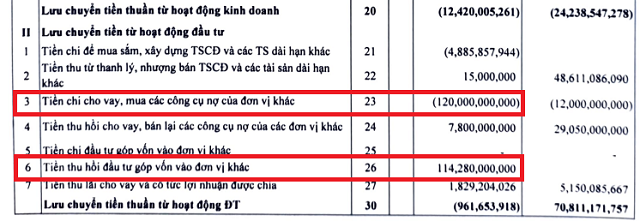

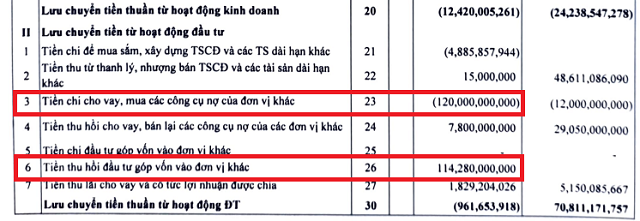

This resolution will further enhance VFR’s lending activities, which have already seen significant growth in the first half of 2024. As of Q2 2024, VFR reported short-term loan receivables of VND 141.45 billion, unchanged from the previous quarter and representing a VND 120 billion increase compared to the beginning of the year.

VFR’s asset structure underwent a shift in the first half of the year, with a significant increase in short-term loan receivables and a corresponding decrease in short-term financial investments. This change occurred due to VFR’s divestment of its entire 49% stake in Hankyu Hanshin Express Vietnam.

Source: VFR’s Consolidated Financial Statements for Q2 2024

|

The divestment deal was cited by VFR as the main reason for the significant growth in Q1 2024 net profit year-on-year, despite relatively ineffective core businesses, including sea transportation, freight forwarding, and real estate leasing.

| VFR’s Net Profit by Quarter for FY 2023 – 2024 |

In Q1 2024, VFR recorded a net profit of nearly VND 13 billion, compared to a loss of almost VND 450 million in the same period last year. In Q2 2024, VFR’s net profit decreased significantly by 91% year-on-year to nearly VND 6 billion due to the absence of large gains from the sale of two vessels, Blue Lotus and Thang Long, in Q2 2023.

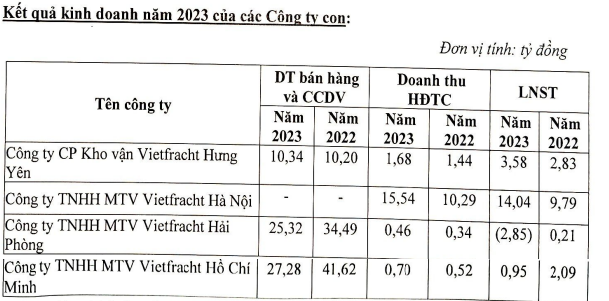

Vietfracht Hanoi is one of VFR’s four subsidiaries, alongside Vietfracht Hung Yen Joint Stock Company, Vietfracht Hai Phong One-Member Limited Liability Company, and Vietfracht Ho Chi Minh City One-Member Limited Liability Company. In 2023, Vietfracht Hanoi was the only subsidiary that did not generate revenue from sales and services, but it contributed the most to financial income with over VND 15.5 billion. After deductions, Vietfracht Hanoi recorded a post-tax profit of more than VND 14 billion, leading among the group of subsidiaries.

Source: VFR’s 2024 Annual General Meeting Resolution

|

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Declining profits at Bank increase in 2023

Throughout the year 2023, this bank achieved a pre-tax profit of over 928 billion VND, a decrease of 16.2% compared to 2022 and only 73% of the set plan was accomplished.