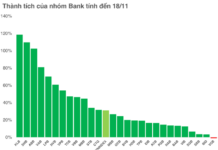

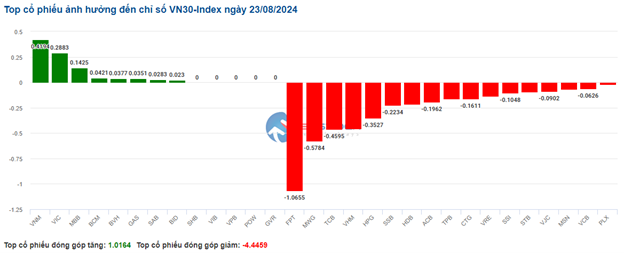

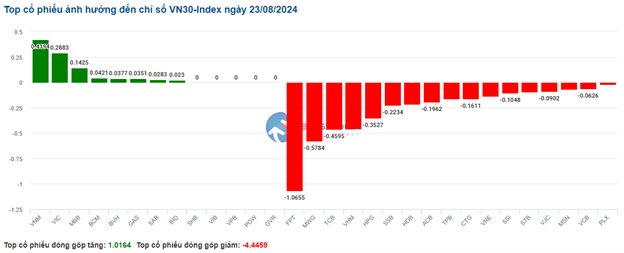

Stocks within the VN30 basket were mixed, but sellers slightly edged out buyers. Specifically, FPT, MWG, TCB, and VHM respectively took away 1.07 points, 0.58 points, 0.46 points, and 0.45 points from the overall index. Conversely, VNM, VIC, MBB, and BCM maintained their positive momentum, contributing almost 1 point to the VN30-Index.

Source: VietstockFinance

|

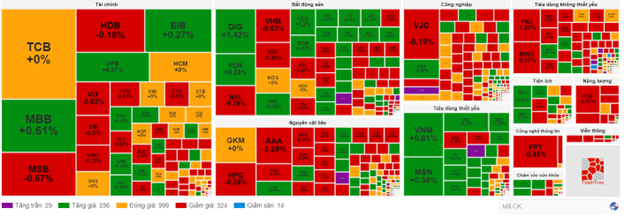

Telecom service stocks experienced the sharpest decline of 1.17%. Selling pressure was concentrated on VGI, down 1.44%; ELC, down 1.02%; YEG, down 2.06%; and FOX, down 1.17%.

Meanwhile, the financial sector exhibited mixed performance, with red dominating and exerting the most significant pressure on the main index. On the selling side, bank codes saw TCB drop by 0.22%, MSB by 0.67%, HDB by 0.37%, and TPB by 0.83%. Conversely, a few codes remained in the green, including MBB, up 0.61%; EIB, up 0.27%; and LPB, up 0.16%…

On a more positive note, essential consumer goods and utility services were the only two sectors that maintained their upward trajectory since the opening bell, rising 0.16% and 0.14%, respectively. Within essential consumer goods, the presence of two giants stood out: VNM, up 0.67%, and MSN, up 0.13%. As for utility services, GAS climbed 0.47%, POW rose 0.37%, and REE inched up by 0.14%…

Compared to the opening, sellers held a stronger position. There were 324 declining codes versus 236 advancing ones.

Source: VietstockFinance

|

Opening: Maintaining a Light Green Hue

As of 9:40 am on August 23, VN-Index had gained over 2 points to reach 1,285.6 points. Likewise, HNX-Index edged up slightly to 238.88 points.

A slight majority of 13 stocks within the VN30 basket advanced, compared to 12 declining and 5 stagnant ones. Notably, several pillar stocks witnessed positive momentum right from the beginning, including BCM, up 1.81%; VNM, up 1.21%; MBB, up 0.61%; and MSN, up 0.51%…

Large-cap stocks like VNM, GAS, and BCM propelled the market higher, contributing almost 1.5 points to the index. Conversely, VCB, FPT, and DGC led the group with a negative impact on the market, but their collective loss fell short of 0.5 points.

The real estate sector sustained stable growth from the get-go, propelled by stocks such as BCM, up 1.94%; VRE, up 0.51%; VIC, up 0.6%; and IDC, up 0.5%… Conversely, other stocks in the sector, including VHM, DIG, PDR, DXG, and HDG, displayed a mild decline of less than 1%.

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.

Lunar New Year Fair: Gathering Iconic Delicacies from All Three Regions

The Spring Fair of the Year of the Horse 2024 brings together over 100 booths and more than 1000m2 of exhibition space showcasing a wide variety of specialty products from 20 provinces and cities across the country. With a focus on promoting local products and fostering economic development, this fair is a must-visit event for those seeking unique and high-quality goods. Whether you’re in search of traditional crafts, delicious local delicacies, or stylish fashion items, you’ll find it all at the Spring Fair of the Year of the Horse 2024. Get ready to indulge in a shopping experience like no other, where you can discover the treasures of different regions and support local businesses in one vibrant and bustling venue. Mark your calendar and join us for a celebration of culture, creativity, and commerce at the Spring Fair of the Year of the Horse 2024.