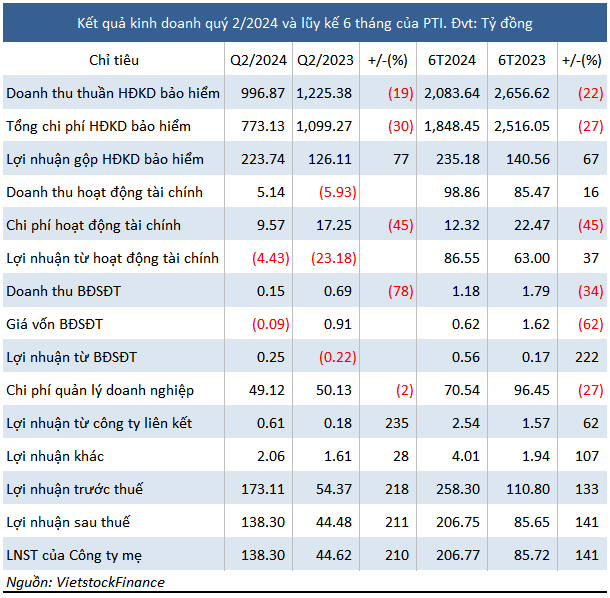

Source: VietstockFinance

|

In Q2 2024, PTI’s net revenue from insurance business decreased by 19% year-on-year to VND 997 billion, mainly due to a decrease in both original insurance premiums (VND 966 billion) and reinsurance premiums (VND 26 billion) by 24% and 39%, respectively.

However, insurance business expenses decreased by a larger percentage than insurance premiums, down 30% year-on-year to over VND 773 billion, mainly due to a 60% decrease in other expenses to VND 253 billion. As a result, gross profit from insurance business increased by 77% year-on-year to nearly VND 224 billion.

Despite a financial loss of more than VND 4 billion, PTI’s net profit was still 3.1 times higher than that of the same period last year, reaching over VND 138 billion.

| PTI’s Insurance and Financial Business Profit in 6M/2024 |

|

|

In the first six months of the year, PTI’s net profit was nearly VND 207 billion, 2.4 times higher than that of the same period last year. The company’s profit increase was driven by a 67% and 37% growth in gross profit from insurance and financial businesses, respectively, reaching over VND 235 billion and VND 87 billion.

| PTI’s Net Profit in the First Half of 2024 |

|

|

In 2024, PTI aims to achieve VND 5,353 billion in insurance business revenue and over VND 279 billion in financial business revenue, an increase of 10% and 3%, respectively, compared to 2023. However, the company expects a post-tax profit of VND 175 billion, a 31% decrease.

Compared to the conservative profit plan, this non-life insurance company has exceeded its target by 18% in the first six months.

As of June 30, 2024, PTI’s total assets decreased by more than 3% from the beginning of the year to VND 7,946 billion. The decrease in assets was mainly due to a 19% decrease in short-term receivables from customers to over VND 384 billion.

The majority of PTI’s assets are in bank deposits, valued at nearly VND 3,961 billion, an increase of over VND 691 billion, or 21%, from the beginning of the year.