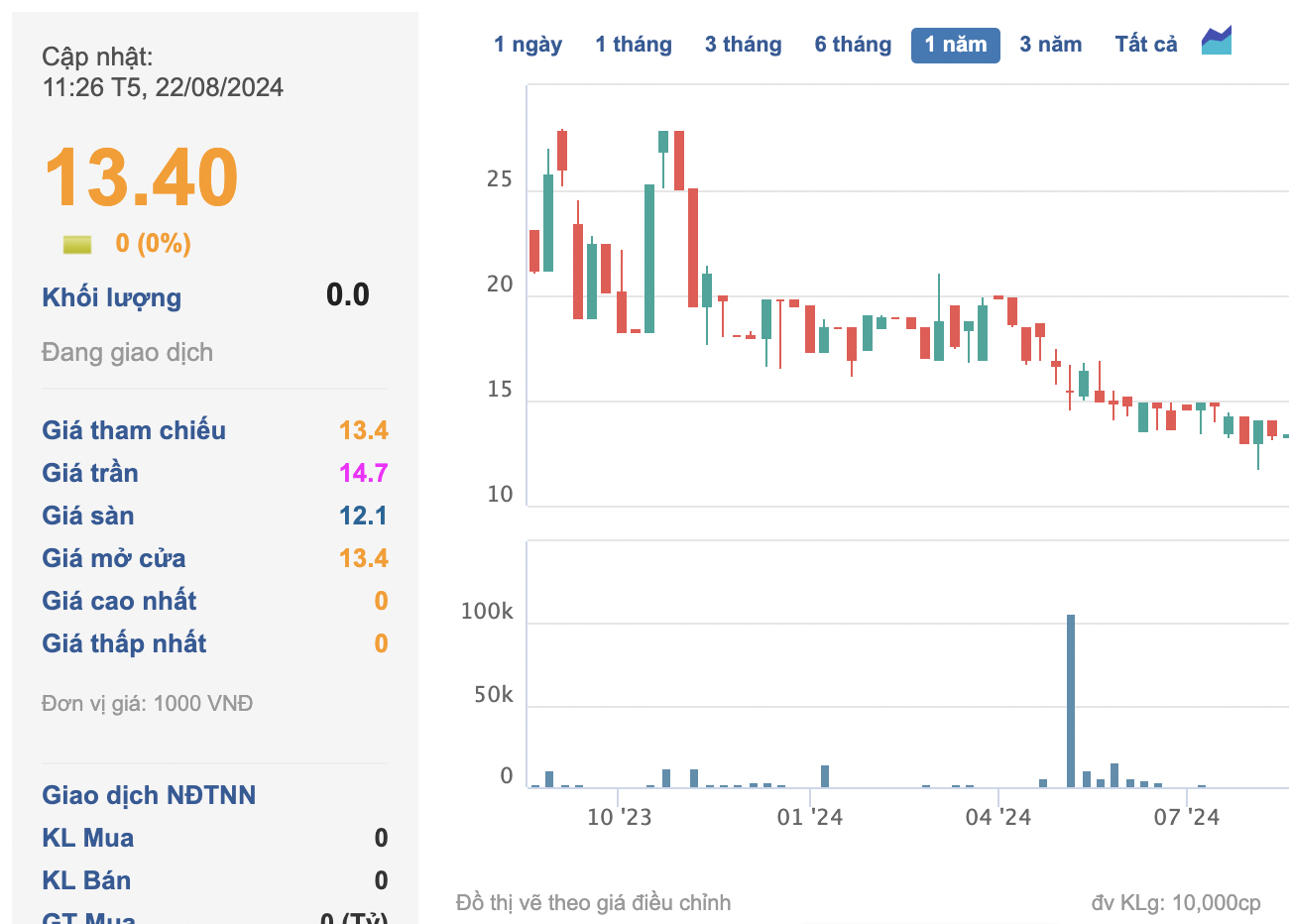

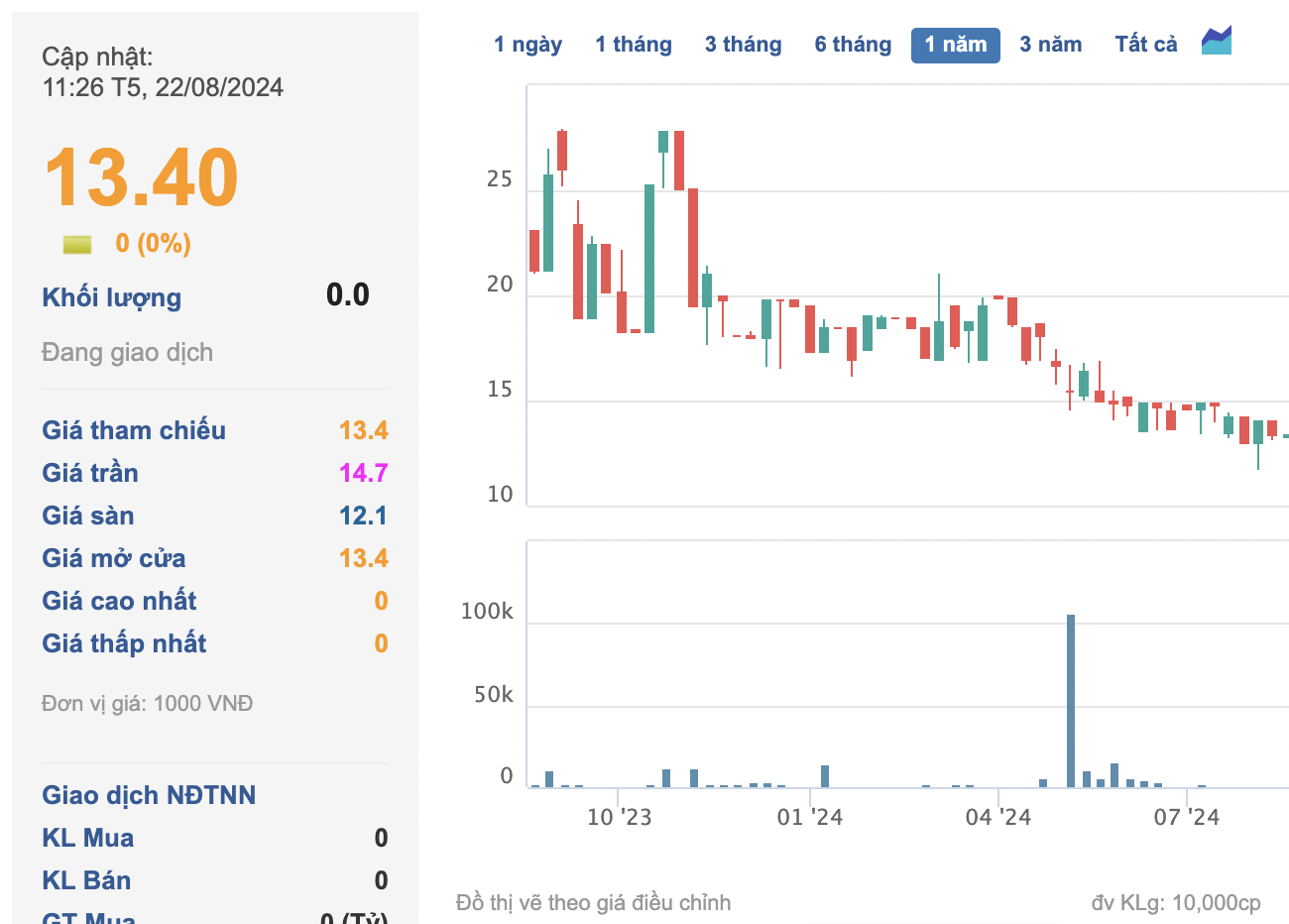

The Hanoi Stock Exchange (HNX) has recently announced the addition of VLA shares of Van Lang Technology Investment and Development JSC to the list of stocks not permitted for margin trading. This decision took effect on August 21, 2024, due to the company’s negative post-tax profit for the first six months and undistributed post-tax profit as of June 30, 2024.

In terms of business performance, the company incurred a loss of over VND 5 billion in the second quarter of 2024. For the first six months of the year, the company reported a 73.5% year-on-year decrease in revenue to VND 2.3 billion. The company attributed this decline to a significant reduction in the number of students enrolling in their courses. After deducting expenses, the company posted a loss of nearly VND 7 billion.

Previously, in 2023, Van Lang experienced a 70% drop in revenue, amounting to only VND 11.2 billion. After expenses, the company barely managed a post-tax profit of VND 137 million.

Formerly a subsidiary of the Vietnam Education Publishing House, Van Lang Technology Investment and Development JSC was established on November 15, 2007, according to Decision No. 1338/QD-TCNS. In its early years, the company focused on traditional publishing, printing, and distributing books, as well as trading in computers and educational equipment.

However, in 2020, with the leadership of Nguyen Thanh Tien, a renowned wealth coach and the company’s chairman, Van Lang began transitioning towards offering training programs in various fields, including critical thinking, sales, communication, leadership, financial management, time management, and public speaking.

As of late 2023, Mr. Tien holds a 9.08% stake in Van Lang.

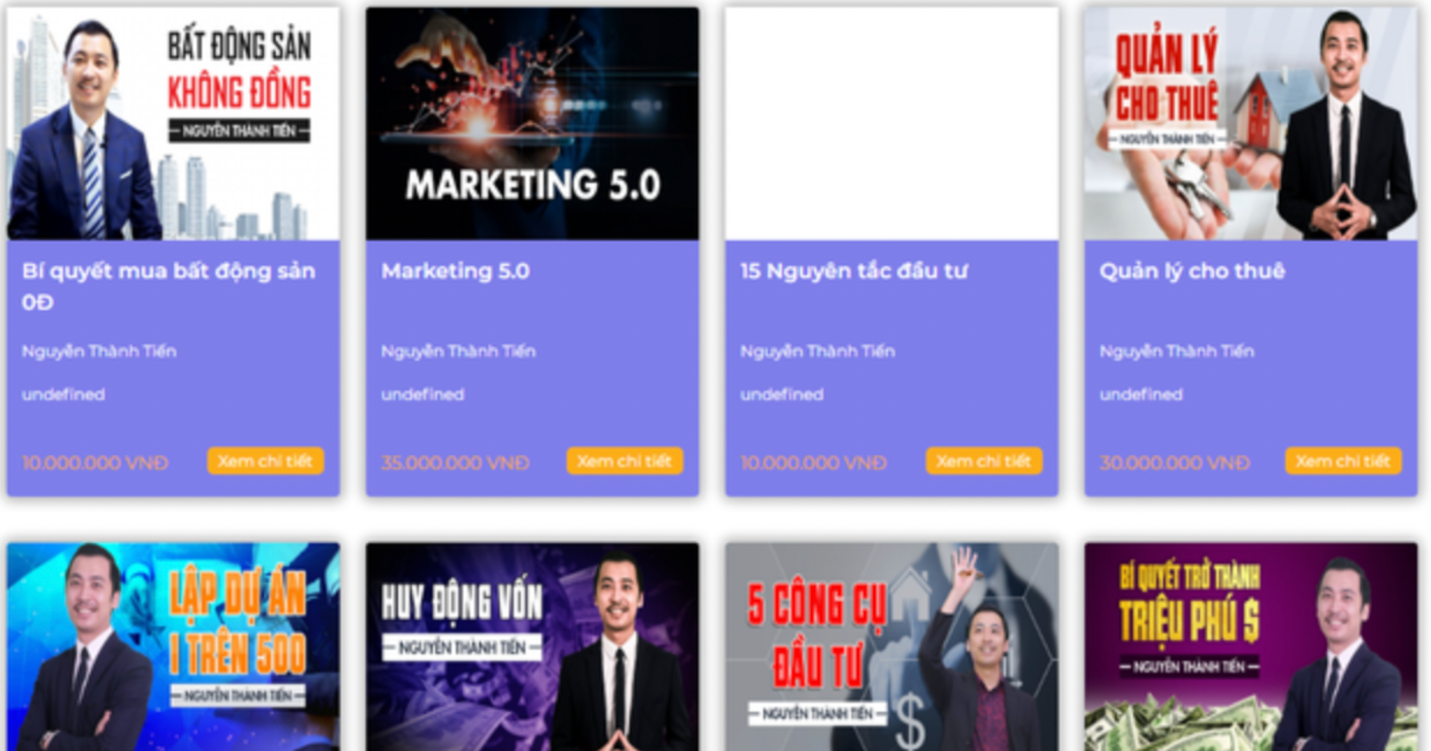

Mr. Tien is a well-known speaker and the owner of a YouTube channel with 179,000 subscribers. The investment courses offered by Van Lang in 2023 under his guidance included topics such as investment strategies, investment intelligence 5.0, effective capital mobilization secrets, and business intelligence.

Mr. Tien is also recognized as a speaker for numerous investment strategy, sales, and real estate negotiation courses, with 1.2 million followers. Despite his significant following, the company he leads, Van Lang, has yet to achieve notable success in this field.

For instance, in 2022, Van Lang made a significant investment in real estate by purchasing a hotel in Quang Ninh for VND 18 billion. However, they encountered challenges in transferring the ownership of the property and faced difficulties due to the impact on the hotel industry. As a result, the Board of Directors proposed a resolution to terminate the hotel purchase contract, recover the investment, and handle compensation procedures accordingly.

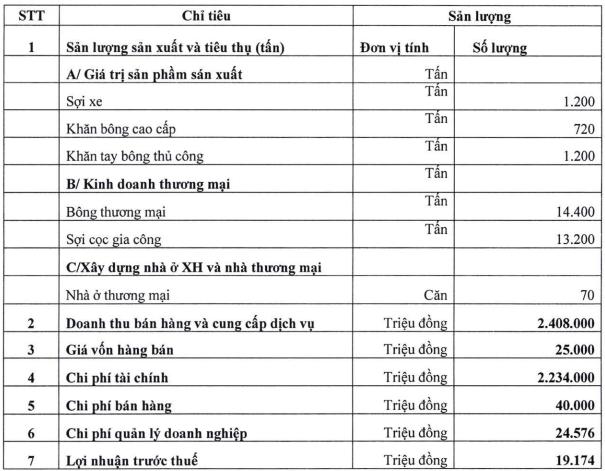

In 2024, besides maintaining its focus on training programs and expanding its course offerings, the company aimed to intensify its efforts in real estate investment, the stock market, and other services to boost revenue. Accordingly, they set a target of VND 20 billion in revenue and VND 3 billion in post-tax profit, with a projected dividend of 4% of charter capital for 2023.