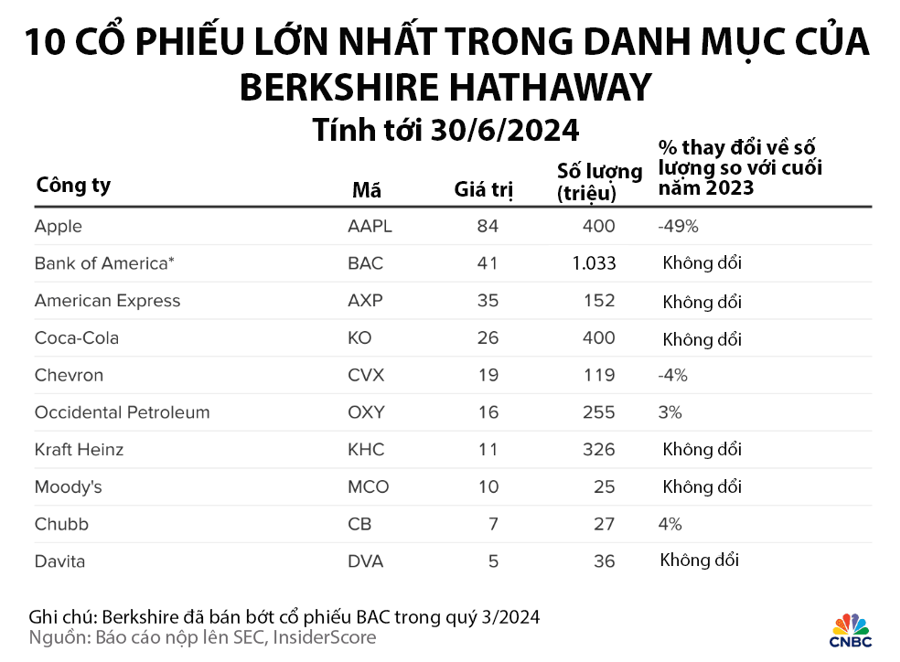

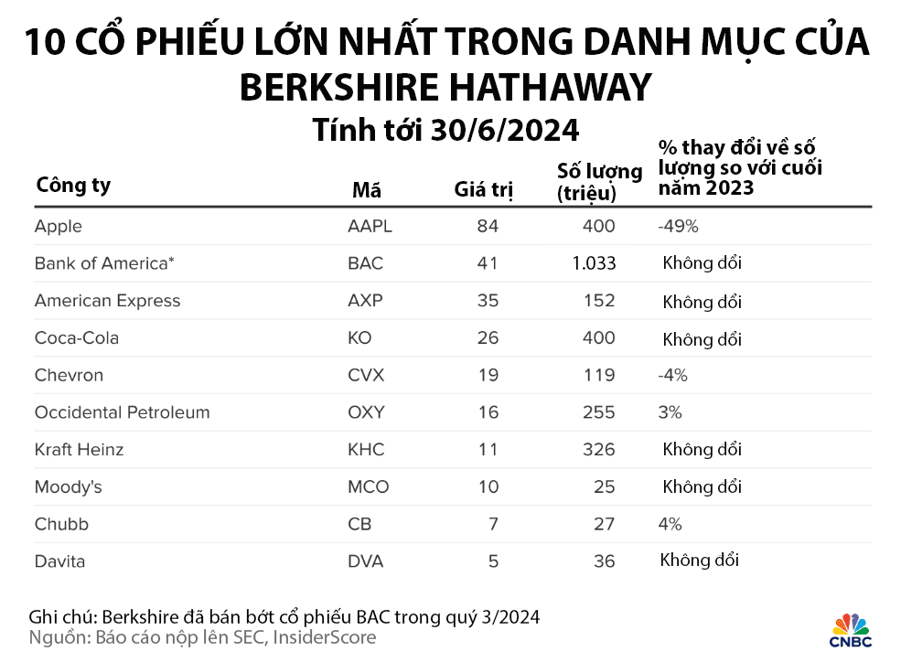

A recent 13F filing with the SEC has revealed an interesting development regarding Warren Buffett’s Berkshire Hathaway. As of Q2 2024, the company now holds an equal number of shares in Apple and Coca-Cola, with 400 million shares each.

This balance has been achieved after a series of sales that halved Berkshire’s Apple holdings from last year.

The question on many minds is whether this is a mere coincidence or a deliberate strategy by the legendary investor.

Regardless, experts believe that Berkshire has concluded its reduction in Apple stock.

“If Buffett favors round numbers, he might not sell more Apple shares,” said David Kass, a finance professor at the Robert H. Smith School of Business, University of Maryland. “Since Coca-Cola is almost a ‘forever’ holding for him, having an equal number of shares in both companies suggests that Apple is, too.”

The 93-year-old investor first bought Coca-Cola stock in 1988, acquiring 14,172,500 shares. By 1994, this number had grown to 100 million. With Coca-Cola’s 2:1 stock splits in 2006 and 2012, Berkshire now holds 400 million shares, a nice round number that Buffett has maintained for 30 years.

Buffett shared that his fascination with the beverage brand began when he was just six years old. In 1936, he started buying Coca-Cola six-packs for 25 cents each from his family’s grocery store and reselling them for a nickel more. He recognized even then the “extraordinary consumer appeal and commercial moorings” of the drink.

Berkshire’s investment in Apple follows Buffett’s value investing principles, treating Apple stock as a consumer staple (like Coca-Cola) rather than a technology investment. He often praises the iPhone’s loyal customer base and believes people would give up their cars before their smartphones. He even referred to Apple as Berkshire’s second-most important business, after insurance.

Hence, it came as a shock when Berkshire sold off nearly 50% of its Apple holdings in just two quarters. Analysts speculate that this could be part of a portfolio restructuring or a broader market view, rather than a reflection on Apple’s future prospects. Apple’s weight in Berkshire’s portfolio has decreased from nearly 50% at the end of last year to around 30% now.

The neat figure of 400 million shares suggests that this is Buffett’s sweet spot for companies he highly regards and intends to hold for the long term.

At Berkshire’s shareholder meeting in May, the billionaire compared Apple and Coca-Cola stocks and asserted that their holding period was “forever.”

“We own Coca-Cola, a fantastic company. We own Apple, an even more fantastic company. And we’re going to own them forever, unless something drastic happens.”