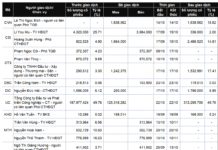

NovaGroup has just registered to sell 3 million shares of No Va Real Estate Investment Corporation (Novaland – code NVL) to balance investments and support debt restructuring. The transaction is expected to be executed by matching and/or agreement from August 27 to September 6.

If successful, NovaGroup will reduce its ownership in Novaland from 346.9 million shares (17.8%) to 343.9 million shares (17.6%). Since the beginning of the year, this shareholder has sold more than 33 million shares on a net basis, including shares pledged by securities companies.

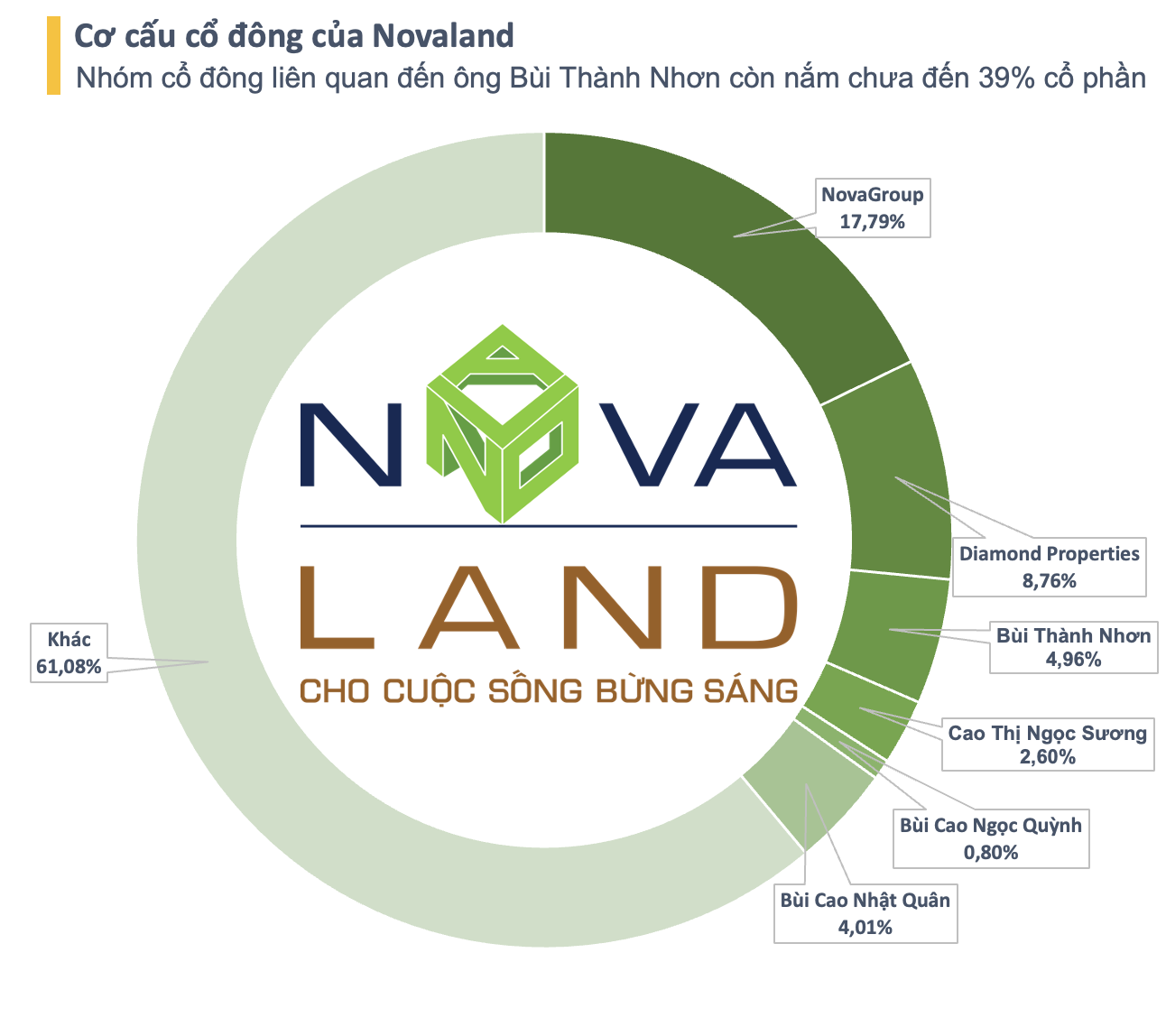

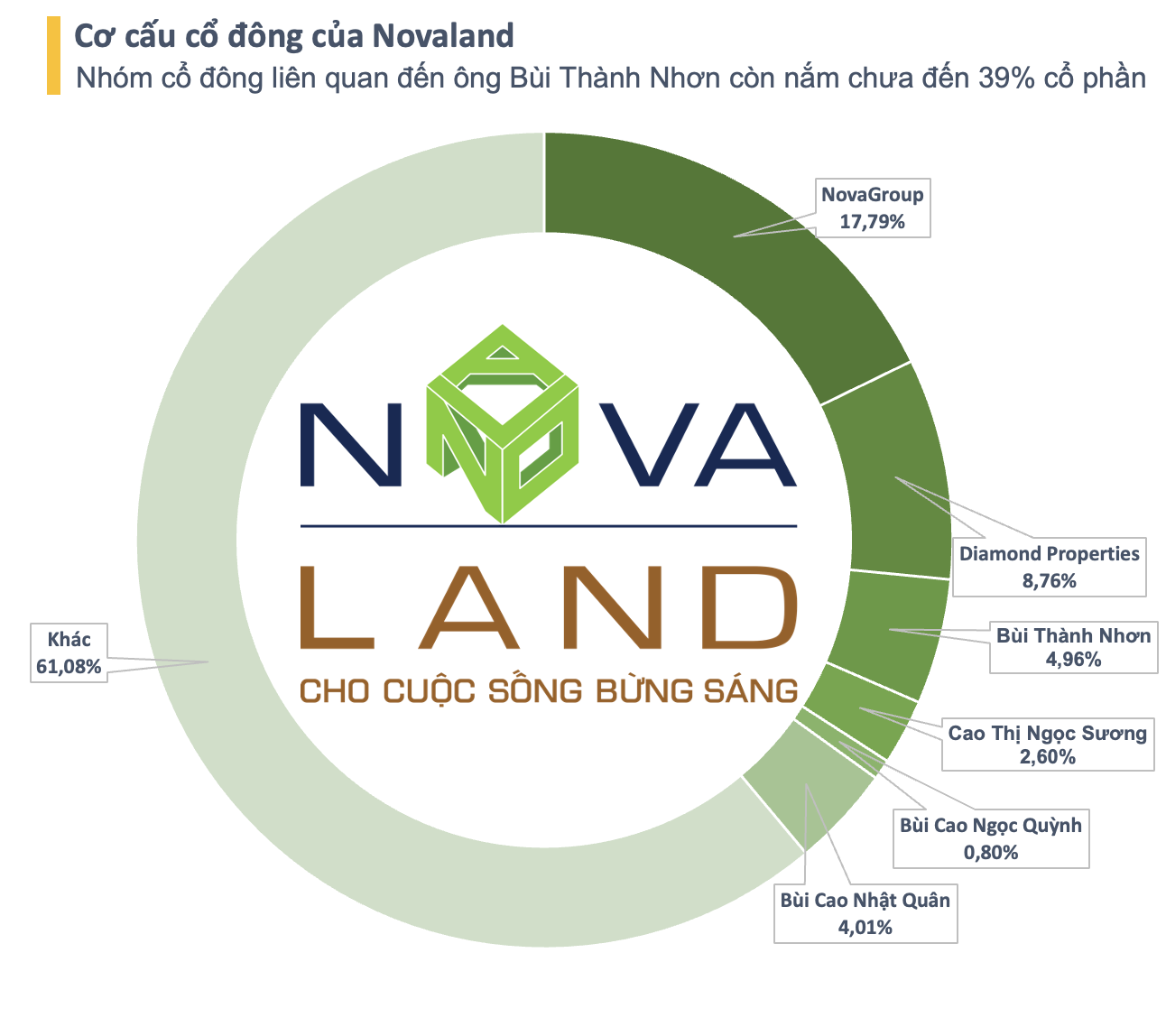

NovaGroup is currently the largest shareholder in Novaland and is related to Mr. Bui Thanh Nhon – Chairman of Novaland’s Board of Directors. Mr. Nhon currently holds nearly 96.8 million NVL shares (4.96%).

Another organization related to Mr. Nhon, Diamond Properties, was recently forced to sell more than 2 million pledged shares on July 16. After the transaction, this shareholder still holds nearly 169 million NVL shares, corresponding to an ownership rate of 8.7%.

Up to now, the group of shareholders related to Mr. Nhon holds a total of less than 39% of Novaland’s capital. This number will decrease further if NovaGroup completes the registered transaction.

With the proactive sale of shares to support debt restructuring and the unceasing forced sale, the ownership rate of the group of shareholders related to the Chairman of Novaland is getting closer to the “red line” of 36% – the threshold for the right to veto.

In the market, NVL shares are recovering from historical lows. At the end of the session on August 22, NVL’s market price stood at 12,900 VND/share, up 17% from the bottom but still 24% lower than at the beginning of 2024. The corresponding market capitalization is approximately VND 25,000 billion (USD 1 billion).

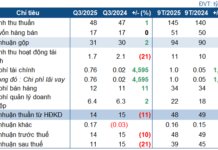

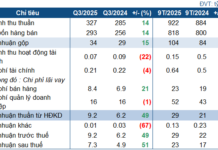

In terms of business results for Q2 2024, Novaland recorded a net profit of VND 941 billion, a sharp increase from a loss of VND 634 billion in the same period last year. This is the highest profit the company has achieved in the past 9 quarters, despite revenue of only VND 1,549 billion.

The main reason for Novaland’s large profit in the last quarter was thanks to financial revenue. Specifically, the company’s financial revenue reached VND 3,951 billion, more than 5 times higher than the same period last year. This item increased thanks to profits from cooperation investment contracts, which amounted to VND 2,885 billion.

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.