The Rise of Phuc Sinh’s Coffee Empire

Entrepreneur Phan Minh Thong and Phuc Sinh made their mark in 2007 as the ‘King of Pepper’ in Vietnam, but their journey began in 2001. Today, after 23 years of hard work, Phuc Sinh is Vietnam’s top pepper exporter, claiming 8% of the global pepper export market share. Their green pepper sauce and freeze-dried pepper products alone account for 40% of the global market share.

It wasn’t until 2010 that Phuc Sinh took coffee seriously, constructing a coffee bean processing plant and an export-oriented coffee roasting and grinding facility in Binh Duong with an annual capacity of 1,000 tons. In 2014, they expanded further by building another complex in Dak Lak with a capacity of 10 tons of green pepper per month, 10,000 tons of fresh coffee per year, and 20 tons of flat pepper per month.

In 2017, Phuc Sinh invested 100 billion VND in the construction of Phuc Sinh Son La, a 45-hectare facility with an annual capacity of 20,000 tons of fresh coffee. Recently, Phuc Sinh Son La announced an additional investment of 100 billion VND in a new factory to produce cascara, a tea made from coffee fruit shells.

The company has made significant investments in sustainability certifications. In 2014, Phuc Sinh became the first spice company in Vietnam to receive the Rainforest Alliance (RA) certification for sustainable agriculture. Currently, they hold around 20 sustainability certifications, including RA, for their spice, agricultural, and coffee-growing regions. Their coffee products also boast UTZ and BRC certifications.

Regarding their growing regions, Phuc Sinh previously shared on their website that they are linked to approximately 10,000 farming households cultivating 1,700 hectares of Robusta coffee and nearly 1,000 hectares of Arabica, mainly in the provinces where their factories are located: Dak Lak (Buon Ho Town) and Son La (Son La City and Mai Son District).

Mr. Phan Minh Thong with products from the Blue Son La and K Coffee brands.

“The company has partnered with 33 farming households in Son La to supply 330 tons of ripe coffee fruit. The technology we’ve invested in requires 10kg of fresh coffee to produce 2kg of coffee beans and 1kg of cascara tea. After discarding low-quality fruits, Blue Son La’s current cascara production is around 20 tons per year,” said Vu Viet Thang, CEO of Phuc Sinh Son La, during the launch of Blue Son La’s cascara tea.

In the B2B wholesale market, Phuc Sinh sells Robusta, Arabia, Excelsa (jackfruit coffee), and specialty coffee beans worldwide. In the retail market, they have two brands: Blue Son La and K Coffee, along with the K Coffee café chain.

In 2023, Phuc Sinh Comsumer signed a cooperation agreement with LNS International Corporation to promote the distribution of K Coffee products in the US, Europe, Australia, New Zealand, and Japan.

To penetrate foreign distribution channels, Phuc Sinh partnered with companies to place K Coffee products in supermarkets and food stores in the US since 2022. The products are also available on Amazon, Walmart, and Faire e-commerce platforms.

In the domestic market, Phuc Sinh Comsumer sells Blue Son La and K Coffee products through two self-built channels: the website kphucsinh.com and the K Coffee café chain. They also collaborate with MT and GT channels and leading e-commerce platforms in Vietnam.

Phuc Sinh prioritizes communication about their Son La growing region because they use the Arabica coffee beans from this region to build their premium brand, Blue Son La, while the K Coffee brand is more affordable and can use both Arabica and Robusta coffee beans from Son La and Dak Lak.

A training session for farming households in Son La by Phuc Sinh Son La.

Son La is currently the largest producer of Arabica coffee in Northern Vietnam and the second-largest in the country, after Lam Dong. Coffee is a key agricultural product for Son La, with 20,000 hectares of land dedicated to its cultivation and an annual yield of approximately 400,000 tons of fresh fruit. Phuc Sinh exports between 60,000 and 80,000 tons of coffee beans annually, including around 8,000 tons of Arabica coffee from Son La, showcasing the region’s significant contribution.

Ambition vs. Reality: How Far Is the Goal?

Intimex Group is the true “King of Coffee” in Vietnam when considering all aspects.

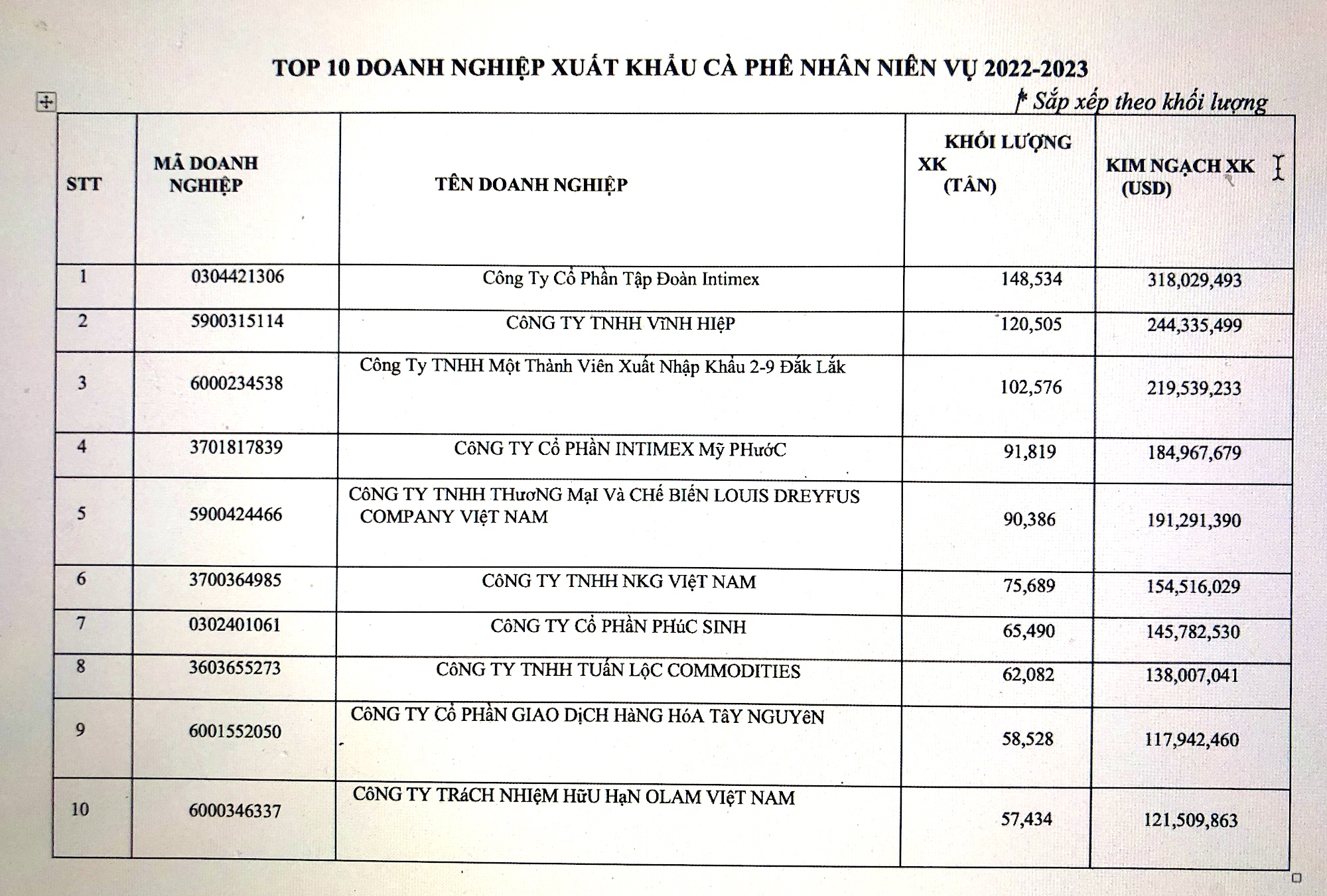

According to Intimex’s 2024 Annual General Meeting documents, in 2023, the group’s export volume of agricultural products decreased for most commodities compared to 2022, except for cashew nuts. However, coffee maintained its market share in Vietnam at 21.4%, retaining its top position in coffee exports for the year.

According to the Vietnam Coffee and Cocoa Association (VICOFA), in the 2022-2023 crop year (from October 2022 to September 2023), Intimex led the way in exporting coffee beans from Vietnam, with a volume of over 148,500 tons, valued at more than 318 million USD (nearly 8,000 billion VND). Their instant coffee factory achieved and exceeded its capacity of 3,500 tons per year, with exports reaching nearly 1,000 tons.

Intimex Group currently owns 13 coffee bean processing plants with a total production capacity of 750,000 tons per year and one instant coffee factory with a capacity of 4,000 tons per year, as per their website.

However, due to their focus on exports and B2B sales, Intimex is not a household name. On the other hand, Trung Nguyen, which operates in both B2B and B2C markets and actively engages in marketing and PR, has earned the title of ‘King of Coffee.’ They have two main segments: exporting roasted and ground coffee and selling instant coffee under the G7, Trung Nguyen Legend, and E-Coffee brands.

According to Vietdata, in 2022, Trung Nguyen Legend generated nearly VND 6,200 billion in revenue and nearly VND 435 billion in after-tax profit. Their total export turnover for the year exceeded USD 100 million (over VND 2,300 billion).

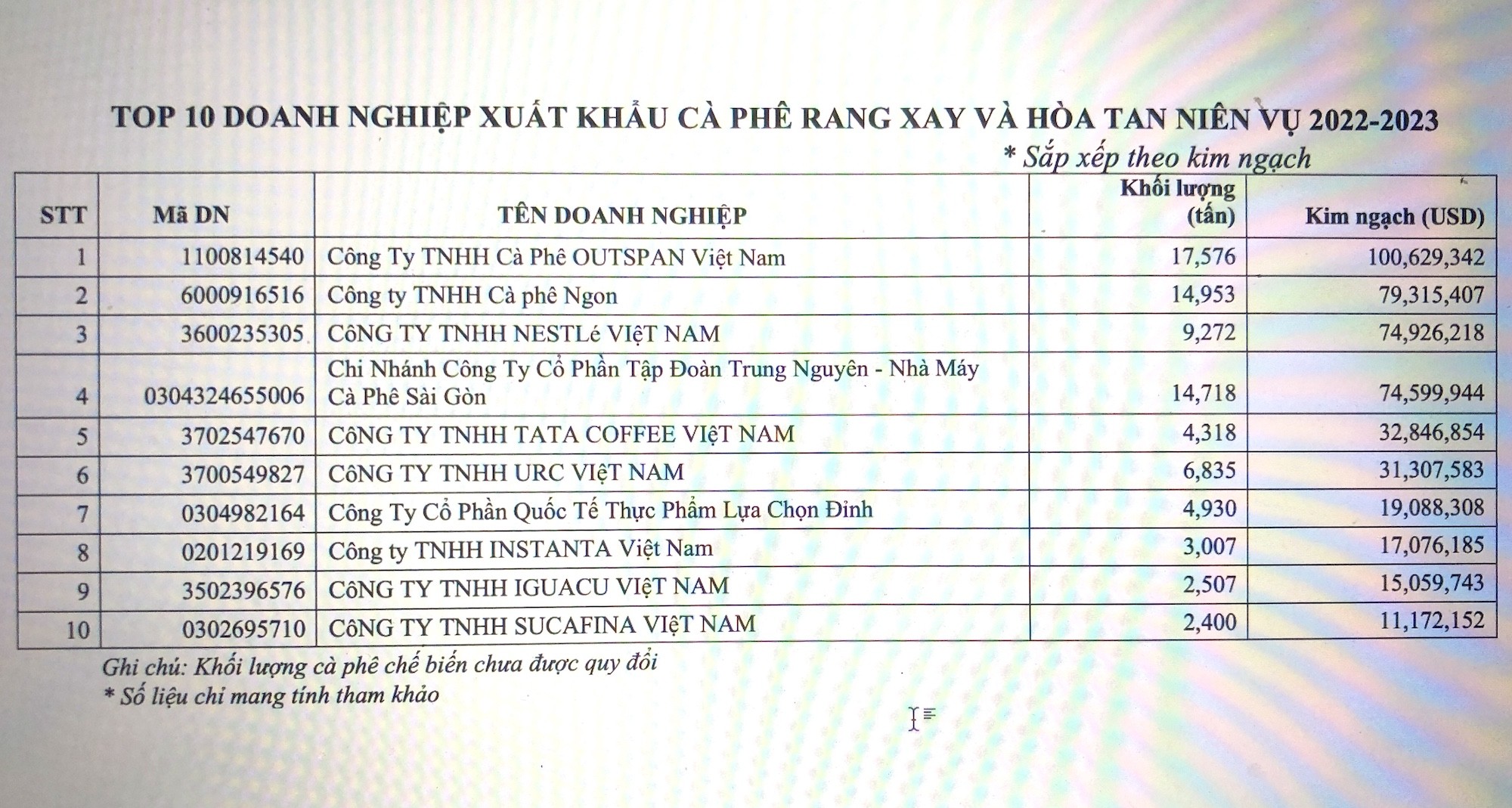

In terms of exports, Trung Nguyen consistently ranks first among Vietnamese enterprises for instant coffee and typically places fourth in the top 10 for coffee exports. During the 2022-2023 crop year, they exported 14,718 tons of coffee worth USD 74.6 million. In the domestic instant coffee market, Vinacafe, Trung Nguyen, and Nestlé are the top three players.

Trung Nguyen Legend is opening about 10 stores in the US and China.

Regarding their café chain scale, Trung Nguyen and E-Coffee have nearly 800 stores across Vietnam, and Trung Nguyen Legend has about 10 stores in the two largest markets in the world: China and the US.

According to Phan Minh Thong, Phuc Sinh’s annual export sales reach USD 300 million (equivalent to VND 7,062 billion), with coffee accounting for the largest share at 60%, followed by pepper at 30%, and tea at 10%. VICOFA data shows that Phuc Sinh typically ranks seventh among the top 10 coffee exporters in Vietnam. In the 2022-2023 crop year, they exported 65,490 tons of coffee beans worth USD 145.8 million.

In terms of café chain scale, K Coffee has about 50 stores in Vietnam and generated VND 100 billion in revenue in the first half of the year. However, Phuc Sinh claims to be among the top four coffee exporters in Vietnam, possibly including their instant coffee and roasted coffee exports under the Blue Son La and K Coffee brands.

Mr. Phan Minh Thong, CEO of Phuc Sinh.

“We are one of Vietnam’s leading coffee exporters. While our export volume may be lower, our sales are substantial. In fact, when it comes to total sales, we are double or even multiple times larger than other companies in the industry,” asserted Phan Minh Thong, CEO of Phuc Sinh.

Considering their overall strengths, Phuc Sinh and Trung Nguyen are on relatively equal footing. However, each has its own advantages in the coffee sector. Phuc Sinh excels in wholesale raw material exports, while Trung Nguyen shines in processed product exports. In terms of café chains, Trung Nguyen has the upper hand thanks to their more extensive experience.

It’s no surprise that Phuc Sinh aims to catch up with Trung Nguyen rather than Intimex. Export-oriented B2B sales are less likely to yield explosive growth, whereas retail and brand building can achieve this. This is the strategy adopted by global giants like Starbucks and Nike.

According to Phan Minh Thong, his company has faced challenges in getting fair valuations from investors over the past decade, which may have prompted their shift in focus.

Opportunities for Phuc Sinh to Overtake Trung Nguyen

After years of dedication to ESG, marketing, PR, developing growing regions, and venturing into retail, Phuc Sinh has finally gained recognition from European investors. Recently, they secured an investment from the Dutch fund &Green, with a total disbursement and planned funding of up to USD 25 million (over VND 600 billion). This is &Green’s first investment in a Vietnamese company.

“After &Green, in the third week of September, we will hold another press conference to announce an investment deal with another ESG development fund. This is a significant victory and a testament to Phuc Sinh’s successful long-term strategy.

Additionally, we are in discussions with another European fund. So, hopefully, we will receive funding from three funds this year, not just one,” shared entrepreneur Phan Minh Thong.

The funds received in 2024 will be used to replace outdated machinery in existing factories, build another coffee factory in Dak Nong, purchase additional land for future factory construction, invest in human resources, management, and software, and pursue various production standards with thousands of farming households.

“I believe there is still room for growth in the café chain market, despite the comings and goings of many players. Unfortunately, many are operating at a loss, and even newcomers with high-quality products are missing the mark by not following market trends.

For instance, new chains focus solely on product innovation without establishing connections with growing regions, which goes against global and local market trends.

With support from our parent company, partners, and access to raw materials, Phuc Sinh Consumer aims to become the number one player in the high-quality product segment in the domestic market within three to five years. We will also focus on exporting value-added coffee products, such as instant coffee, specialty coffee, and cascara tea…

Phuc Sinh also plans to go public within the next four years, aiming for a revenue target of USD 510 million,” expressed Phan Minh Thong.

With substantial capital and their development strategy, Phuc Sinh could surpass Trung Nguyen in terms of coffee sales or trading volume within three years. However, they still have a long way to go regarding their café chain.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.