Illustration

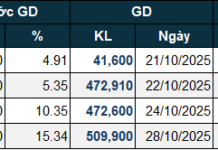

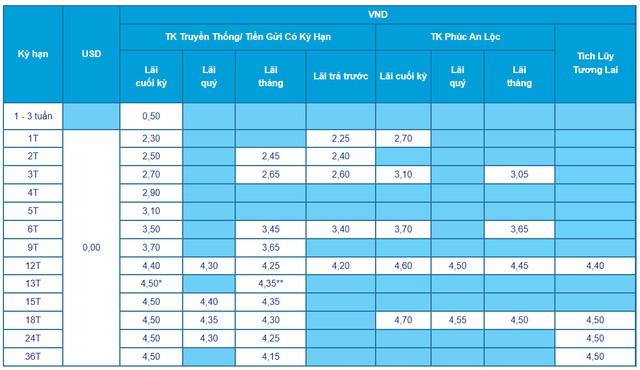

ACB’s Deposit Interest Rates for Over-the-Counter Deposits in August 2024

The latest survey shows that the interest rates for over-the-counter deposits at Asia Commercial Joint Stock Bank (ACB) for regular customers, with interest payable at maturity, range from 0.5% to 4.5% per annum.

Specifically, the lowest interest rate of 0.5% per annum applies to tenors of 1-3 weeks; tenor of 1 month has an interest rate of 2.3% per annum; tenor of 2 months is 2.5% per annum; tenor of 3 months is 2.7% per annum; tenor of 4 months is 2.9% per annum; tenor of 5 months is 3.1% per annum; tenor of 6 months is 3.5% per annum; tenor of 9 months is 3.7% per annum; tenor of 12 months is 4.4% per annum.

ACB offers an interest rate of 4.5% per annum for tenors of 13-36 months. Especially for the 13-month tenor, when customers deposit from 200 billion VND or more, they will receive a preferential interest rate of 5.9% per annum.

For non-term deposits, the interest rate is set at 0.01% per annum

ACB’s Deposit Interest Rates for Over-the-Counter Deposits in August 2024

Source: ACB

In May, ACB also continued to implement other flexible interest payment methods: Quarterly interest: Interest rates range from 4.30% to 4.4% per annum; Monthly interest: Interest rates range from 2.45% to 4.35% per annum (For the 13-month tenor, a minimum deposit of 200 billion VND is required to receive an interest rate of 5.7% per annum); Interest paid in advance: Interest rates range from 2.25% to 4.2% per annum

In addition, ACB offers savings packages such as “Phuc An Loc” and “Tich Luy Tuong Lai”, with the highest interest rate of up to 4.7% per annum, for customers to choose from.

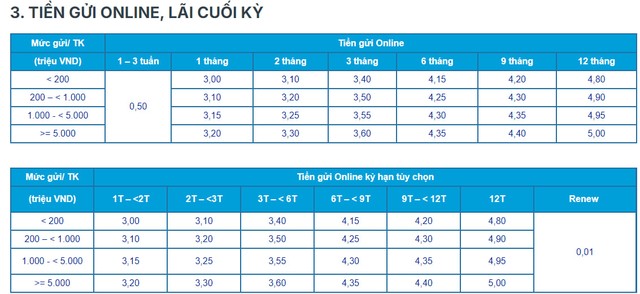

ACB’s Deposit Interest Rates for Online Deposits in August 2024

For online deposits, ACB offers interest rates ranging from 0.5% to 5.0% per annum for customers receiving interest at maturity.

Specifically, ACB sets a common interest rate for tenors of 1-3 weeks at 0.5% per annum

For other tenors, ACB offers interest rates based on the following deposit amounts:

For deposits below 200 million VND: The interest rate for a 1-month tenor is 3.0% per annum, 2 months is 3.1% per annum, 3 months is 3.4% per annum, 6 months is 4.15% per annum, 9 months is 4.2% per annum, and 12 months is 4.8% per annum.

ACB’s Deposit Interest Rates for Online Deposits in August 2024

Source: ACB

For deposits from 200 million VND to less than 1 billion VND: The interest rate for a 1-month tenor is 3.1% per annum, 2 months is 3.2% per annum, 3 months is 3.5% per annum, 6 months is 4.25% per annum, 9 months is 4.3% per annum, and 12 months is 4.9% per annum.

For deposits from 1 billion VND to less than 5 billion VND: The interest rate for a 1-month tenor is 3.15% per annum, 2 months is 3.25% per annum, 3 months is 3.55% per annum, 6 months is 4.3% per annum, 9 months is 4.35% per annum, and 12 months is 4.95% per annum.

For deposits of 5 billion VND or more: The interest rate for a 1-month tenor is 3.2% per annum, 2 months is 3.3% per annum, 3 months is 3.6% per annum, 6 months is 4.35% per annum, 9 months is 4.4% per annum, and 12 months is 5.0% per annum.

Thus, for online deposits with a tenor of 12 months, ACB currently offers the highest interest rates for all deposit amounts, ranging from 4.8% to 5.0% per annum.

ACB’s Lending Interest Rates

Recently, ACB announced the average lending rates for new loans disbursed in July 2024. Specifically, the average lending rate was 6.87% per annum, and the average interest rate spread between deposits and loans was 3.1% per annum.

ACB notes that this is the bank’s average lending rate and not the rate applied to specific loans. Customers can contact the nearest ACB Branch or Transaction Office for consultation and more information about ACB’s credit programs and promotions.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.