The stock market on August 22nd witnessed a surprising surge in Vincom Retail’s VRE stock, with very active trading. At one point, the stock price rose sharply, reaching just below the ceiling before the morning session temporarily halted at VND 19,900/share, a more than 5% increase. Since hitting a historical low on August 5th, VRE’s stock price has risen by over 18%.

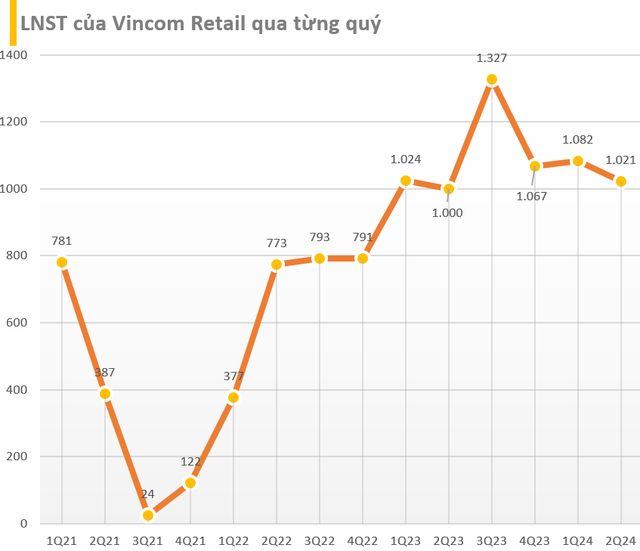

This sharp increase comes as Vincom Retail has posted profits exceeding VND 1,000 billion for the sixth consecutive quarter. Specifically, in Q2 2024, Vincom Retail recorded VND 2,479 billion in net revenue, a 14% increase compared to the same period last year. The company’s after-tax profit was VND 1,021 billion, a slight 2% increase from 2023.

For the first six months of 2024, Vincom Retail’s net revenue reached VND 4,733 billion, and its after-tax profit was VND 2,104 billion, representing a 15% and 4% increase, respectively, compared to the first half of 2023. With these results, the company has achieved 50% of its annual revenue plan and 48% of its profit target.

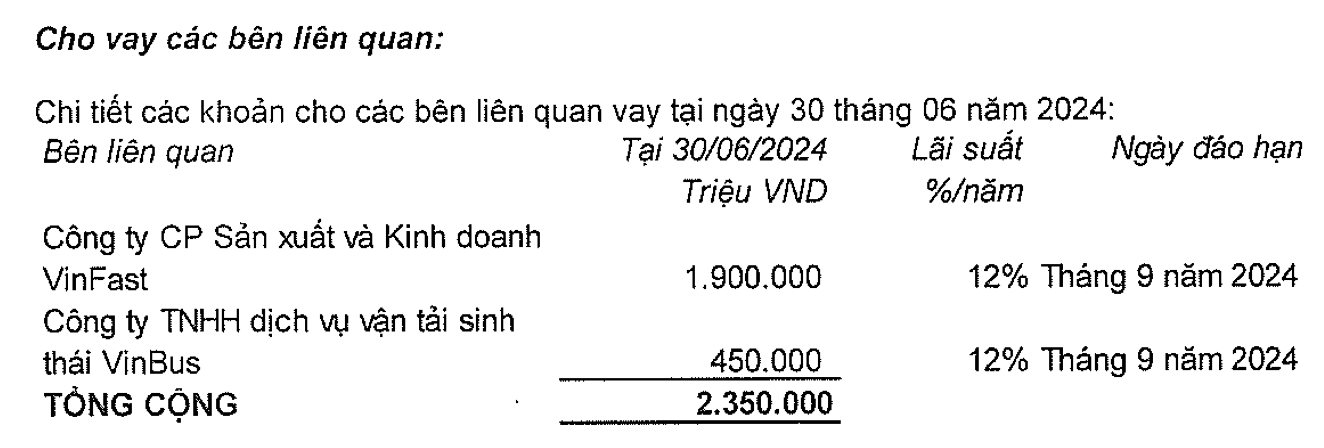

Notably, as of the end of Q2, Vincom Retail’s loan balance to related parties stood at VND 2,350 billion, including VND 1,900 billion loaned to VinFast and VND 450 billion to VinBus. Additionally, the company holds over VND 16,100 billion in deposits for business and investment purposes, of which VND 13,800 billion is deposited with Vingroup and related parties.

During an investor meeting in April 2024, Vincom Retail’s management announced that all loans to related parties would be recalled by the end of September 2024. In contrast, the deposit balance for business cooperation contracts may be challenging to reduce in the future to ensure Vincom Retail’s access to land funds in its development plans and the receipt of assets at book value. The deposit balance for business cooperation contracts may decrease after the shopping malls’ construction is completed and handed over to Vincom Retail.

Vincom Retail is known for managing and operating the largest system of shopping malls in Vietnam. As of the end of Q2 2024, the total number of Vincom Retail’s shopping malls increased to 86, and the total floor area expanded by 67,000 square meters to over 1.8 million square meters. The average occupancy rate in Q2 2024 was 83.9%, a 1.6% year-over-year decrease but a 1.1% increase quarter-over-quarter.

In the second half of 2024, Vincom Retail plans to open two new shopping malls (VCP Bac Giang and VCP Dong Ha Quang Tri), adding 27,600 square meters to its total floor area. The opening of VMM Ocean City has been postponed from late 2024 to April 2025 due to: (1) an expected increase in consumer demand for shopping after the Tet holiday, as more residents will have moved into Vinhomes Ocean City, and (2) the longer-than-expected time required for economic needs assessments and the granting of permits for international tenants by authorized agencies.

Earlier, in April 2024, Vincom Retail announced the purchase of three shophouse projects in Quang Ninh, Hai Phong, and Nha Trang from Vinhomes, Vingroup, and Vinwonders Nha Trang, respectively. However, due to delays in the Nha Trang project, VRE decided to halt it and will receive a refund of VND 1,300 billion in deposits from VinWonders Nha Trang. The other two projects are on schedule, and Vincom Retail plans to introduce them in early 2025.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.