According to statistics from VietstockFinance, only 23 out of 54 power companies that have published their second-quarter financial statements saw profit growth. The remaining businesses experienced a decline in performance, with six companies incurring losses.

Thermal power companies faced challenges due to fluctuations in fuel prices and exchange rates.

|

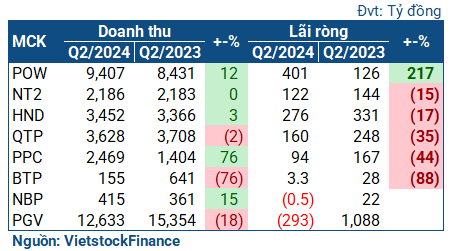

Second-quarter business results of the thermal power group

|

Overall, the second-quarter performance of the thermal power group was significantly impacted by fuel prices and exchange rate volatility, resulting in negative outcomes for most companies. Even for businesses that experienced growth, such as PV Power (HOSE: POW), fluctuations in exchange rates had a notable influence.

In the second quarter, POW’s revenue increased more than its cost of goods sold, resulting in a net profit of 401 billion VND, triple that of the previous year, and the highest in the thermal power group. However, this improvement was partly attributed to POW’s increased profits from a hydropower plant, the Dakdrinh Hydropower Plant. Meanwhile, financial expenses surged by 69% to 229 billion VND, mainly due to exchange rate losses.

| Business situation of POW |

|

|

NT2 (Nhon Trach 2) was also impacted by fuel prices. Although revenue increased during the period, it was outpaced by the rise in cost of goods sold, resulting in a gross profit of only 130 billion VND, a 20% decrease compared to the previous year. Additionally, financial expenses increased significantly by 77%, exceeding 9 billion VND. Ultimately, the company’s after-tax profit was 122 billion VND, a 15% decline.

Phả Lại Thermal Power (HOSE: PPC) benefited from increased power generation, with revenue surging to 2.5 trillion VND, a 77% increase, and gross profit reaching 128 billion VND, a 33% improvement. However, a significant drop in dividends received from invested units led to a substantial decrease in financial revenue, eroding PPC’s profits. The company concluded the second quarter with a net profit of 94 billion VND, a 44% reduction.

| Drop in dividends from invested units leads to a significant decline in PPC’s profits |

|

|

Bà Rịa Thermal Power (HOSE: BTP) also reported a profit decline of 88%, resulting in a net profit of 3.3 billion VND. The company explained that due to system load requirements, the machines were less utilized and operated at lower loads, resulting in higher specific fuel consumption and a significant drop in power output compared to the previous year.

The company most severely impacted by exchange rate losses was PGV. In reality, PGV’s second-quarter performance was weak due to lower power sales than the previous year. However, the main reason for the company’s net loss of 293 billion VND (compared to a profit of nearly 1.1 trillion VND in the same period last year) was the exchange rate loss of 591 billion VND.

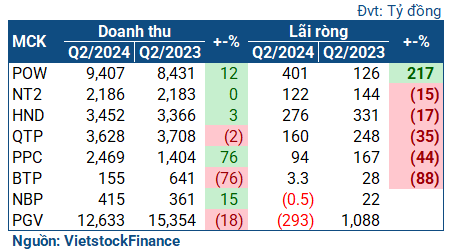

Considering the cumulative results, HND and PPC achieved profit growth due to strong performance in the first quarter, with net profits for the first half of 2024 reaching 431 billion VND (+26%) and 251 billion VND (+25%), respectively. POW experienced a slight increase of 3%, reaching 678 billion VND. NT2 incurred a net loss of 36 billion VND (compared to a profit of 378 billion VND in the same period last year) due to a significant loss in the first quarter. PGV suffered a loss of over 948 billion VND (compared to a profit of 1.7 trillion VND in the same period last year).

|

First-half results of thermal power companies in 2024

|

Hydropower companies faced challenges due to weather conditions.

With the prolonged El Niño phenomenon affecting the second quarter, most hydropower companies witnessed a decline in performance. The reasons provided had a significant overlap: unfavorable hydrological conditions.

|

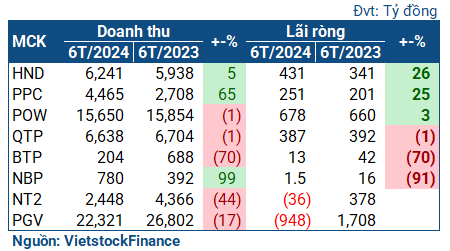

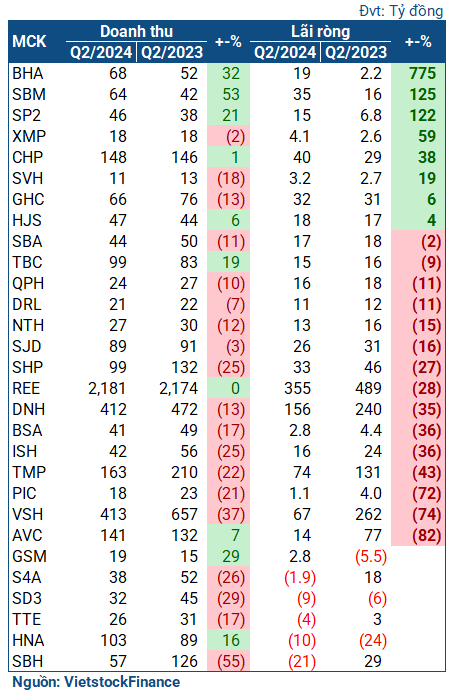

Second-quarter results of hydropower companies in 2024

|

A Vuong Hydropower (UPCoM: AVC) led the decline with a net profit of only 14 billion VND, an 82% drop compared to the previous year. The main reason was the low rainfall and water inflow into the reservoir, resulting in lower power output and higher cost of goods sold compared to revenue.

El Niño was also cited as the reason for the 74% profit drop experienced by Vĩnh Sơn – Sông Hinh Hydropower (HOSE: VSH), with a net profit of 67 billion VND in the second quarter. The company stated that the hydrological conditions in the first six months of the year in the central and Central Highlands regions were unfavorable, with water inflow into the reservoirs of the plants decreasing significantly compared to the previous year, resulting in a 22.52% drop in commercial power output.

| VSH faced a challenging business situation due to unfavorable hydrological conditions |

|

|

Thác Mơ Hydropower (HOSE: TMP) also recorded a 43% decrease in profit, amounting to 74 billion VND. The company attributed this to lower power output in the second quarter compared to the previous year.

For REE, the second quarter followed a similar pattern as the previous one. The decline in performance of hydropower companies such as VHS, TMP, and CHP dragged down REE’s net profit by 27%, reaching 355 billion VND. This marked the fifth consecutive quarter of profit decline for the company.

Nevertheless, a few companies managed to buck the trend and were less impacted by El Niño. Bac Ha Hydropower (UPCoM: BHA) saw its net profit surge to nearly nine times that of the previous year, reaching 19 billion VND, due to higher water inflow into the reservoir. Similarly, Su Pan 2 Hydropower (UPCoM: SP2) achieved a profit of 15 billion VND, more than double that of the previous year, thanks to more favorable hydrological conditions.

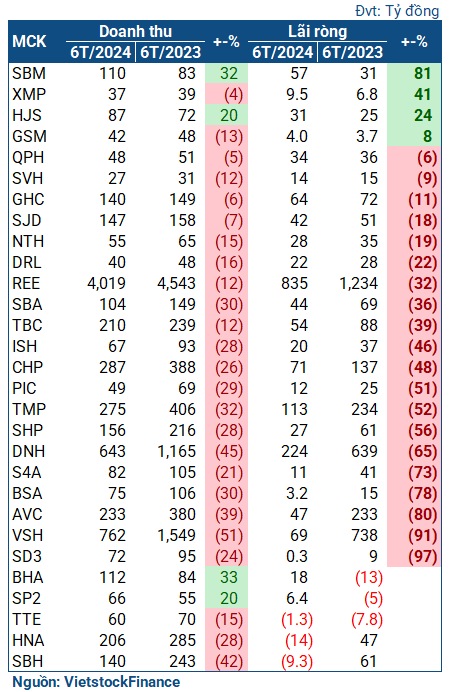

The prolonged impact of hydrological conditions since the beginning of the year has generally painted a negative picture for the cumulative results of the hydropower group. Apart from a few exceptional cases, such as SBM (+81%), XMP (+41%), BHA, and XMP (turning from losses to profits), most companies experienced declines. Some companies, such as VSH and SD3, witnessed sharp drops in profits, falling by 91% and 97%, respectively, compared to the previous year.

|

First-half results of hydropower companies in 2024

|

Renewable energy companies showed improvement.

The renewable energy group witnessed a notable improvement in the second quarter. GEG achieved strong growth with a net profit of 21 billion VND, 2.5 times higher than the previous year, due to revenue recognition from the Tan Phu Dong 1 Wind Power Plant and reduced financial expenses as a result of lower debt and interest expenses. Combined with the positive performance in the first quarter, the company’s net profit for the first six months exceeded 111 billion VND, a 52% increase compared to the previous year.

| Tan Phu Dong 1 contributes to GEG’s improved second-quarter performance |

|

|

Similarly, the electricity segment of PC1 achieved a gross profit (revenue from electricity sales minus cost of goods sold) of 223 billion VND, an 88% increase, and a net profit of 399 billion VND, a 24% improvement, for the first six months.

On the other hand, the electricity segment of Ha Do (HOSE: HDG) experienced a decline, with a gross profit of 198 billion VND in the second quarter, a 17% decrease, and a cumulative profit of 464 billion VND, a 27% drop, for the first six months. As HDG’s energy segment operates in hydropower, wind power, and solar power, the decline is likely attributed mainly to hydropower.

Anticipating brighter prospects in the second half of the year

Setting aside the gloomy performance in the first two quarters, hydropower companies have reasons to look forward to the latter half of the year. The worst of El Niño is now behind us, and the La Lina phase has arrived earlier than expected, starting in the third quarter (previously forecasted for August 2024).

Vinh Son – Song Hinh Hydropower

|

With La Lina, hydropower companies can expect higher commercial power output due to increased water inflow into the reservoirs. Securities companies such as Rong Viet (VDSC) and MBS share the view that the hydropower group will achieve more positive revenue in the third and fourth quarters of this year.

However, the improvement in hydropower performance also means that coal-fired power will face challenges. Hydropower is considered the cheapest source of electricity production and will always be prioritized for dispatch. Similarly, gas-fired power is expected to be less favorable due to the preference for hydropower. Additionally, domestic gas sources are gradually declining, according to ACBS Securities Company.

Regarding renewable energy, the government’s issuance of a decree approving the direct power purchase agreement (DPPA) mechanism has raised expectations. According to VDSC, DPPA is a pilot step towards the wholesale electricity market (VWEM) and a further step in the liberalization of Vietnam’s electricity sector.