Mr. Nguyen Huu Doanh, Chairman of SD7, has registered to purchase nearly 1.8 million SD7 shares through a negotiated deal, with the intention of investing. The transaction is expected to take place between August 27 and September 20, 2024. If successful, the Chairman of SD7 will increase his holdings from over 2.6 million shares (24.6%) to nearly 4.4 million shares (41.4%).

|

According to sources, Mr. Nguyen Huu Doanh, born in 1968, holds a Master’s degree in Business Administration from Hanoi National University. He has extensive experience working in various units of Song Da Corporation, including the Underground Construction Company, Song Da 8 Construction Company, Song Da 7.04 JSC, and Song Da 7 JSC. At Song Da 7 JSC, he officially took on the role of Chairman of the Board in May 2016.

Returning to Mr. Doanh’s purchase of SD7 shares, if we consider the closing price of SD7 on August 23, 2024, which was VND 3,200 per share, he would need to spend approximately VND 5.7 billion to acquire all the registered shares.

It is worth noting that the trading of SD7 shares on August 23, 2024, witnessed a significant surge, reaching the ceiling price after several days of no transactions.

| SD7 Share Price Movement since the beginning of 2024 |

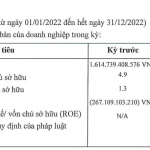

This surge can be attributed to the fact that SD7 was placed under trading restrictions by the Hanoi Stock Exchange (HNX) on April 4, 2024, due to the auditing organization’s refusal to provide an opinion on its financial statements. This refusal was a result of issues related to loans to other entities, provision for losses, entrusted investments of individuals, and incomplete confirmation of accounts receivable and payable.

Introducing a New Subsidiary of CII Issuing 550 Billion Dong Bonds

Following the success of BOT Binh Thuan, it is now the turn of the investor of the BOT project to expand Ha Noi Boulevard to issue a successful bond issue worth 550 billion VND. This is also a subsidiary of Ho Chi Minh City Infrastructure Investment JSC (CII).

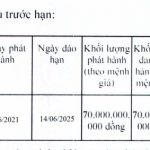

Compassionate Food settles 70 billion VND bond ahead of schedule

On February 23, 2024, Huu Nghi Food successfully settled the bond batch HNFH2125002, which was issued on June 14, 2021, with a face value of 70 billion VND.