The VN-Index closed slightly lower, shedding just over a point. Throughout the trading session, the market remained range-bound as heavyweight stocks exhibited a lack of momentum. In contrast, mid-cap stocks faced strong selling pressure, with many stocks witnessing profit-taking after a strong run.

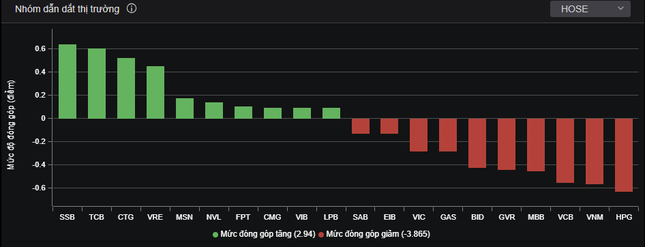

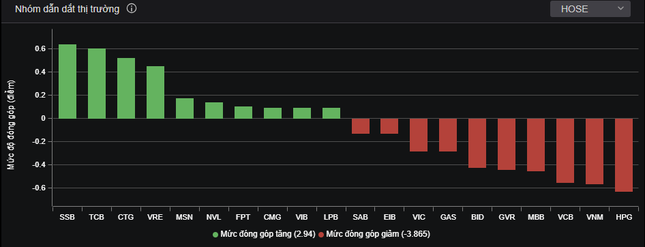

The VN30 index painted a mostly red picture, with 14 stocks in negative territory. HPG, VNM, VCB, MBB, GVR, and BID were among the top drags on the market. Key sectors such as banking and real estate lacked consensus, leaving the VN-Index without a clear leader. On the HoSE, nearly 230 stocks declined, outnumbering gainers.

The market returned to a state of divergence, with heavyweight stocks failing to provide direction.

Most sectors experienced a mixed performance. Contractor stocks were awash with red, with declines primarily in the 1-2% range. This included a stock of a company belonging to the Deo Ca joint venture, which was recently disqualified during the technical round of bidding for Package No. 4.7 (valued at over VND6,300 billion) of Component Project No.3 of the Long Thanh International Airport Project. HHV of Deo Ca fell by 1.6%.

Steel stocks witnessed broad-based declines, with foreign investors consistently selling HSG and HPG. The Dragon Capital Fund recently announced the sale of 3.17 million HSG shares. Over the past month, the group has sold nearly 8 million HSG shares.

As the market underwent a period of divergence and faced significant corrective pressure, Apec stocks, including API, IDJ, and APS, surprised investors with strong gains, even triggering trading halts due to rising demand. Notably, all three stocks are currently under control or warning by the HNX.

In the past, this trio of Apec stocks has stirred up the stock market with their dramatic price movements, sometimes increasing by several times their original value. On the stock exchange, Apec stocks have seen gains of up to 15 times their initial price, followed by prolonged downturns and allegations of stock manipulation.

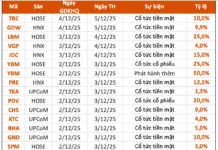

At the closing bell, the VN-Index lost 1.27 points (0.1%) to land at 1,282.78. Meanwhile, the HNX-Index and UPCoM-Index posted modest gains, ending the day at 238.47 and 94.49, respectively. Liquidity weakened, with the matching value on HoSE falling to VND14,000 billion. Foreign investors net sold over VND546 billion, focusing on HPG, HSG, VPB, and HDB.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.