“Silicon Valley,” or Silicon Valley, is home to some of the world’s leading technology companies, including Alphabet (Google), Chevron, Systems, Apple, and Facebook. As of 2024, nearly 40 companies on the Fortune 1000 list are headquartered in Silicon Valley.

In Vietnam, there has been a similar aspiration to create a “Silicon Valley” that would serve as an incubator for domestic technology companies. In fact, Vietnam already has several high-tech parks, such as Hoa Lac and Danang IT Park, with the latter being envisioned to become Vietnam’s Silicon Valley.

However, the Danang IT Park has fallen into a state of neglect, with overgrown grass and some roads even being used for cattle grazing. Located in Hoa Lien, Hoa Vang District, Da Nang city, the project covers an area of 341 hectares and has a total investment of VND 2,744 billion. The first phase, covering 131 hectares, has been completed and is ready to serve investors, while the second phase, spanning 210 hectares, is planned to be constructed over five years (from 2020 to 2025).

Currently, the Danang IT Park is rather deserted and quiet. Some roads within the project have been turned into cattle grazing areas, and wild grasses have overgrown. Several structures are left unfinished, and the construction equipment lies idle.

The deserted scene of the Danang IT Park project

The expert area of the project is also abandoned.

The project’s investor is Danang IT Park Development Joint Stock Company, introduced as a member of the Trung Nam Group. Mr. Nguyen Tam Thinh, Chairman of the Board of Directors of Trung Nam Group, used to be the legal representative and Chairman of Danang IT Park Development. However, this position has now been transferred to Ms. Dao Thi Minh Hue. The company has a charter capital of VND 777 billion.

At the beginning of 2022, the leadership of Trung Nam Group announced that Danang IT Park had attracted three investors, including one FDI and two domestic projects. Danang IT Park also signed a cooperation agreement with a Singaporean partner for the development of a green Data Center with regional-level standards and scale.

Outside of Danang IT Park

In early August 2024, Danang IT Park Development Joint Stock Company issued a bond lot, DTPCB2427001, with a volume of 5,000 bonds. Each bond has a face value of VND 100 million, and the total value of the issued bonds is VND 500 billion. The issuance and completion of this bond lot took place on July 16, 2024, with a term of 30 months. The bonds will mature on January 16, 2028.

The collateral for these bonds is 100 million common shares issued by Trung Nam Renewable Energy Joint Stock Company. Of these, more than 79.6 million shares are owned by Trung Nam Energy Investment and Development Joint Stock Company, and more than 20.4 million shares are owned by Mr. Nguyen Tam Tien.

Mr. Nguyen Tam Tien is also known as the General Director of Trung Nam Corporation. Trung Nam Energy Investment and Development Joint Stock Company is a member of the Trung Nam Group.

TRUNG NAM GROUP – THE TYCOON OF RENEWABLE ENERGY WITH HUGE DEBT

Regarding the owner of Danang IT Park Development Joint Stock Company, Trung Nam Group was established in 2004 with a starting point in the construction industry. The company was founded by two well-known entrepreneurs, Mr. Nguyen Tam Thinh (born in 1973) and Mr. Nguyen Tam Tien (born in 1967). Over 20 years, the two businessmen have transformed Trung Nam Group into a multi-sectoral corporation operating mainly in five fields: energy, infrastructure – construction, real estate, and information technology electronics.

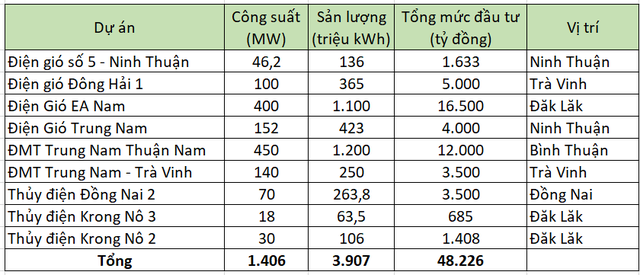

The field that made Trung Nam Group famous is renewable energy. According to statistics, the corporation has nine power projects with a total designed capacity of 1,406 MW and an output of nearly 4 billion kWh. The company has invested more than VND 48,200 billion in these projects.

According to VNDirect Research, Trung Nam Group is currently the largest developer of renewable energy in Vietnam. The group’s two largest projects are the Trung Nam Thuan Nam Solar Power Project, with an output of 1.2 billion kWh and a total investment of VND 12,000 billion, and the Ea Nam Wind Power Project, with an output of 1.1 billion kWh and a total investment of VND 16,500 billion.

To meet the huge investment needs in the field of renewable energy, Trung Nam Group requires a large amount of capital to carry out its projects. Therefore, the group has continuously increased its charter capital and borrowed in recent years to ensure cash flow.

The company has increased its charter capital from VND 1,886 billion to VND 20,940 billion within just seven years, an increase of more than 11 times.

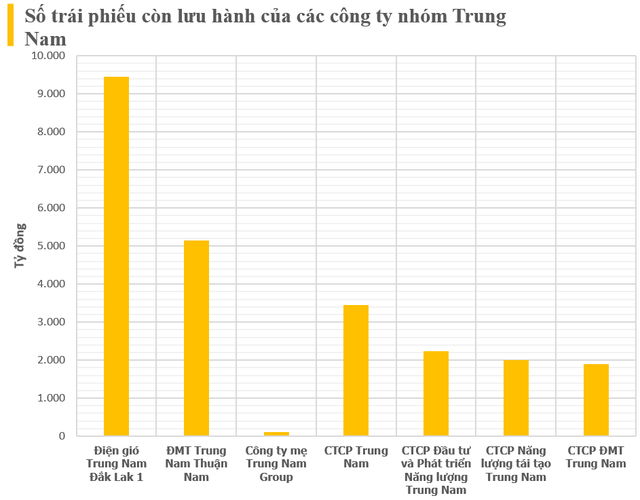

Along with the capital increase, Trung Nam Group has also increased its borrowing in recent years. The company’s preferred borrowing channel is through bond issuances. As of the end of the year, the entire Trung Nam Group still has VND 24,200 billion in bonds outstanding. Among these, the largest lot is a VND 9,500 billion issuance by Trung Nam Dak Lak 1 Wind Power Joint Stock Company in 2021, which is still outstanding.

The huge bond issuances are a double-edged sword, and Trung Nam Group is facing difficulties in the current period. The bond market underwent many fluctuations in 2022, causing many investors to turn away and sell large amounts of the company’s bonds. The company has also announced late bond payments on several occasions.

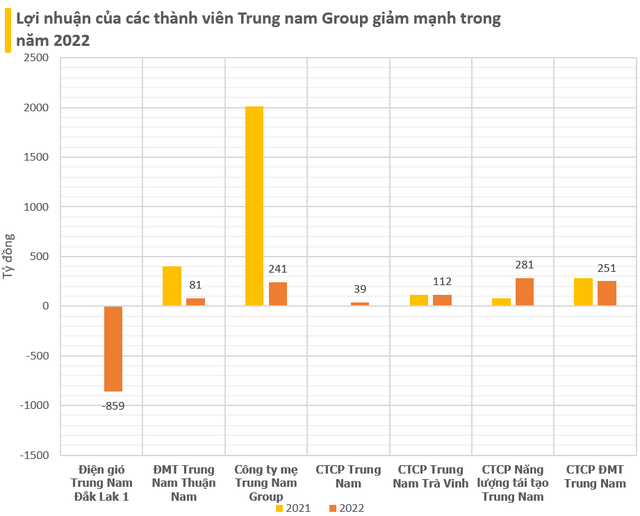

The main reason for these difficulties is that some of the group’s power projects are entangled in legal issues. Notably, the Trung Nam – Thuan Nam Solar Power Project was halted by EVN in September 2022 because it did not meet the requirements to enjoy the FIT (fixed electricity selling price). Out of the 172 MW currently in operation, 86 MW is on an area of land (about 108 hectares) that the investor implemented in violation of legal regulations, meaning the land was not approved, and environmental impact assessments and fire protection inspections were not carried out. Therefore, EVN does not pay for the electricity generated on this excess land area.

Due to the above difficulties, the members of the Trung Nam Group reported a decrease in profit in the latest financial statements they published.

According to the 2022 consolidated financial statements of Trung Nam Group, the company’s total assets were over VND 96,000 billion, and equity capital reached VND 27,914 billion. However, the debt-to-equity ratio was 2.44 times, corresponding to a debt value of VND 68,110 billion, an increase of 5.5% compared to the beginning of the year. Bond debt at the end of the year was more than VND 24,200 billion, accounting for nearly 36% of total debt.

In July 2024, Trung Nam Renewable Energy Joint Stock Company transferred 19.9 million shares of Trung Nam Solar Power Joint Stock Company in a transaction related to bonds. The transferees included Asia Renewable Energy Investment and Development Company Limited (18 million shares) and Mr. Nguyen Thanh Binh (1.9 million shares).

One of the transferees, Asia Renewable Energy Investment and Development Company Limited, is known to be a subsidiary of Asia Technical Industries Corporation (ACIT). In addition, Mr. Nguyen Dang Khoa, who will also receive a transfer of 100,000 shares of Trung Nam Solar Power, is related to ACIT as he currently serves as Deputy General Director of ACIT.

ACIT has owned 49% of the shares of the Trung Nam Solar Power Plant since 2021. Meanwhile, Trung Nam Solar Power has a charter capital of VND 1,000 billion. Thus, with its subsidiary acquiring an additional 18 million shares (equivalent to 18% capital) of Trung Nam Solar Power, ACIT may recognize this company as a subsidiary, and the Trung Nam Group may lose control of Trung Nam Solar Power.

Sharp Decline in Consumption, Warning of Very Low Water Levels in Hydropower Reservoirs

The Ministry of Industry and Trade’s Electricity Regulatory Authority has announced that electricity consumption during the Lunar New Year holiday is significantly low nationwide. In light of the low water levels in the hydropower reservoirs in the northern region, coal-fired and renewable energy power plants have been maximally utilized.