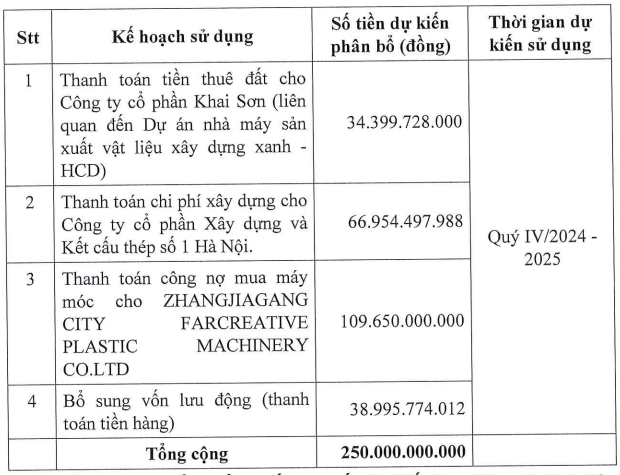

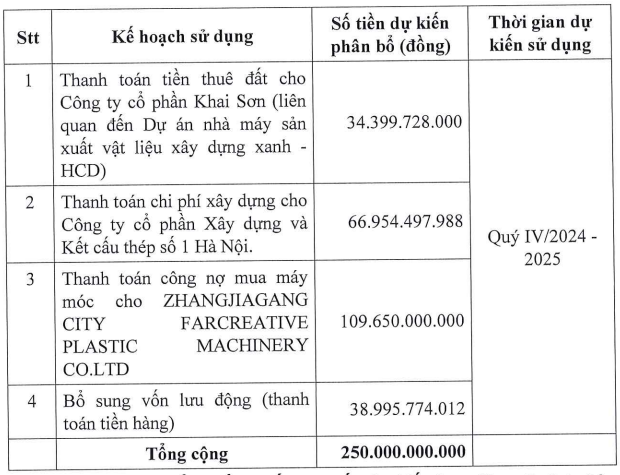

With the offering price set, HCD could raise a maximum of VND 250 billion. The company plans to allocate these funds towards the following: paying land lease fees to Khai Son JSC (related to the green building materials manufacturing plant – HCD) amounting to nearly VND 34.4 billion; settling construction fees for Hanoi Construction and Steel Structure Joint Stock Company totaling nearly VND 67 billion; clearing machinery purchase debts of nearly VND 109.7 billion; and the remaining will be used to supplement the company’s working capital.

|

Capital allocation plan from the offering as per the Board of Directors’ resolution on August 21, 2024

Source: HCD

|

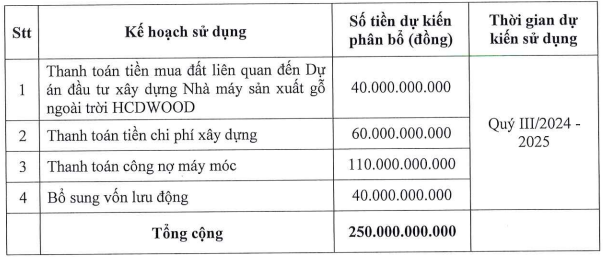

The capital allocation plan has been adjusted slightly from the one approved by the 2024 Annual General Meeting of Shareholders. Notably, the name of the project requiring land lease payment has been changed from the HCDWOOD outdoor wood manufacturing plant to the green building materials manufacturing plant – HCD.

|

Capital allocation plan from the offering as per the 2024 Annual General Meeting resolution

Source: HCD

|

The offering is expected to take place towards the end of 2024 and the beginning of 2025. Once the State Securities Commission announces the receipt of the registration dossier, the offering will be conducted within 90 days.

Following the completion of the offering, professional securities investors will be restricted from transferring their shares for one year, while strategic investors will be restricted for three years. In the event that strategic investors participating in the offering exceed the ownership limit (over 25%) as stipulated by the Securities Law, they will not be required to carry out a public offering procedure.

The list of investors participating in this private offering by HCD includes eight individuals, three of whom are company leaders: two Board members, Mr. Tran Ngoc Huu and Mr. Pham Duy Liem, who have registered to purchase 3.5 million shares and 3 million shares, respectively; and the Ho Chi Minh City branch director, Mr. Nguyen Manh Thang, who has registered to buy 3 million shares. Post-transaction, the ownership ratios of Mr. Huu, Mr. Liem, and Mr. Thang are expected to be 5.72%, 4.86%, and 4.84%, respectively. All three individuals are purchasing shares as strategic investors.

The remaining five individuals are Ms. Le Thi Huyen, Mr. Nguyen Van Huan, Mr. Nguyen Ba Luan, Mr. Nguyen Thanh Phu, and Mr. Tran Minh Tuan. Apart from Mr. Tuan, who registered to buy 3.5 million shares, the other four individuals each registered to purchase 3 million shares. Additionally, only Mr. Huan and Mr. Phu are buying shares as professional securities investors (as certified by Yuanta Securities Vietnam), while the rest are strategic investors.

Although not participating in the private offering, Mr. Nguyen Phuong Dong, a major shareholder of HCD, increased his ownership ratio from 7.42% to 9.38% between August 9 and 15, 2024, equivalent to purchasing 723,100 HCD shares during this period.

| HCD share price movement since the beginning of 2024 |

Ha Le

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.