VN-Index Recap: A Tug-of-War Session Ends on a Positive Note

The VN-Index experienced a tug-of-war trading session on August 23, with the benchmark index oscillating around the reference mark in a narrow range. Despite the back-and-forth movement, a upward trend eventually emerged toward the end of the day. At the close, the VN-Index posted a modest gain of 2.54 points, settling at 1,285.32. HoSE witnessed low trading liquidity, with a turnover value of VND16,839 billion.

In terms of foreign investment, foreign investors continued to be a drag on the market, recording a net sell-off of VND106 billion across all exchanges:

On the HoSE, foreign investors net sold nearly VND 80 billion

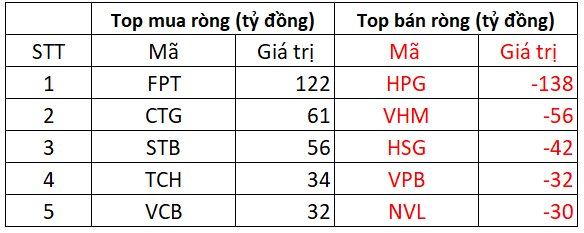

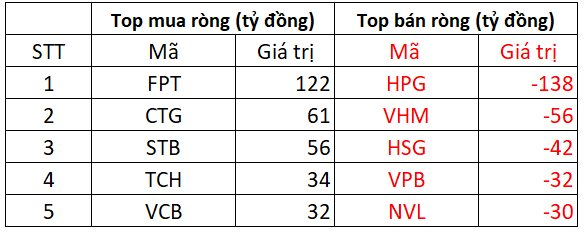

On the buying side, FPT witnessed the strongest foreign buying, with a net buy value of VND122 billion. CTG and STB followed suit, with net purchases of VND61 billion and VND56 billion, respectively. TCH and VCB also attracted net buys in the range of VND32-34 billion.

Conversely, HPG faced the most significant foreign selling pressure, with a net sell-off of VND138 billion. VHM, HSG, VPB, and NVL also witnessed net sell-offs ranging from VND30 billion to over VND50 billion.

HoSE trading activity on August 23

On the HNX, foreign investors net sold approximately VND 46 billion

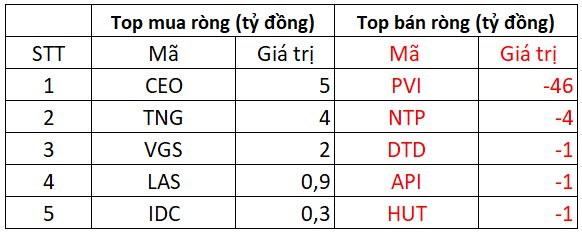

CEO and TNG saw the strongest net buying on the HNX, with values of VND4-5 billion. VGS also stood out with net purchases of VND2 billion. Additionally, foreign investors snapped up LAS and IDC, albeit on a smaller scale, with net buys in the hundreds of millions of VND.

On the selling side, PVI faced the brunt of foreign selling, with a net sell-off of VND46 billion. NTP, DTD, and API also witnessed net selling in the range of VND1-4 billion.

HNX trading activity on August 23

On the UPCOM, foreign investors net bought VND 19 billion

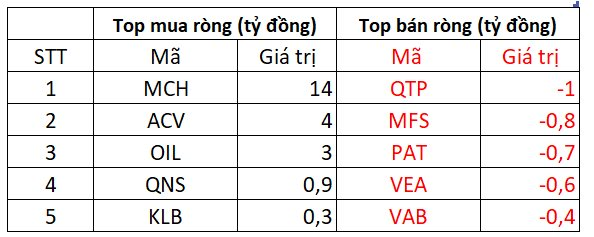

MCH topped the buying list on the UPCOM, with net purchases of VND14 billion. ACV and OIL also saw net buying in the range of VND3-4 billion.

On the opposite end, QTP faced net selling of VND1 billion by foreign investors. MFS, PAT, VEA, and VAB were also among the stocks that witnessed net sell-offs by foreign investors.

UPCOM trading activity on August 23

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.