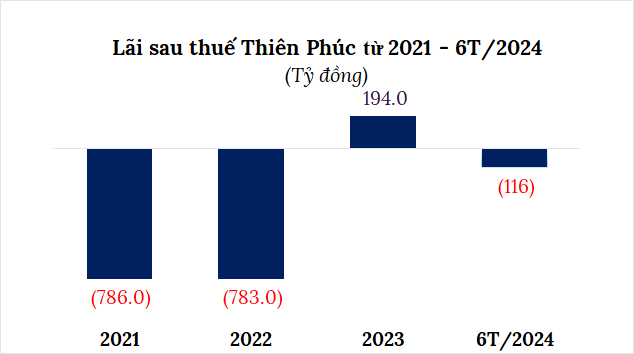

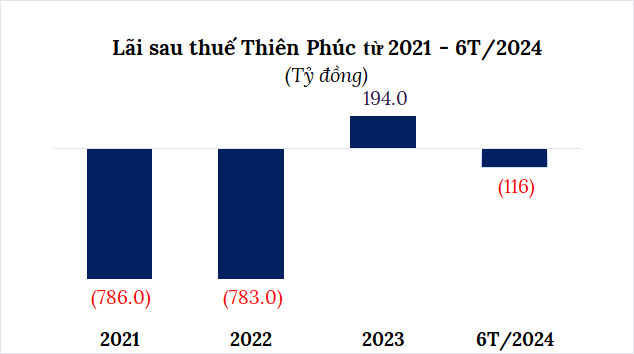

In a stark contrast to the losses incurred in 2021 and 2022, totaling VND 1,570 billion, Thien Phuc International Hotel JSC (Thien Phuc) turned a profit of nearly VND 200 billion in 2023. However, in the first half of 2024, the company has slipped back into the red, reporting losses.

According to the financial report for the first six months of 2024 submitted to the Hanoi Stock Exchange (HNX), Thien Phuc posted a loss of nearly VND 116 billion, an improvement from the loss of nearly VND 370 billion in the same period last year.

Source: Consolidated

|

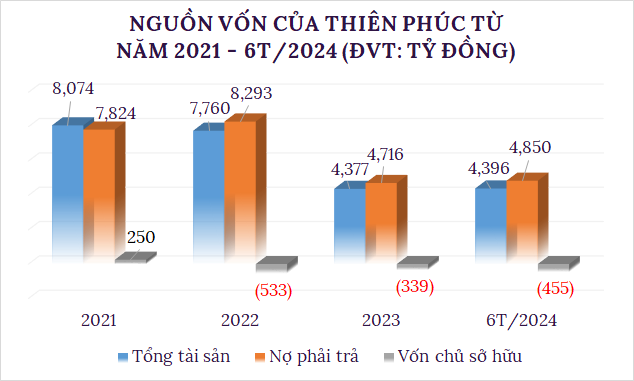

As of June 30, 2024, Thien Phuc still had negative equity of nearly VND 455 billion, compared to negative equity of nearly VND 903 billion in the previous period. The company’s debt stood at approximately VND 4,850 billion, a reduction of 44%; this includes VND 3,000 billion in bond debt.

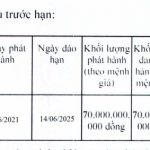

Earlier this year, in March, Thien Phuc was scheduled to pay nearly VND 150 billion in interest on the 30 lots of bonds currently in circulation. However, due to challenges in arranging funds, the company failed to make this interest payment on time.

Source: Consolidated

|

According to the Hanoi Stock Exchange (HNX), Thien Phuc currently has 30 lots of bonds with codes from THP.H2025.01 to THP.H2025.30, totaling VND 3,000 billion in face value. All 30 lots of bonds are under custody at Tan Viet Securities JSC (TVSI) and share the same issue date of August 31, 2020, and maturity date of August 31, 2025, with an interest rate of 11% per annum.

Established in September 2013, Thien Phuc owns the Novotel Saigon Centre hotel, located at 167 Hai Ba Trung, District 3, Ho Chi Minh City, which also serves as the company’s headquarters.

According to the latest information from HNX, Thien Phuc’s chartered capital now stands at over VND 1,694 billion, with Ms. Hong Kim Yen serving as Chairwoman of the Members’ Council and legal representative.

Novotel Saigon Centre hotel, 167 Hai Ba Trung, District 3, Ho Chi Minh City, is the headquarters of Thien Phuc.

|

Thanh Tu

Thai Tuan Group Keeps Piling Up Bond Debts, Owes 9 Months of Social Insurance

In the first month of 2024, Thai Tuan Corporation was able to pay only one month of social insurance amounting to approximately 1.4 billion VND. Consequently, as of January 31, 2024, the company still owes nine months of social insurance, equivalent to a total amount exceeding 12 billion VND.