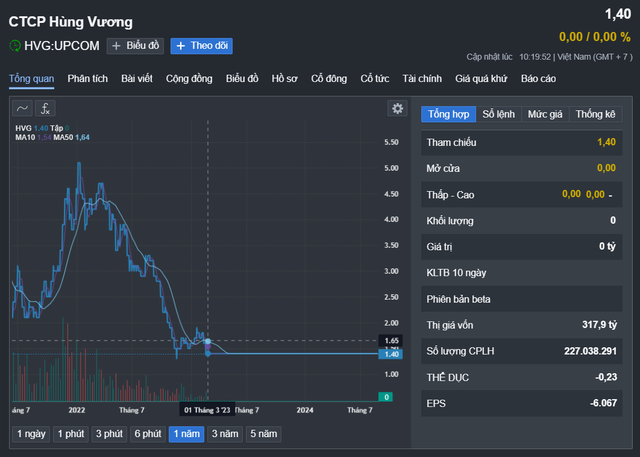

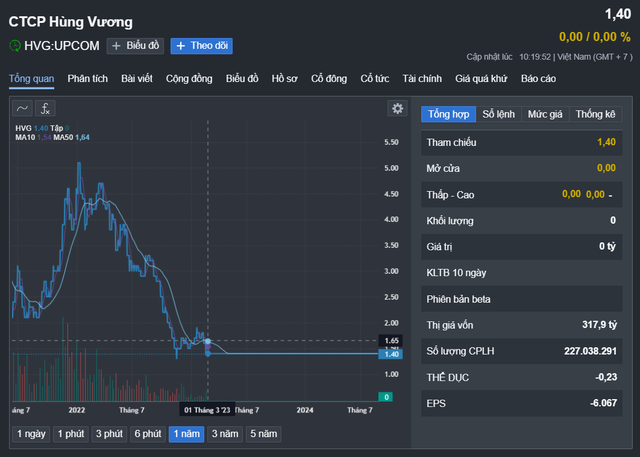

The Hanoi Stock Exchange (HNX) recently announced trading restrictions on HVG stock of Hung Vuong Corporation due to the company’s failure to hold its Annual General Meeting for two consecutive years. Additionally, the company delayed submitting its reviewed semi-annual financial reports for 2022 and 2023.

HVG stock is suspended from trading on UpCom, currently at VND1,400 per share. Source: Fireant

Once known as the “Tra Fish King,” Hung Vuong owned seven factories eligible for exports to 27 EU countries and continuously expanded its export markets to the US, Eastern Europe, and China.

With a vision of achieving USD 1 billion in revenue, Hung Vuong aggressively acquired shares in prominent food and seafood companies in Vietnam and ventured into real estate, expanding its distribution channels domestically and abroad.

However, since 2015, Hung Vuong’s ambitions began to falter as its revenue and profits declined, leading to significant losses. As of the 2019 financial report, the company, led by “Tra Fish King” Duong Ngoc Minh, had accumulated losses of over VND 1,700 billion. In early August 2020, HVG stock was forcibly delisted from HoSE due to serious violations of information disclosure obligations and was transferred to UpCom for trading.

In early 2020, investors anticipated a rescue when Hung Vuong and Thadi – a subsidiary of Truong Hai Thaco Group – signed a strategic cooperation agreement. However, this rescue effort lasted only until July 2021 when Tran Aoanh Production and Trading Company and its chairman, Tran Ba Duong, simultaneously sold off their entire holdings of over 19.8 million HVG shares.

In December 2023, HVG stock of Hung Vuong was officially suspended from trading on UPCoM as the company failed to publish audited financial statements for three or more consecutive financial years.

In early 2024, Hung Vuong Corporation announced a proposal to divest from its member companies to raise capital and comprehensively settle the company’s debts.

As of the first quarter of 2020 financial report, Hung Vuong’s payables stood at VND 7,134 billion as of December 31, 2019.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.