Recently, real estate stocks have been on a positive recovery trajectory after a period of significant declines. Among them, SGR, the stock of Saigon Real Estate Joint Stock Corporation, has stood out with a strong upward trend in the last four sessions, including two sessions that hit the ceiling price.

Currently trading at 37,300 VND per share (+5.67%, +2,000), SGR has witnessed a remarkable surge of 46% in just one week since August 15. It is now approaching its historical peak of over 39,000 VND per share reached in January 2022.

With approximately 60 million shares in circulation, SGR’s market capitalization has increased by over 700 billion VND within a week to nearly 2,240 billion VND.

This impressive rally in SGR shares comes just ahead of the company’s upcoming shareholder record date on August 29, with the process taking place in September and October 2024. Specific details have not yet been announced.

In related news, there has been a new development in the province of Thai Nguyen regarding this real estate business. Specifically, the Department of Planning and Investment of Thai Nguyen province announced the results of the opening of the registration dossier for the implementation of the Nam Tien 2 Urban Area project in Nam Tien ward, Pho Yen city, at the end of July.

Consequently, the only investor registered to implement the project is the Saigon-Thai Nguyen Joint Venture, comprising of Joint Stock Total Real Estate Corporation of Saigon (Saigonres, SGR), Total Construction Investment and Development Joint Stock Company (DIC Corp, DIG), and Hung Thinh Incons Joint Stock Company (HTN).

It is understood that the Nam Tien 2 Urban Area covers an area of 352,862m2. The total investment capital is nearly VND 3,825 billion, including implementation costs of over VND 3,403 billion and compensation and resettlement costs of nearly VND 422 billion. The investment schedule is expected to last from the second quarter of 2024 to the end of the third quarter of 2029.

The housing products include: detached houses (built with exterior finishes); mixed apartment buildings (commercial services, apartments); land for transfer of land use rights in the form of plot subdivision and sale of land plots for self-construction of houses in accordance with the law of land, housing and real estate business; resettlement land fund with an area of nearly 21,300m2; and land fund for social housing construction with an area of over 32,200m2.

‘Dismal’ business performance after a year of success

Turning our attention back to Saigon Real Estate Joint Stock Corporation, Saigonres was corporatized from the state-owned Gia Dinh Construction and Trading House Company under the Department of Geopolitics and Land of Ho Chi Minh City.

Saigonres is known for its expertise in real estate investment and trading, construction of industrial and civil works, trading and import-export of construction materials, machinery and equipment leasing, investment consulting and design construction, mineral exploitation, and ecological garden houses.

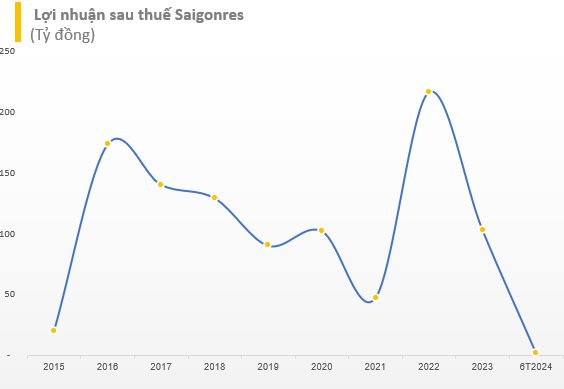

In terms of business performance, after achieving a high profit margin in 2022, Saigonres’ results took a significant downturn in 2023. Revenue reached VND 100 billion, and after-tax profit exceeded VND 103 billion, representing decreases of 85% and 52%, respectively, compared to the previous year’s figures.

The company attributed these declines to the challenging economic landscape, particularly in the real estate sector. In addition to the impact of the State Bank’s tight credit policy and the controlled channel of bond issuance, Saigonres’ real estate projects in Ho Chi Minh City and neighboring areas also faced legal procedure complications, hindering their progress.

In the first half of 2024, SGR’s revenue rose sharply by 166% over the same period last year to nearly VND 77 billion. However, financial revenue for the period decreased by 94%, yielding only VND 5 billion. This decrease was due to reduced interest income, delayed loan repayments, received dividends, and cooperative investment revenue. Consequently, the company’s after-tax profit for the first six months of 2024 plummeted by 92%, amounting to just over VND 2 billion.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.