In a bid to secure financial investments, the Vinalines Union has initiated a transaction to retrieve funds.

As per the announcement, the union aims to offload 395,300 shares, reducing their ownership from 0.04% to 0.008%. This move is intended to safeguard their financial investments, with an expected return of approximately VND 15.6 billion based on the closing price of VND 39,500 per share on August 23rd.

This decision comes after a similar attempt in July, where the union registered to sell 400,000 shares between July 23rd and August 21st, 2024, managing to sell only 4,700 shares due to unfavorable market conditions.

The union’s selling actions coincide with the stabilization of MVN stock prices following a period of significant volatility, including a rapid surge and subsequent sharp correction.

| MVN stock has witnessed substantial fluctuations recently |

Vinalines’ business operations have also garnered attention with several notable developments. During an extraordinary general meeting in July, significant agenda items were approved, including a VND 356 billion investment in 2024 to facilitate financial restructuring at the Cai Lan International Container Terminal (CICT) – a joint venture between SSA (USA) and Cai Lan Port Investment JSC (with Vinalines holding a 56% stake). This restructuring is projected to turn CICT profitable annually, with improved cash flow for debt repayment and new investments to enhance productivity.

Additionally, the general meeting approved the addition of new business lines and amendments to the company’s charter.

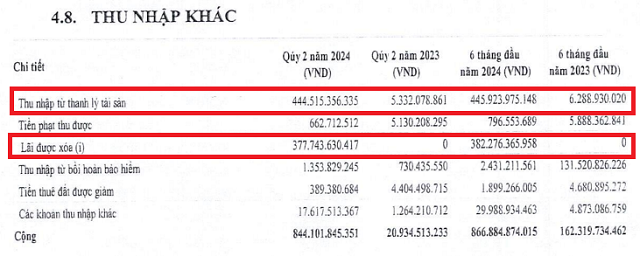

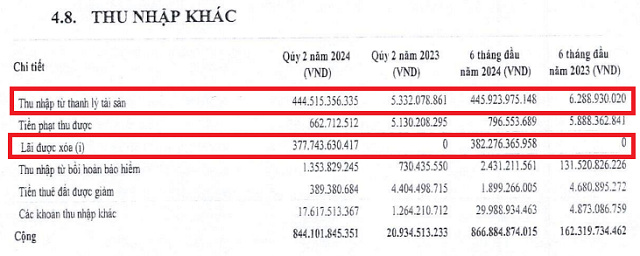

In terms of financial performance, Vinalines reported impressive results for the second quarter of 2024, with a net profit of nearly VND 861 billion, more than double that of the same period last year. This surge in profitability was attributed to increased income from asset liquidation and additional waived loans.

For the first half of 2024, Vinalines’ net profit reached nearly VND 1,203 billion, almost twice the figure from the previous year.

Source: Consolidated Financial Statements for the second quarter of 2024 of MVN

|

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.