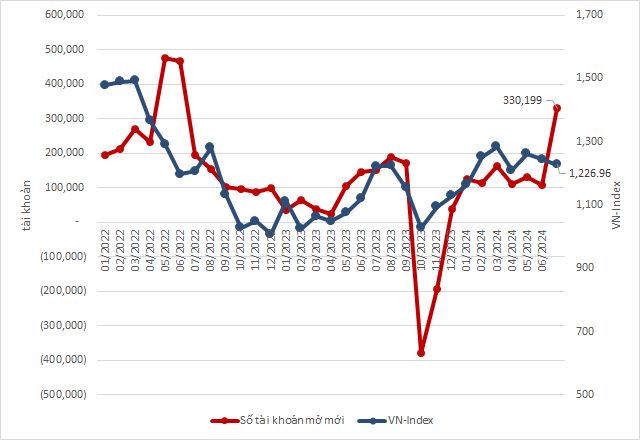

The stock market witnessed a positive trading week from August 19-23, with the VN-Index posting gains in three out of five sessions before fluctuating in the last two sessions. However, thanks to proactive buying support, the VN-Index still ended the week higher by +33.09 points (+2.64%) to close at the 1,285.32 mark. Liquidity on both exchanges improved significantly compared to the previous trading week, with matched volume up 21% on the HOSE and 24% on the HNX.

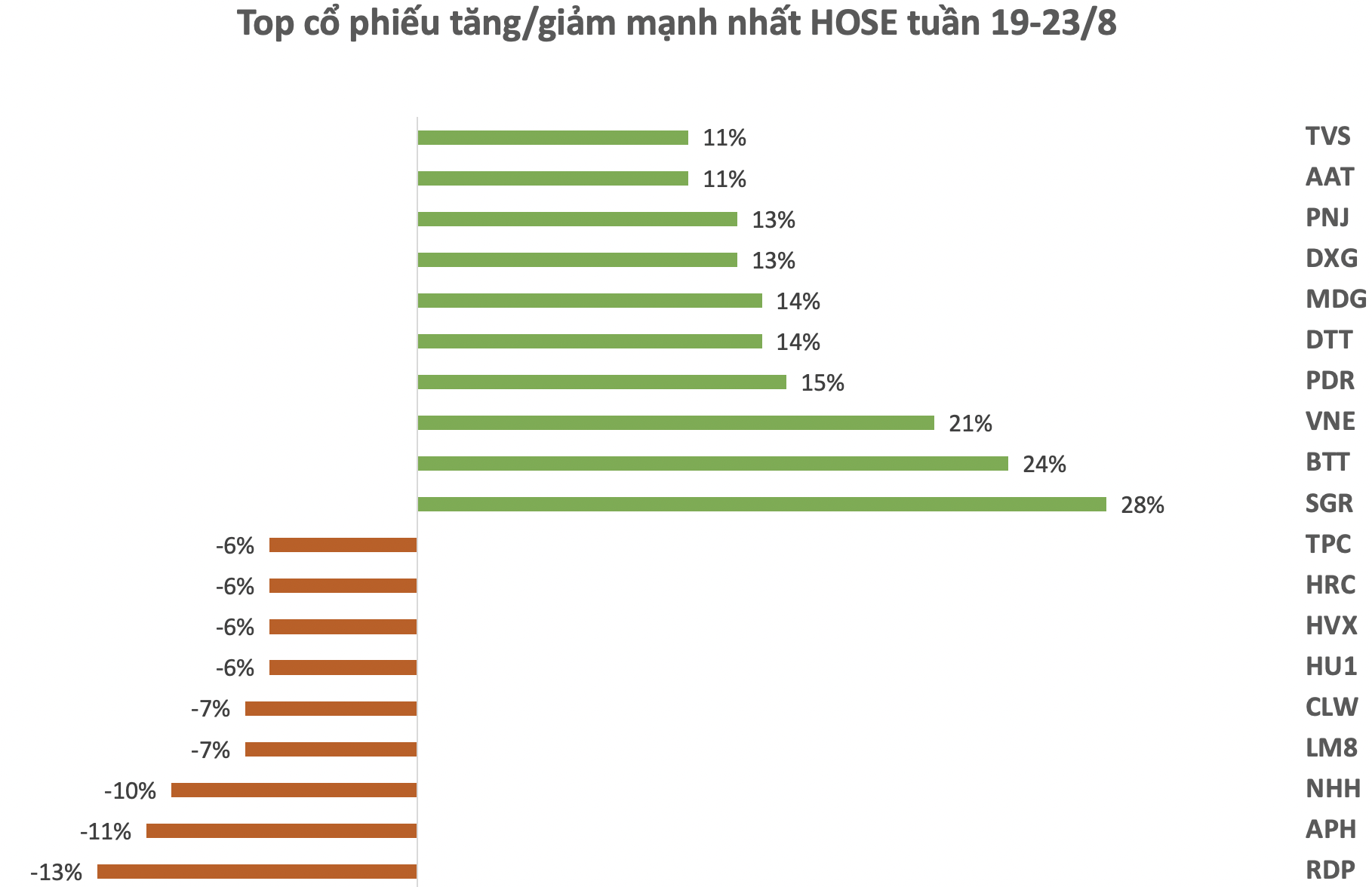

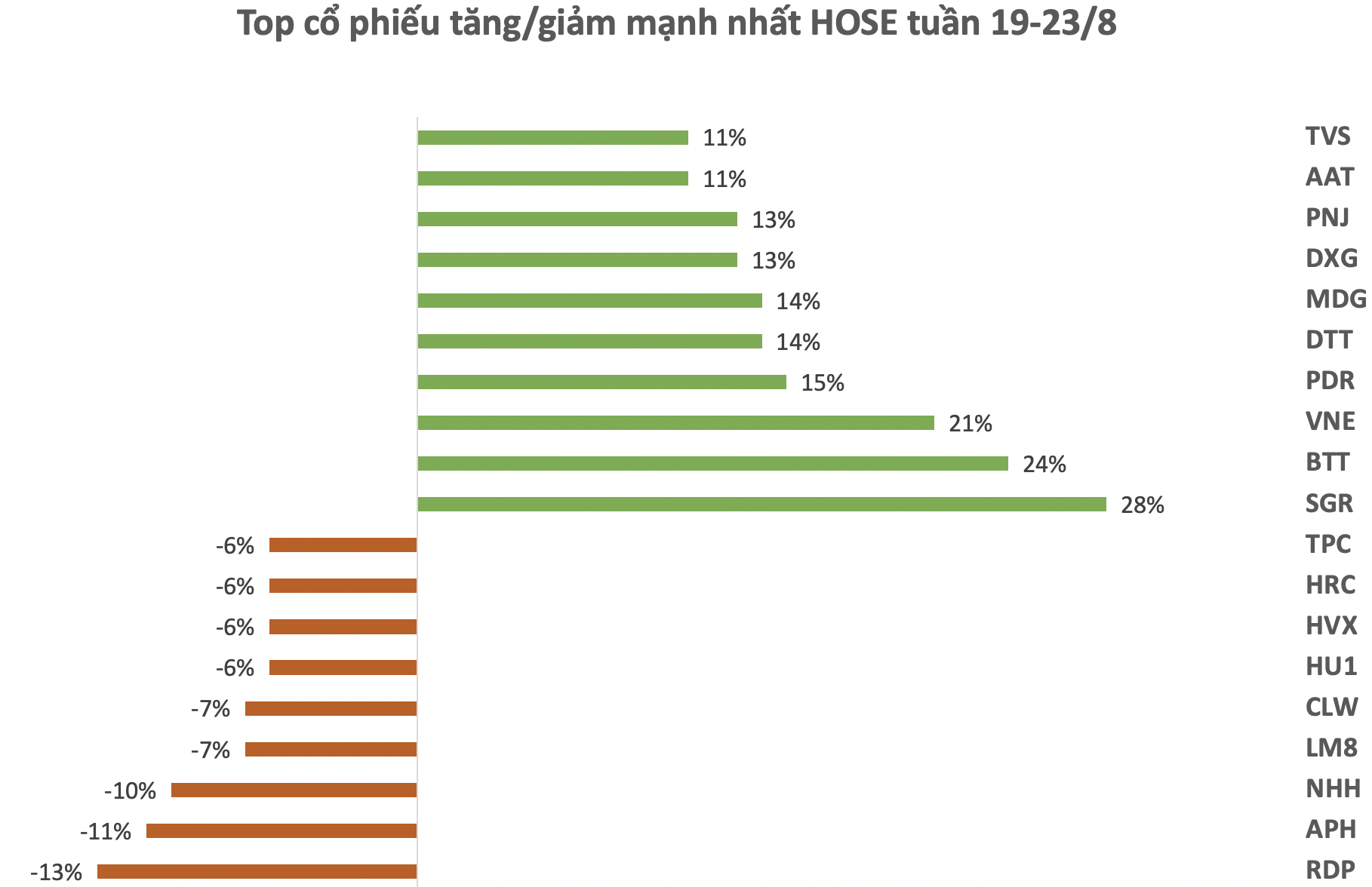

On the HOSE, SGR topped the list of biggest gainers with a strong four-day rally, including two ceiling-hitting sessions. Currently, SGR is trading at VND37,200 per share, representing a gain of 28% in just one week. Moreover, SGR is approaching its historical peak of over VND39,000 reached in January 2022.

SGR’s impressive rally occurred just before the company finalizes its shareholder list on August 29 to collect opinions via postal voting. The implementation is scheduled for September and October 2024, with specific details yet to be announced.

In the real estate group, PDR and DXG also broke out this week, surging 15% and 13%, respectively.

PNJ was also among the top gainers on the HOSE. Despite a slight correction on August 23 after a surprising rally to a new all-time high, PNJ still climbed 13% this week. The share price currently stands at VND108,900, up 27% year-to-date. Its market capitalization corresponds to over VND36,400 billion.

In contrast, RDP, APH, NHH, and LM8 faced profit-taking pressure, declining over 7% this week.

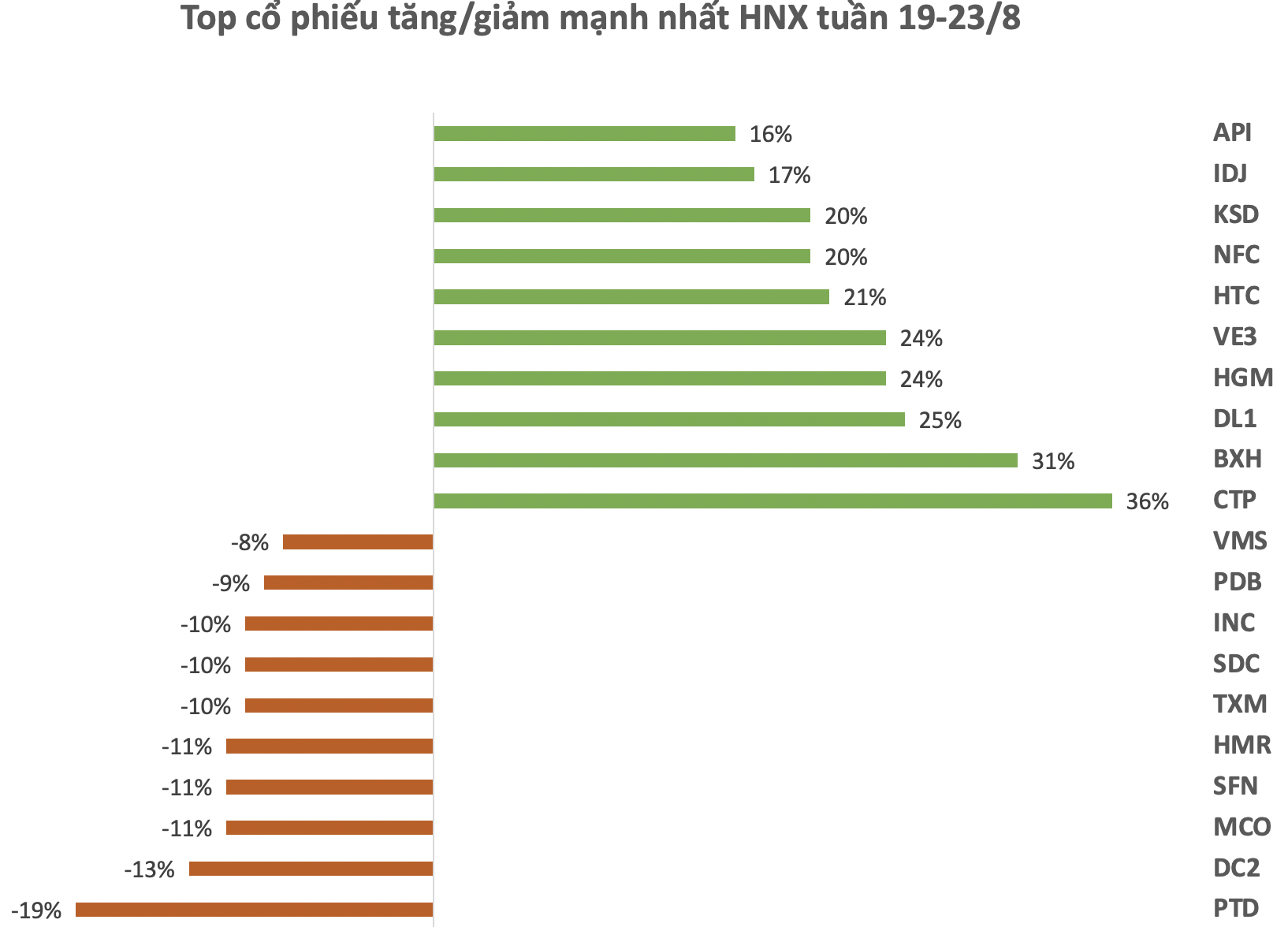

On the HNX, the gainers were mostly small-cap, low-liquidity stocks such as CTP, BXH, DL1, and HGM,..

On the downside, PTD, DC2, and MCO faced profit-taking pressure, declining over 11% this week.

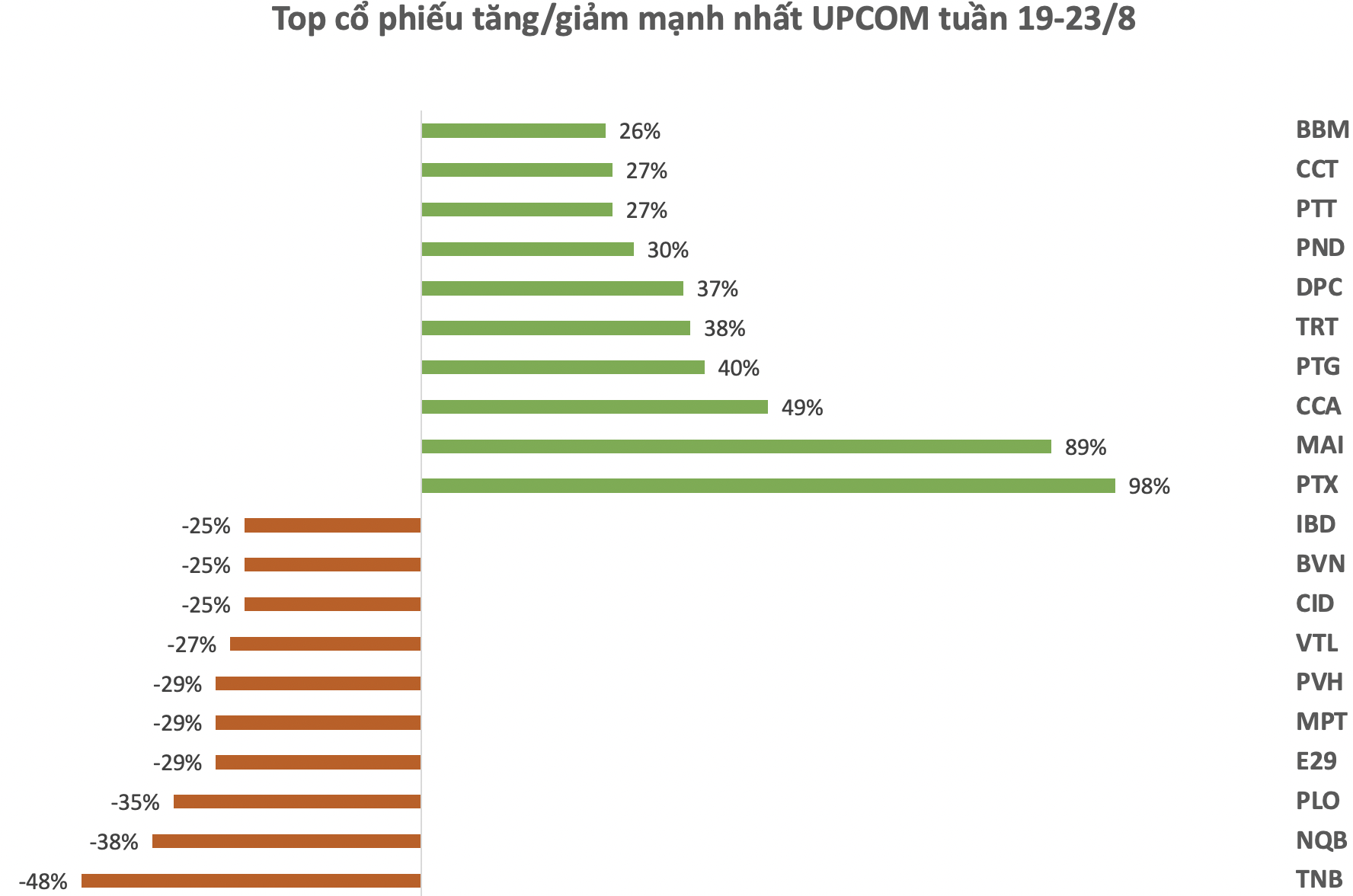

On the UPCOM, PTX led the gains, surging to the ceiling price in four sessions this week, pushing its share price to VND21,400. For the week, PTX rose nearly 98%. Despite the strong increase, the trading volume of this stock was only a few hundred to a few thousand units.

In a mid-July explanation for the five consecutive ceiling-hitting sessions, PTS Nghe Tinh attributed the phenomenon to market supply and demand factors. The company stated that it had no influence on the trading price on the stock market. All business activities remain normal and stable.

In contrast, many stocks on UPCOM also recorded declines ranging from 25% to 48%. Notably, TNB of the Vietnam Steel Southern Company – VNSTEEL, plunged nearly 40% in a session. Its share price “evaporated” by 48% this week to VND8,200, with a meager trading volume of a few hundred units.