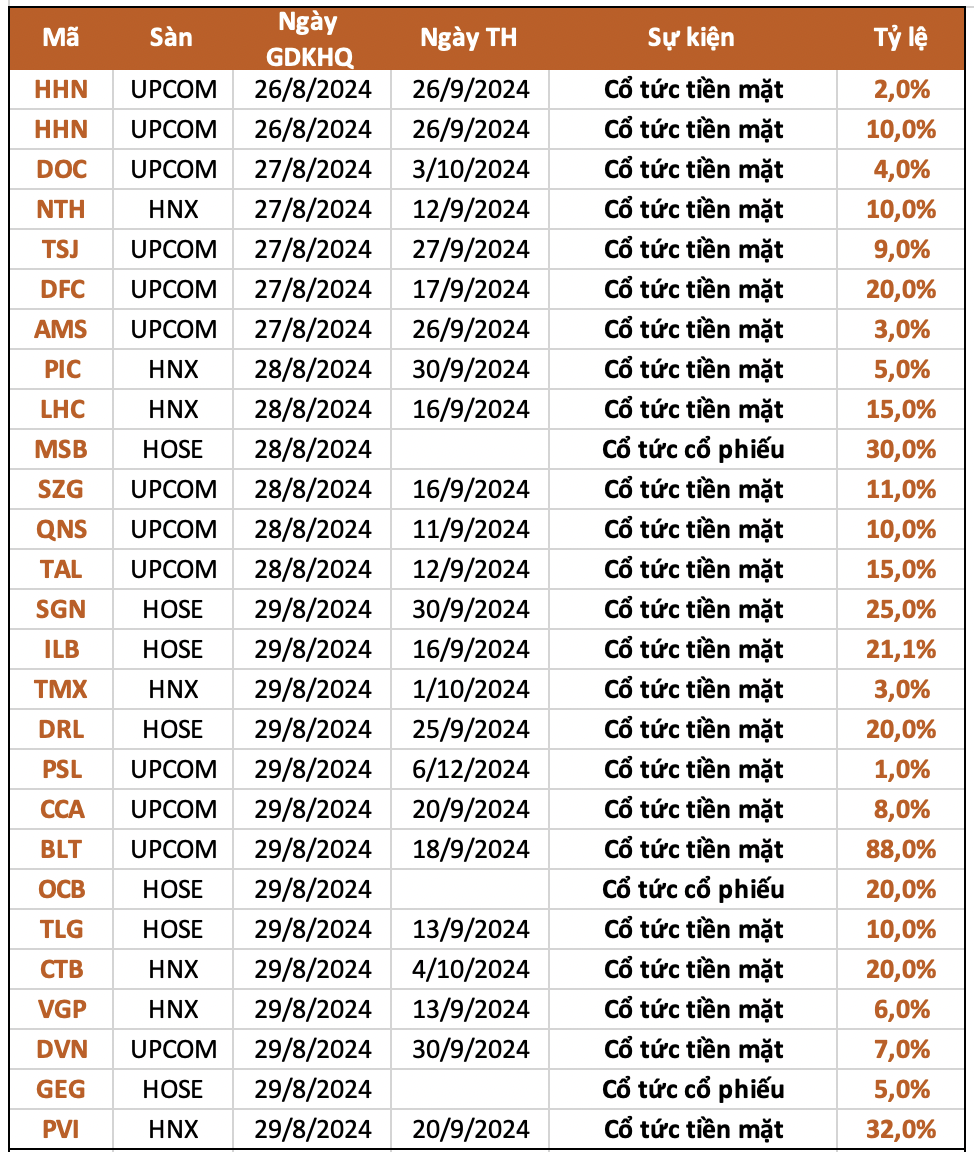

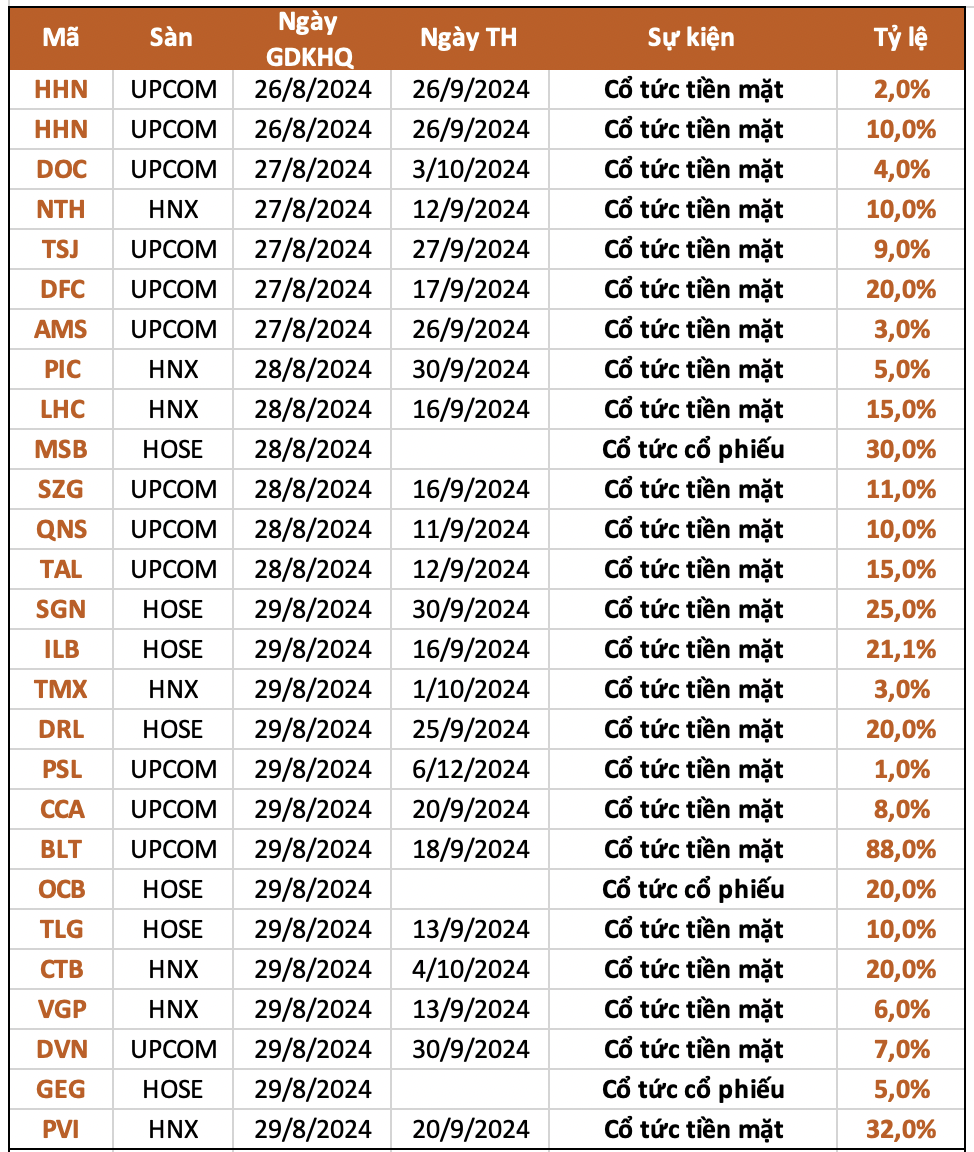

According to statistics, 26 companies announced dividend lock-in during the week of August 26-30. Of these, 22 companies will pay cash dividends this week, with the highest rate being 88% and the lowest 2%. In addition, three companies will pay stock dividends this week, and one company will pay a combination of cash and stock dividends.

Dong Anh Chain Joint Stock Company (DFC) is preparing to finalize the list of shareholders for a 20% cash dividend payout for 2023 (VND 2,000/share), requiring a total expenditure of VND 22.8 billion, thus fulfilling the plan assigned by the Annual General Meeting of Shareholders. The ex-dividend date is August 27, and the payment date is set for September 17, 2024.

DFC has consistently paid dividends to its shareholders for nine consecutive years since 2015, although there has been a decreasing trend over time, with the rate dropping from a high of 45% in 2015 to a low of 11% in 2020, before rising to 17% and 36% in 2022 and 2023, respectively.

Lam Dong Hydraulic Construction Investment Joint Stock Company (HNX: LHC) announced that August 29 is the record date for the first 2024 interim cash dividend. The ex-dividend date is August 28.

LHC will allocate approximately VND 21 billion for dividend distribution, expected to be paid on September 16, 2024, at a rate of 15% (each share will receive VND 1,500). This year, the company plans to distribute dividends to shareholders at a rate ranging from 15% to 25%.

The company, headquartered in Lam Dong province, has maintained a consistent track record of dividend payments over the years, including both stock and cash dividends. The amount of cash paid out as dividends has also gradually increased. For instance, in 2023, LHC paid two cash dividend installments at rates of 5% and 15%, respectively, totaling approximately VND 49 billion, the highest in its history.

Vietnam Maritime Commercial Joint Stock Bank (MSB – Code: MSB) has just announced that August 29 is the record date for a 30% stock dividend. Specifically, the bank plans to issue a maximum of 600 million new shares to distribute as dividends to its shareholders, equivalent to a 30% ratio (for every 100 shares held, shareholders will receive 30 new shares). Following this issuance, MSB’s charter capital is expected to increase by VND 6,000 billion, from VND 20,000 billion to VND 26,000 billion.

Orient Commercial Joint Stock Bank (OCB) has announced that August 30 is the deadline to finalize the list of shareholders eligible to receive a 20% stock dividend (for every 5 shares held, shareholders will receive 1 new share).

Accordingly, OCB will issue nearly 411 million shares as stock dividends. The source of this issuance will be the undistributed after-tax profit accumulated up to the end of 2023. Following this issuance, OCB’s charter capital is expected to increase to nearly VND 24,658 billion.

Binh Dinh Food Joint Stock Company (BLT) announced that August 30 is the record date for BLT to pay the 2023 cash dividend at a rate of 88% (each share will receive VND 8,800). With more than 4 million shares currently in circulation, the company expects to pay out VND 35 billion in dividends for this period.

In the shareholder structure, the Southern Food Corporation-VINAFOOD II, as the parent company holding 51% of the charter capital, is expected to receive nearly VND 18 billion. Following this, Mr. Nguyen Phan Quang, Deputy General Director of the company, may receive more than VND 1 billion, given his ownership of nearly 3% of the capital. Shareholders will receive their dividend payments just over two weeks later, on September 18.

Which companies’ shareholders will receive cash dividends at the beginning of 2024, Year of the Wood Horse?

In the beginning of the year 2024, numerous businesses will be paying dividends in cash. This is delightful news for the shareholders who hold stakes in these companies.